News

LG To Withdraw From Smartphone Market Due To Ongoing Losses

After nearly 6 years of losses, South Korea’s LG Electronics has decided to completely withdraw from the smartphone market and focus on other areas instead.

After nearly six years of losses, South Korea’s LG Electronics has decided to withdraw from the smartphone market and focus on other areas instead, including home electronics, connected devices, and smart vehicle components.

The total losses of the LG’s mobile division amount to $4.5 billion even though the brand currently enjoys the third place in the United States, after Apple and Samsung Electronics.

“In the United States, LG has targeted mid-priced — if not ultra-low — models and that means Samsung, which has more mid-priced product lines than Apple, will be better able to attract LG users,” commented Ko Eui-young, an analyst at Hi Investment & Securities.

For a long time, LG was considered to be one of the most innovative smartphone manufacturers, pioneering ultra-wide-angle cameras, dual-display devices, vein-tracking aerial gestures, and swappable components. Unfortunately, most of its innovations failed to gain any significant traction among consumers.

To make things even worse, some of the more recent flagship models have suffered both software and hardware problems, and professional reviewers were quick to point them out, steering potential buyers toward other brands.

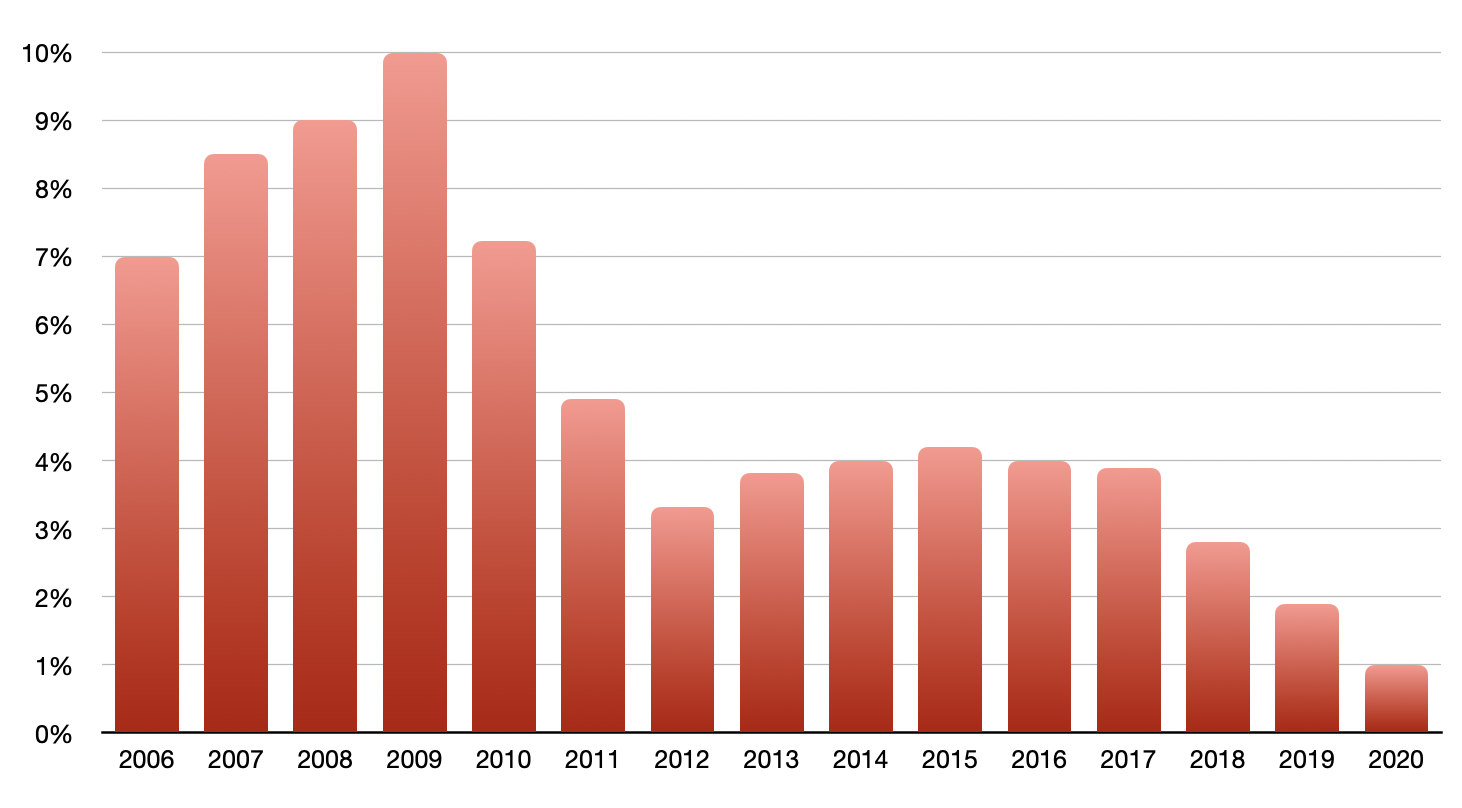

LG Smartphone Market Share

Currently, LG’s global share is only around 2 percent, with 23 million smartphones shipped last year. When compared with Samsung’s 256 million shipped units, the company’s decision to withdraw from the smartphone market suddenly becomes easier to understand.

Also Read: Huawei Wants To Make Long-Range Wireless Charging A Reality

It’s also worth pointing out that successful Chinese brands, such as Xiaomi, Vivo, and OPPO, have greatly increased buyers’ expectations by offering flagship specifications at mid-range prices.

The good news is that current employees of LG’s mobile division won’t lose their jobs — at least not those who are based in South Korea. Instead, they will be moved to other electronics divisions. Owners of LG smartphones also have nothing to worry about because both service support and software updates will continue to be provided even in the near future.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.