News

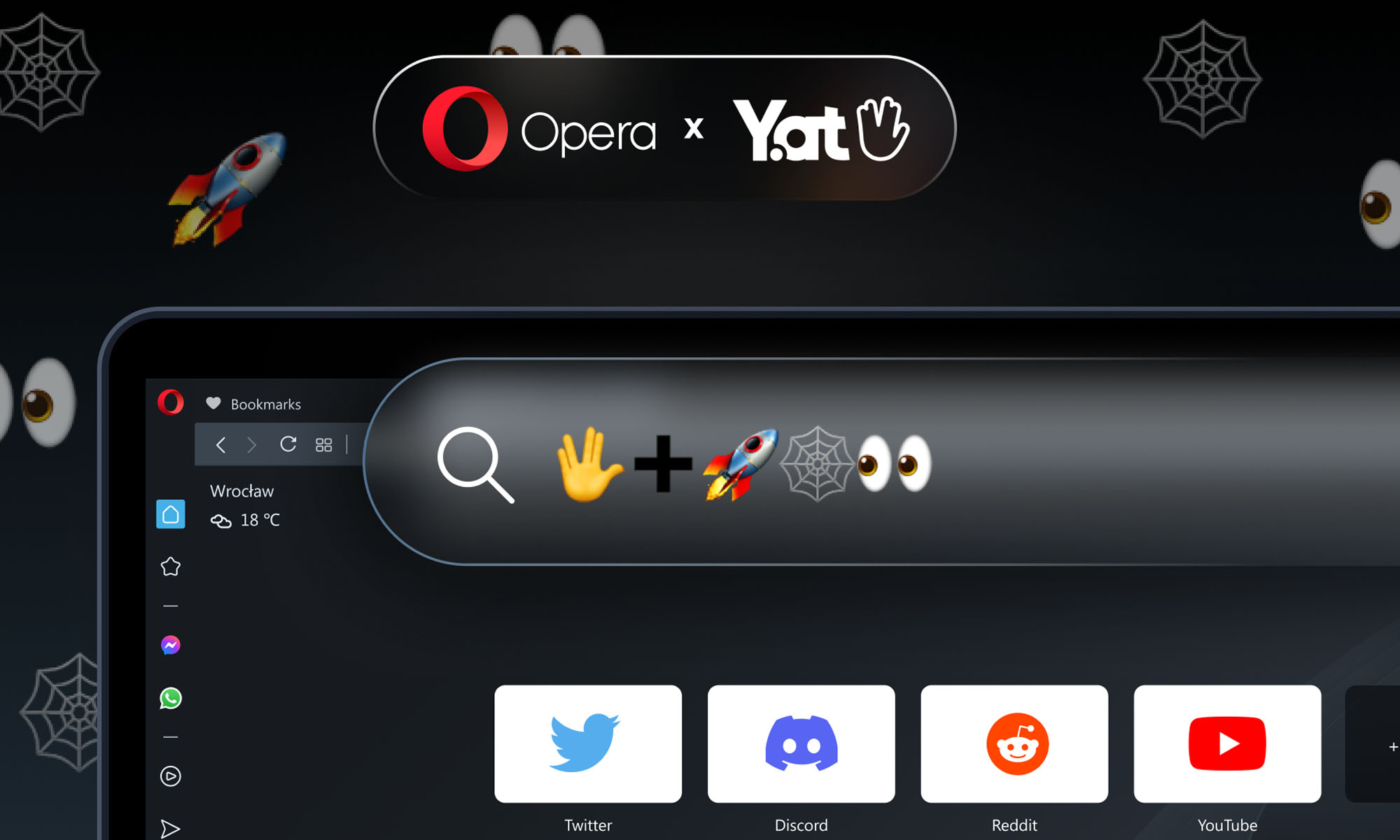

Opera Enables Emoji-Only Web Addresses Provided By Yat

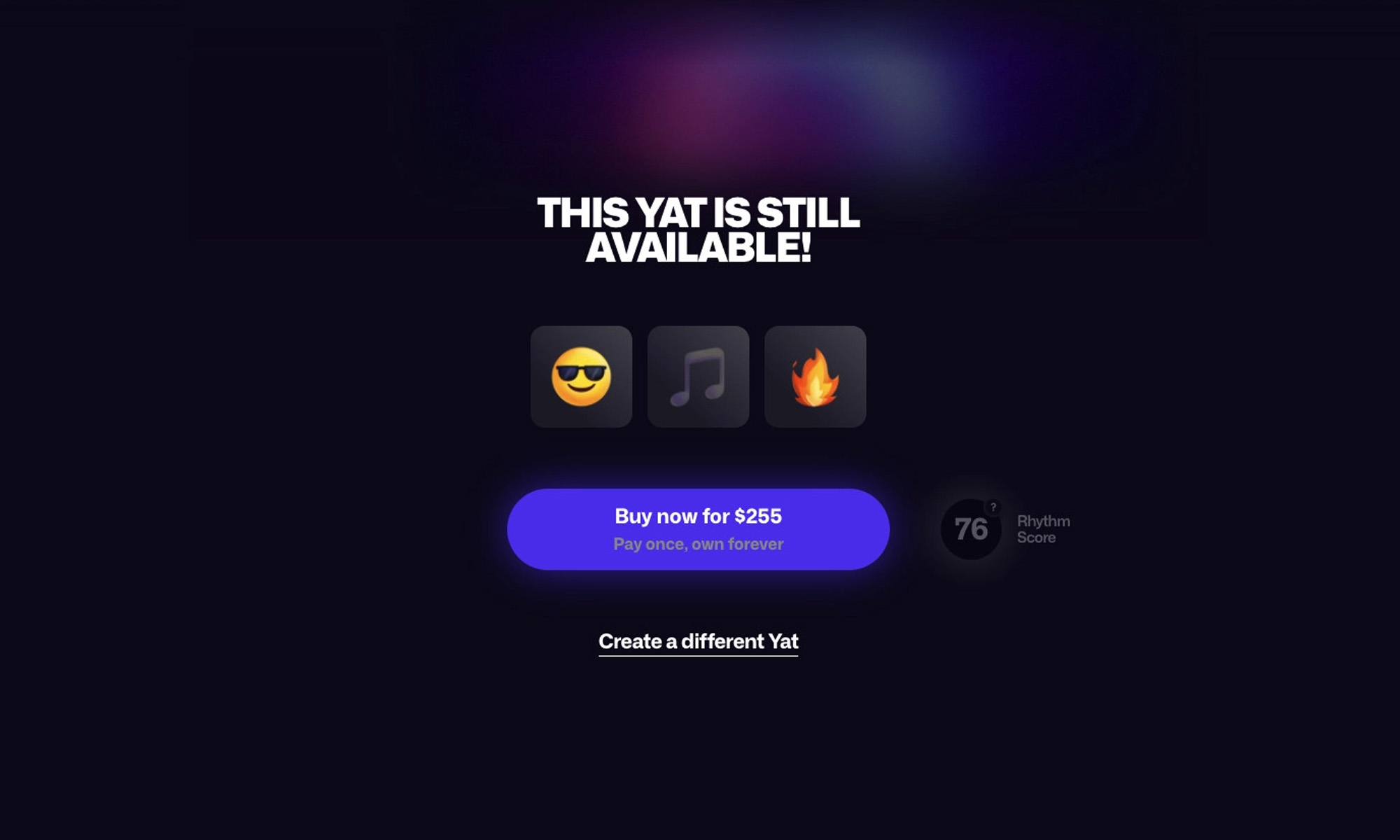

While longer addresses consisting of four or five emojis sell for as little as $4, it can cost hundreds of thousands of dollars to secure a memorable single-emoji URL.

If you have the latest version of the Opera web browser installed on your computer, go ahead and launch it.

Now, copy & paste 🌈🚀👽 into the address bar and press Enter. You should see a landing page belonging to Kesha, the American singer-songwriter.

You can also enter 👽🎵 to be redirected to the official website of Young Money Entertainment, the American record label founded by rapper Lil Wayne.

These emoji-only web addresses are the result of Opera’s partnership with Yat, a startup that sells URLs with emojis using its Y.at domain. Thanks to the partnership, Opera users now don’t have to enter “y.at” when visiting Yat’s emoji-only web addresses.

“The partnership marks a major paradigm shift in the way the internet works” said Jorgen Arnesen, the executive vice president of mobile at Opera. “It’s new, it’s easier, and more fun”.

It can also be pretty damn expensive. While longer addresses consisting of four or five emojis sell for as little as $4, it can cost hundreds of thousands of dollars to secure a memorable single-emoji URL.

Why would anyone do that when it’s fairly easy to purchase a custom domain name that supports emojis and use it instead of the “y.at” domain? Because Yat’s CEO Naveen Jain has big plans for the startup.

Also Read: Fakespot Review: Easily Identify Fake Online Reviews

In the future, Jain would like Yat to become a self-sovereign company using blockchain technology to provide a decentralized alternative to the current domain name system (DNS).

“This is laying the foundation. There are certain elements of the vision that are certainly more of a social contract than actual implementation at this point in time” says Jain. “But this is the vision that we’ve set forth, and we’re working continuously towards that goal”.

In 2021, Yat sold almost $20 million worth of emoji identities, and the partnership with Opera could make 2022 sales figures even more impressive.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant