News

Ovasave Empowers Women To Tackle Difficult Fertility Choices

The UAE-based startup helps women to test their fertility at home and connects them to a network of clinics offering egg-freezing procedures.

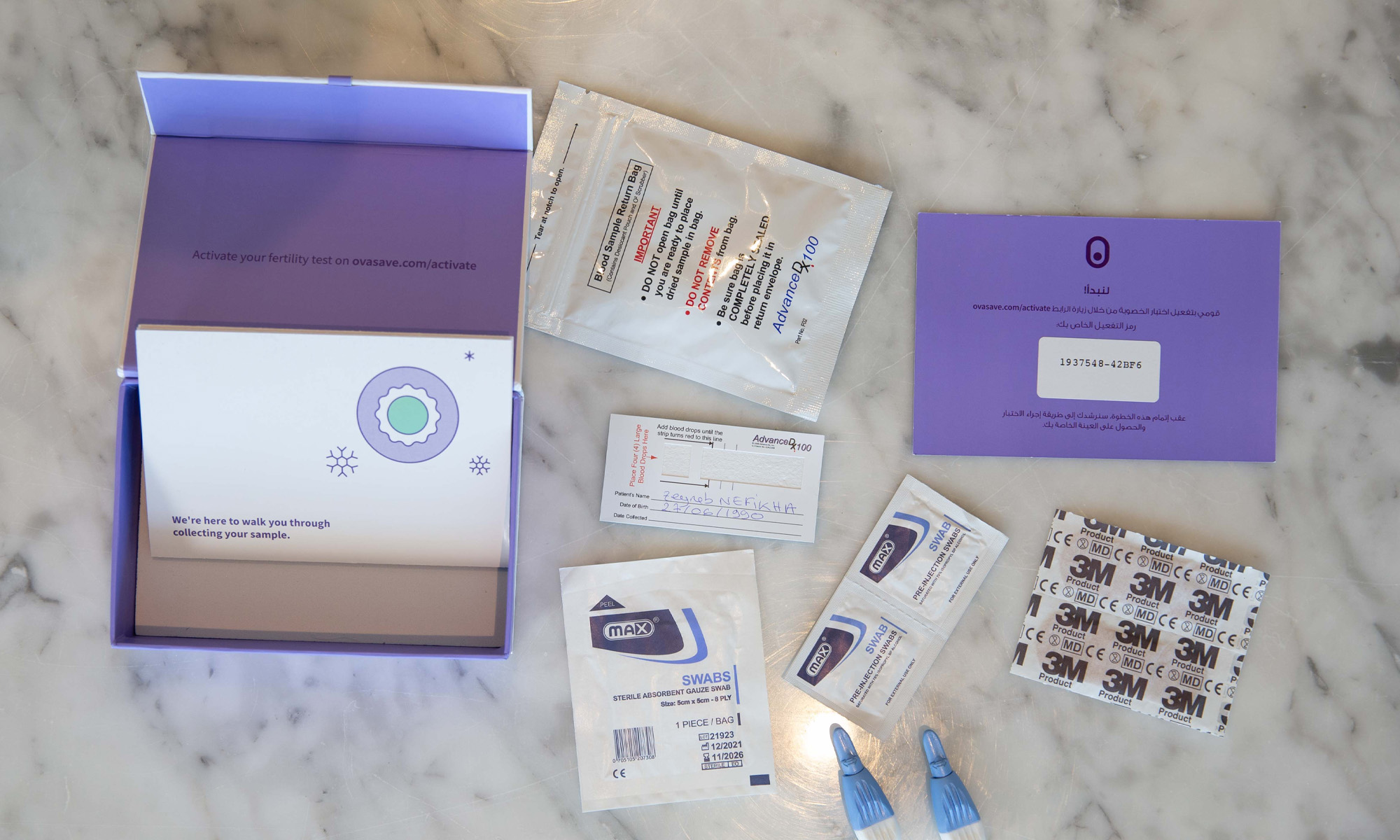

Abu Dhabi-based Ovasave is on a mission to empower women to take control of their fertility. Founded by Torkia Mahloul and Majd Abu Zant, the startup seeks to ease the complexity of freezing eggs while encouraging women to start testing their ovarian reserves at thirty years of age to improve their chances of becoming pregnant in the future.

Ovasave’s digitized process is centered around a $100 FDA-approved self-administered home hormone test, followed by a remote consultation by a doctor from a vetted fertility clinic network. Depending on the results and the consultation outcome, patients can opt for an egg-freezing package from one of the clinics in the network.

“Access to fertility services is a major issue. Women are delaying having children, so their fertility is declining, but they are not acting on it because of a lack of awareness […] and because the fertility journey is fragmented and complex,” Ms Mahloul says.

Recent changes to reproductive health laws in the United Arab Emirates now allow single and married women to preserve eggs for both social and medical reasons (including pursuing education or career advancement or undergoing cancer treatments).

According to co-founder Abu Zant, freezing eggs costs around Dh25,000 per cycle, with storage averaging another Dh1,500 per year. In the UAE, frozen eggs can be legally stored for five years, with an option to extend by an additional five years.

Also Read: LVL Wellbeing Receives $10 Million Investment To Scale Operations

Ovasave is partnering with eight UAE fertility clinics and twenty IVF specialists. Users will be able to rate doctors so that other women can compare the reviews when they book a consultation.

So far, the co-founders have invested $400,000 into the startup and are seeking to raise up to $2 million over the coming six months. The funds will be used for technical development, recruitment, and general market growth.

News

Rabbit Expands Hyperlocal Delivery Service In Saudi Arabia

The e-commerce startup is aiming to tap into the Kingdom’s underdeveloped e-grocery sector with a tech-first, locally rooted strategy.

Rabbit, an Egyptian-born hyperlocal e-commerce startup, is expanding into the Saudi Arabian market, setting its sights on delivering 20 million items across major cities by 2026.

The company, founded in 2021, is already operational in the Kingdom, with its regional headquarters now open in Riyadh and an established network of strategically located fulfillment centers — commonly known as “dark stores” — across the capital.

The timing is strategic: Saudi Arabia’s online grocery transactions currently sit at 1.3%, notably behind the UAE (5.3%) and the United States (4.8%). With the Kingdom’s food and grocery market estimated at $60 billion, even a modest increase in online adoption could create a multi-billion-dollar opportunity.

Rabbit also sees a clear alignment between its business goals and Saudi Arabia’s Vision 2030, which aims to boost retail sector innovation, support small and medium-sized enterprises, attract foreign investment, and develop a robust digital economy.

The company’s e-commerce model is based on speed and efficiency. Delivery of anything from groceries and snacks to cosmetics and household staples is promised in 20 minutes or less, facilitated by a tightly optimized logistics system — a crucial component in a sector where profit margins and delivery expectations are razor-thin.

Despite the challenges, Rabbit has already found its stride in Egypt. In just over three years, the app has been used by 1.4 million customers to deliver more than 40 million items. Revenue has surged, growing more than eightfold in the past two years alone.

Also Read: Top E-Commerce Websites In The Middle East In 2025

CEO and Co-Founder Ahmad Yousry commented: “We are delighted to announce Rabbit’s expansion into the Kingdom. We pride ourselves on being a hyperlocal company, bringing our bleeding-edge tech and experience to transform the grocery shopping experience for Saudi households, and delivering the best products – especially local favorites, in just 20 minutes”.

The company’s growth strategy avoids the pitfalls of over-reliance on aggressive discounting. Instead, Rabbit leans on operational efficiency, customer retention, and smart scaling. The approach is paying off, having already attracted major investment from the likes of Lorax Capital Partners, Global Ventures, Raed Ventures, and Beltone Venture Capital, alongside earlier investors such as Global Founders Capital, Goodwater Capital, and Hub71.