News

Orchid Plans To Find Out What’s Wrong With You Before You’re Born

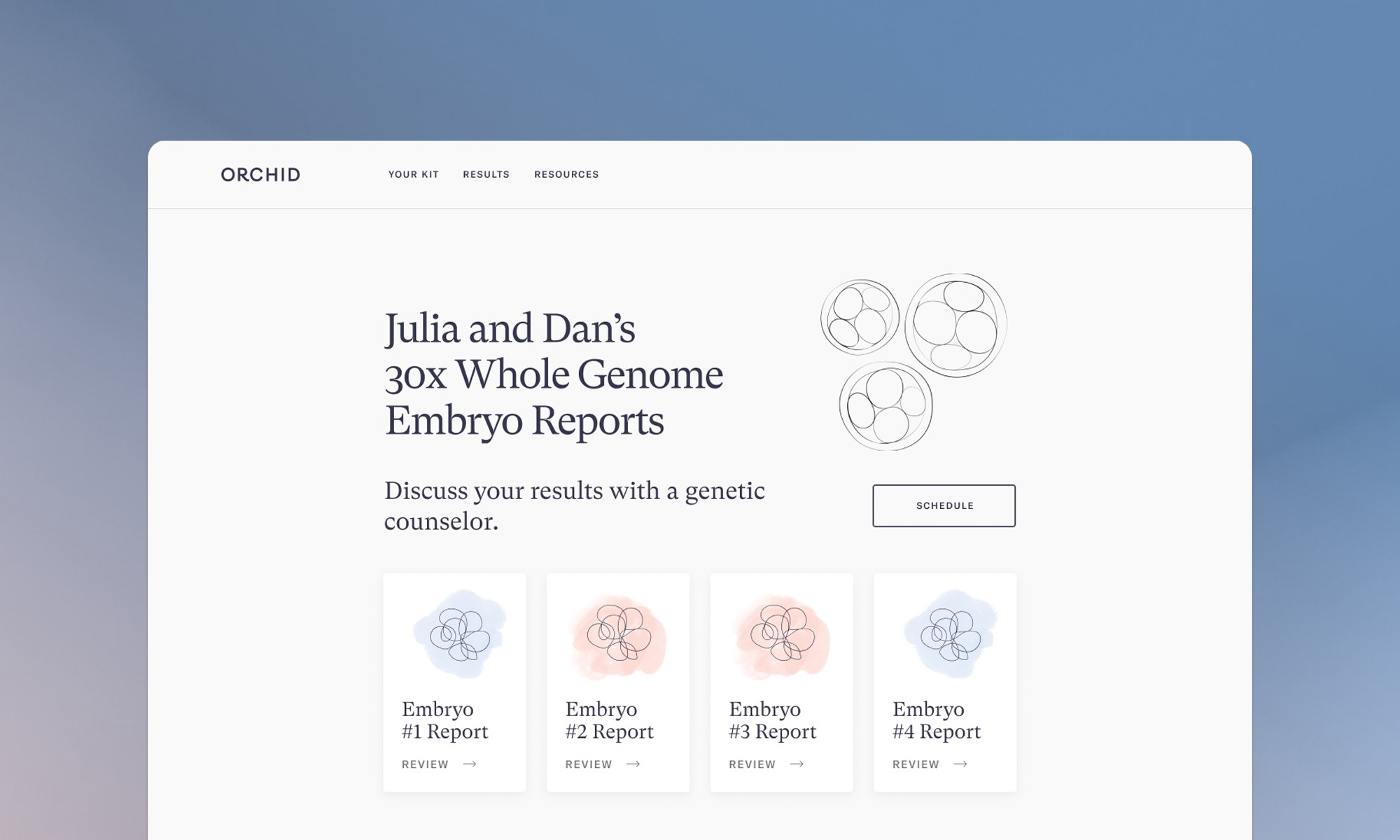

According to CEO Noor Siddiqui, the company isn’t on a mission to make designer babies, but aims to beat genetic odds and relieve suffering.

Each day, around 400,000 babies are welcomed into the world. However, among those, a growing number will experience some kind of birth defect or inherited disease.

Noor Siddiqui, CEO of Orchid, hopes to “mitigate” unpleasant genetic surprises using genome sequencing technology to reveal a wealth of genetic information on which newborns will grow into healthy adults.

Until 2019, IVF specialists had access to under 1% of the human genome. The tests, called PGT-A and PGT-M, scanned a mere 1,000 data points in a genome comprising around 3 billion bases, offering a very limited dataset compared to the technology used by Orchid.

“Our chromosomes are like chapters in a book that make up the table of contents.” Explained Siddiqui. “[PGT-A and PGT-M tests] only examine the table of contents, whereas what Orchid is doing is like a spellcheck on the entire book.” Orchid’s genome sampling technology assesses “100 times the data, covering many more conditions.” In essence, an Orchid report covers three categories of common genetic issues: monogenic disorders, polygenic conditions, and de-novo mutations.

Also Read: Advancing MENA Health Through AI Vascular Age Analysis

Orchid’s technology raises many questions. Aside from the obvious ethical concerns, data privacy is the most obvious potential issue with the tests. Noor Siddiqui is keen to alleviate any concerns: “No data at Orchid is ever sold to any third parties. Parents are in complete control of their data. If they want to delete the data, we’re happy to delete it off of our servers. If they want to export the data, they can export the data. And if they want us to re-analyze the data, we can re-analyze the data”.

Compared to a lifetime of medical bills, gene therapy, and suffering, Orchid’s genome screening report has the potential to change the future lives of thousands of newborns worldwide.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant