News

Samsung Pay Introduces Support For Digital COVID-19 Vaccination Cards

The feature is currently available only in the United States.

In 2021, digital COVID-19 vaccination cards have become reality for many people around the world who decided to take the vaccine in order to better protect themselves and their loved ones from the deadly infectious disease that brought the world to a stand still last year.

Now Samsung, in partnership with The Commons Project Foundation, a non-profit public trust established to build and operate digital platforms and services for the common good, has announced that Samsung Pay users can use the mobile payment and digital wallet service to store digital versions of their COVID-19 vaccination cards.

“As more and more consumers use their Samsung devices as a digital wallet, it is a natural extension to make Covid-19 vaccination records more easily accessible,” explains Rob White, Sr. Director of Product for Samsung Pay at Samsung Electronics America, in the official announcement. “We are proud to partner with The Commons Project Foundation on this important initiative and to help make life easier” he added.

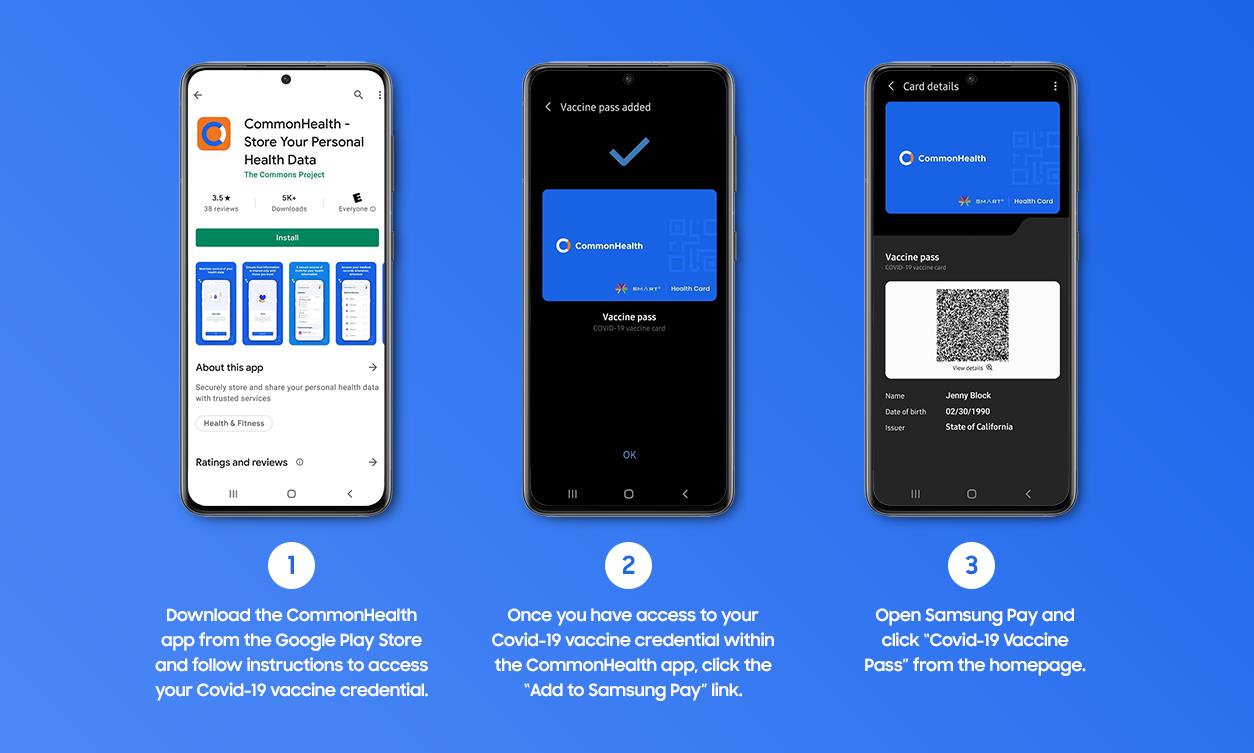

Here’s what you need to do to add your own COVID-19 vaccination card to Samsung Pay:

- Open the Google Play Store app and download the CommonHealth app to your device.

- Follow the instructions provided by the CommonHealth app to access your COVID-19 vaccine information.

- You can then tap the Add to Samsung Pay link to transfer your COVID-19 vaccine information to Samsung Pay.

- Launch the Samsung Pay app and tap the COVID-19 Vaccine Pass on the homepage.

At the moment, this handy feature is available only in the United States, and we have no information on global availability.

Also Read: Mastercard Plans To Say Goodbye To Magnetic Stripes In 2024

Of course, Samsung can’t force any business, educational institution, or other places to actually accept digital vaccination cards stored in Samsung Pay, but we predict that the willingness to accept this form of COVID-19 certification will only increase as more similar solutions become available.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant