News

RemotePass Secures $5.5M Series A Funding, Led By 212VC

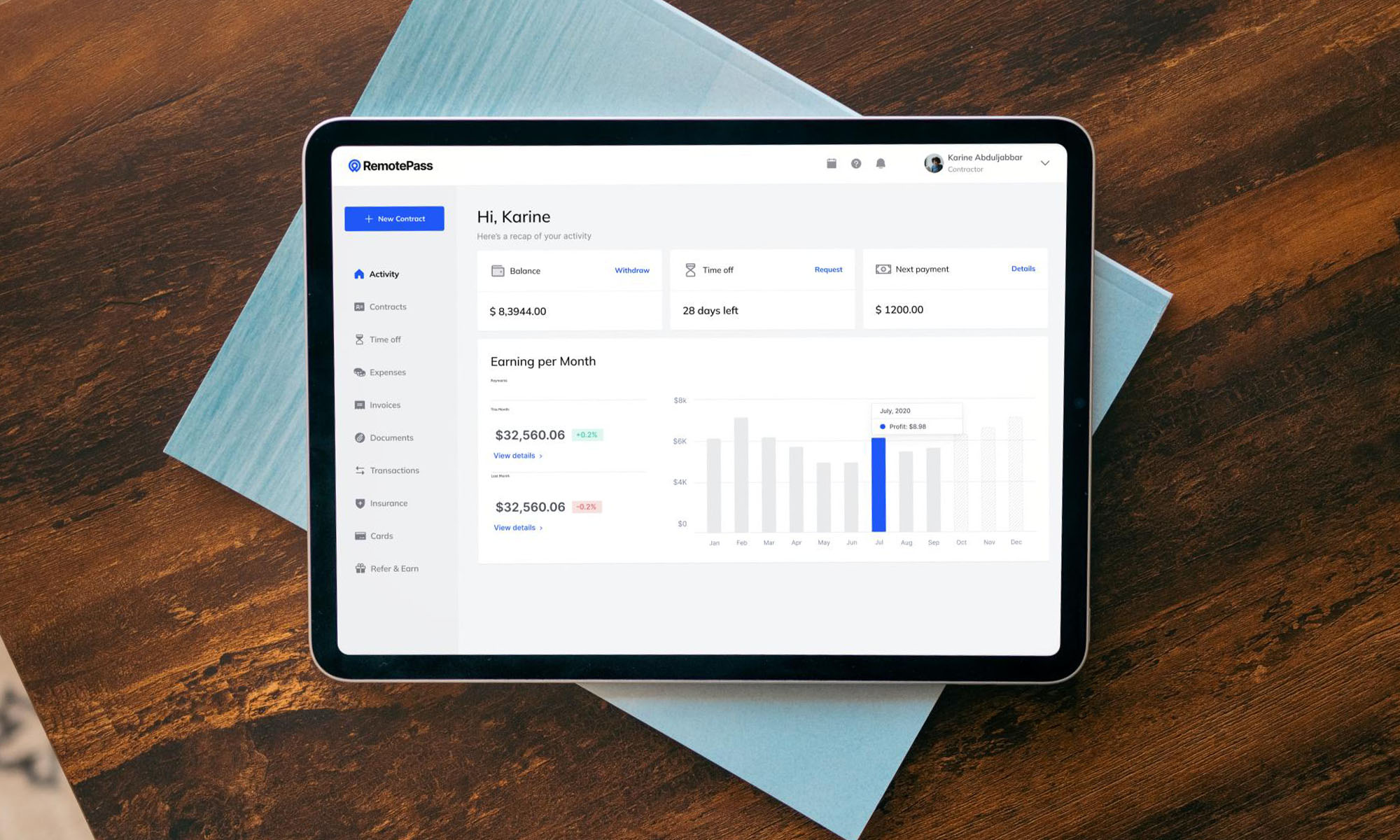

The company will use the funds to drive market expansion, improve its already award-winning app, and unlock a new phase of product innovation.

RemotePass, a platform aiding companies in remote workforce management, has acquired $5.5 million in a recent Series A funding round.

The round was spearheaded by 212 VC, with contributors from the US, Europe, and the Middle East, such as Endeavor Catalyst, Oraseya Capital, Khwarizmi Ventures, Flyer One Ventures, Access Bridge Ventures, A15, and Swiss Founders Fund. With the cash injection, RemotePass’s total raised funds now exceed $10 million, adding to previous investments from BECO Capital, Wamda Capital, Plug & Play, and Flat6Labs.

“Witnessing RemotePass’s remarkable product growth and stellar customer service since early 2023 solidified our belief in their visionary team & business model [which] positions them as game-changers in the UAE & KSA, hubs poised for global dominance,” said Ali Hikmet Karabey, Managing Director for lead investor 212 VC.

Established by Kamal Reggad and Karim Nadi, RemotePass caters to various sectors and clients, ranging from startups to major corporations like Spotify, Logitech, and Paymentology. The platform facilitates onboarding, management, and workforce payment in countries where companies lack local legal representation. RemotePass also allows the hiring of full-time employees and contractors across 150+ nations.

“Our platform helps democratize access to global opportunities, leveling the playing field for skilled individuals and enabling them to compete in a global job marketplace. This funding fuels our mission to empower countless lives and help global teams succeed,” explained Kamal Reggad, CEO and Co-Founder of RemotePass.

Also Read: Top 10 Best Freelance Platforms In The Middle East

Amidst the evolving global remote work trend, RemotePass has positioned itself as a leader, notably making significant gains in the MENA region. The platform is accompanied by a comprehensive “super app” delivering financial services and tailored benefits for remote workers, including varied payout options, a USD debit card, and access to premium health insurance.

Initially conceived in 2019 as a SaaS platform for business travel, RemotePass’s founders, being remote work advocates, transitioned to address the challenges of remote team management, particularly in emerging markets. The pivot, catalyzed by the COVID-19 pandemic, enabled substantial growth for the company, with a remarkable 35% month-over-month increase in the first two years, predominantly propelled by client referrals.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.