News

meta[bolic] And ŌURA Partner To Manage Metabolic Disease

The hybrid therapeutics company will incorporate the smart ring into its programming, taking an innovative approach to care delivery.

![meta[bolic] and oura partner to manage metabolic disease](https://techmgzn.com/wp-content/uploads/2024/01/metabolic-and-oura-partner-to-manage-metabolic-disease.jpg)

For millions of people around the world, managing a metabolic disease can be emotionally challenging and complex. Metabolic issues are difficult to treat because they often require foundational behavioral changes combined with clinical interventions based on accurate medical data.

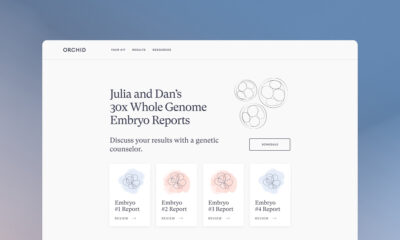

meta[bolic], a Dubai-based hybrid therapeutics company dedicated to managing chronic metabolic disease, aims to help people to better manage their metabolic health by partnering with ŌURA, the startup behind the Oura Ring — a smart wearable that delivers health data, and daily guidance into sleep, activity, readiness, and recovery.

“Wearables have come a long way in just the past few years,” explained Ali Hashemi, co-founder and chief executive officer of meta[bolic]. “Oura Ring is a step above the wearables of yesterday in terms of data fidelity and quality, but also in terms of interface and useful insights delivered to users. We are eager to bring ŌURA’s continuous monitoring and daily engagement to our patients, unlocking new capabilities around preventive care, behavior change, and habits”.

The partnership between ŌURA and meta[bolic] aims to empower patients with robust support and continuous remote data monitoring. By consistently tracking patient progress and identifying behavior patterns, the initiative will become a first step in a more integrated approach to preventive care.

“At ŌURA, we envision a future where the model for preventative care is multi-faceted and unique to each individual,” added Tom Hale, Chief Executive Officer of ŌURA. “True innovation in healthcare is driven by providers who are implementing multidimensional care and using integrated technology to empower people to make changes to their daily behavior that improve health and well-being”.

Also Read: Mobile Trends Shaping MENA In 2024

The ŌURA and meta[bolic] partnership will also include a dedicated research program to explore the relationship between sleep, stress, and metabolic health. The resulting data will provide useful biomarkers to measure how engagement levels and sleep impact glucose improvement.

The results of the research are expected within 12 months and will act as a framework for approaching metabolic health in a more comprehensive way while generating valuable insights for the scientific community and members of the public.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News2 weeks ago

News2 weeks agoGoogle Cloud Opens New Kuwait Office To Aid Digital Transformation