News

New Fintech App Aims To Improve Children’s Financial Literacy

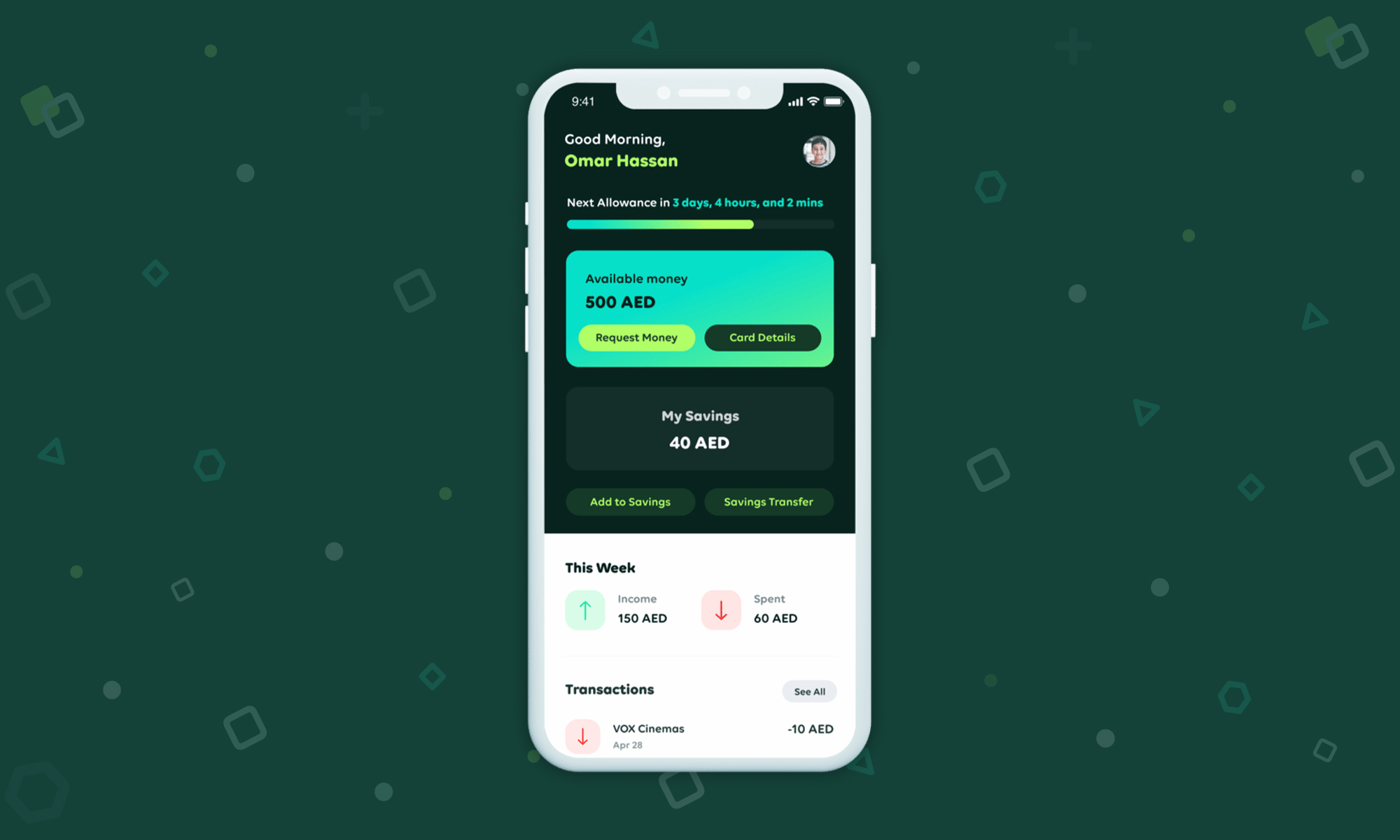

A startup known as Leap has built an app to help kids track where their money is being spent, and to help them save more effectively.

For children and young teens, it can be hard (and not to mention boring!) to get a handle on topics such as budgeting and saving. Money and financial matters aren’t exactly a top priority for youngsters, but they are vital subjects to master in order to be better prepared for adult life.

To that end, UAE-based startup Leap has an ambitious goal of helping young people to make better financial decisions and to improve basic money management skills and literacy. The fintech company has developed an app aimed at young people and their parents, which works to incentivize good budgeting and saving habits.

“Financial literacy is a core life skill that is not readily taught while growing up. Most kids get their first taste of financial responsibility when they go off to college without the oversight and knowledge on managing their money. We’re committed to changing this reality and empowering kids as young as 6 years old to understand, value, and manage their money,” says Ziad Toqan, CEO and Co-founder of Leap.

Parents can transfer a child’s allowance into the app or have funds appear when certain milestones are achieved (such as good school grades). Children using the service will get a prepaid Visa card linked to their Leap account, allowing them to use their balance however they see fit.

Also Read: Egyptian Digital Lending Platform Blnk Raises $32 Million

As well as helping to promote better budgeting and sensible spending, the app also diverts unused funds to a savings account at the end of each week, which Leap hopes will encourage kids to spend less and save more.

The app is available on both Apple and Android devices and is suitable for children between 6 and 18 years of age. Leap is currently focused on the UAE, but has plans to expand into Saudi Arabia and Egypt in the future.

News

Google Releases Veo 2 AI Video Tool To MENA Users

The state-of-the-art video generation model is now available in Gemini, offering realistic AI-generated videos with better physics, motion, and detail.

Starting today, users of Gemini Advanced in the MENA region — and globally — can tap into Veo 2, Google’s next-generation video model.

Originally unveiled in 2024, Veo 2 has now been fully integrated into Gemini, supporting multiple languages including Arabic and English. The rollout now brings Google’s most advanced video AI directly into the hands of everyday users.

Veo 2 builds on the foundations of its predecessor with a more sophisticated understanding of the physical world. It’s designed to produce high-fidelity video content with cinematic detail, realistic motion, and greater visual consistency across a wide range of subjects and styles. Whether recreating natural landscapes, human interactions, or stylized environments, the model is capable of interpreting and translating written prompts into eight-second 720p videos that feel almost handcrafted.

Users can generate content directly through the Gemini platform — either via the web or mobile apps. The experience is pretty straightforward: users enter a text-based prompt, and Veo 2 returns a video in 16:9 landscape format, delivered as an MP4 file. These aren’t just generic clips — they can reflect creative, abstract, or highly specific scenarios, making the tool especially useful for content creators, marketers, or anyone experimenting with visual storytelling.

Also Read: Getting Started With Google Gemini: A Beginner’s Guide

To ensure transparency, each video is embedded with SynthID — a digital watermark developed by Google’s DeepMind. The watermark is invisible to the human eye but persists across editing, compression, and sharing. It identifies the video as AI-generated, addressing concerns around misinformation and media authenticity.

While Veo 2 is still in its early phases of public rollout, the technology is part of a broader push by Google to democratize advanced AI tools. With text-to-image, code generation, and now video creation integrated into Gemini, Google is positioning the platform as a full-spectrum creative assistant.

Access to Veo 2 starts today and will continue expanding in the coming weeks. Interested users can try it out at gemini.google.com or through the Gemini app on Android and iOS.