News

Signal Now Supports In-App MobileCoin Cryptocurrency Payments

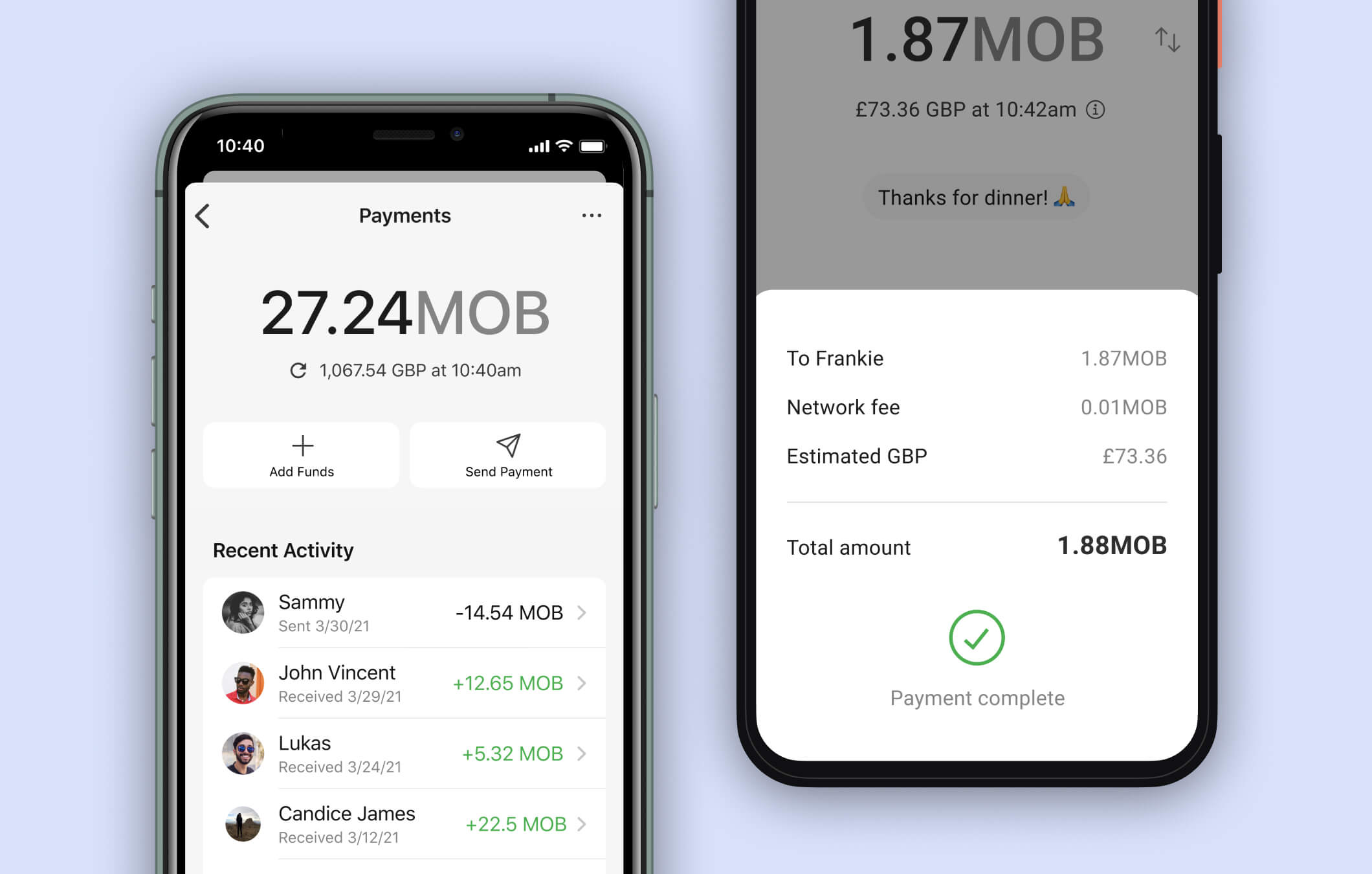

Signal’s latest beta version has introduced a new payment feature, called Signal Payments, allowing users to send and receive cryptocurrency from within the app.

The latest beta version of the privacy-oriented instant messaging platform Signal has introduced a new cryptocurrency payment feature, called Signal Payments, allowing its users to send and receive MobileCoin tokens directly from the Signal app.

Initially, the cryptocurrency payment feature will be available only to Signal users living in the United Kingdom, but support for more regions is planned for the future.

Signal

“Signal Payments makes it easy to link a MobileCoin wallet to Signal so you can start sending funds to friends and family, receive funds from them, keep track of your balance, and review your transaction history with a simple interface,” explains Signal in the official announcement. “As always, our goal is to keep your data in your hands rather than ours; MobileCoin’s design means Signal does not have access to your balance, full transaction history, or funds.”

Following the launch of the beta integration of MobileCoin, the value of a single MOB token jumped from $7 to over $60.

It’s no coincidence that MobileCoin was picked as the first cryptocurrency supported by the messaging app. The platform’s founder, Moxie Marlinspike, is listed as MobileCoin’s technical adviser, and some keen observers have pointed out that his involvement could be much deeper than both he and MobileCoin admit.

According to an early version of the MobileCoin whitepaper, Marlinspike was the project’s original CTO. If this information is true, then the decision to integrate MobileCoin should raise some serious questions among users, questions some members of the crypto community have already voiced their opinions.

Also Read: What Will Happen If You Don’t Accept WhatsApp’s New Privacy Changes?

“Signal sold out their user base by creating and marketing a cryptocurrency based solely on their ability to sell the future tokens to a captive audience,” said Bitcoin Core developer Matt Corallo, who also used to be a contributor.

MobileCoin CEO Joshua Goldbard disputed the authenticity of the whitepaper, claiming that it wasn’t written by anyone at MobileCoin even though the project’s current whitepaper is almost identical to it. Marlinspike refused to say anything about his professional relationship with MobileCoin.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.

-

News2 weeks ago

News2 weeks agoSpace42 & Cobham Satcom Launch New Satellite Broadband Terminal

-

News3 weeks ago

News3 weeks agoVernewell UK: Forging The Future Of Intelligence, Quantum, And AI

-

News3 weeks ago

News3 weeks agoYasmina Smart Speakers Now Feature Ramadan-Specific Content

-

News3 weeks ago

News3 weeks agoPure Electric Expands To UAE, Boosting Micro-Mobility Sector