News

Widespread Phishing Scam Discovered In Saudi Arabia

Group-IB, a global cybersecurity firm, has published research into a scheme where scammers impersonate one of the leading manpower agencies in Saudi Arabia.

Analysts from a leading cybersecurity firm, Group-IB, have uncovered a massive phishing scam operation meant to impersonate one of the Kingdom of Saudi Arabia’s top recruitment agencies.

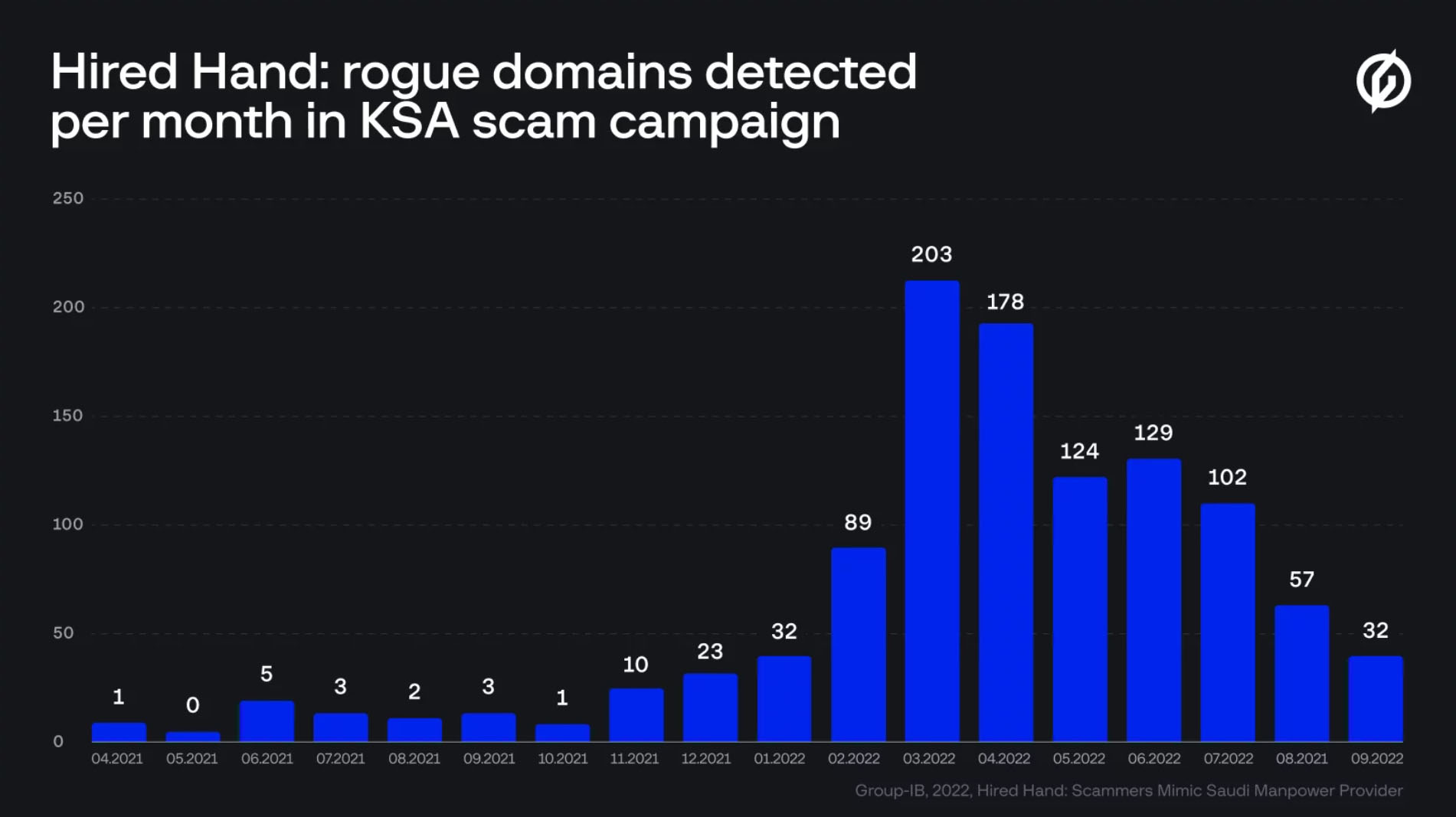

The cybersecurity team found at least 1,000 malicious domains during their research, with most containing a close match to a well-known Saudi agency that offers assistance in hiring employees for the construction and services sector, as well as domestic workers. Scams of this nature are growing at a rate of 10% per year, with more than $55 billion stolen during 2021 alone.

How The Scam Worked

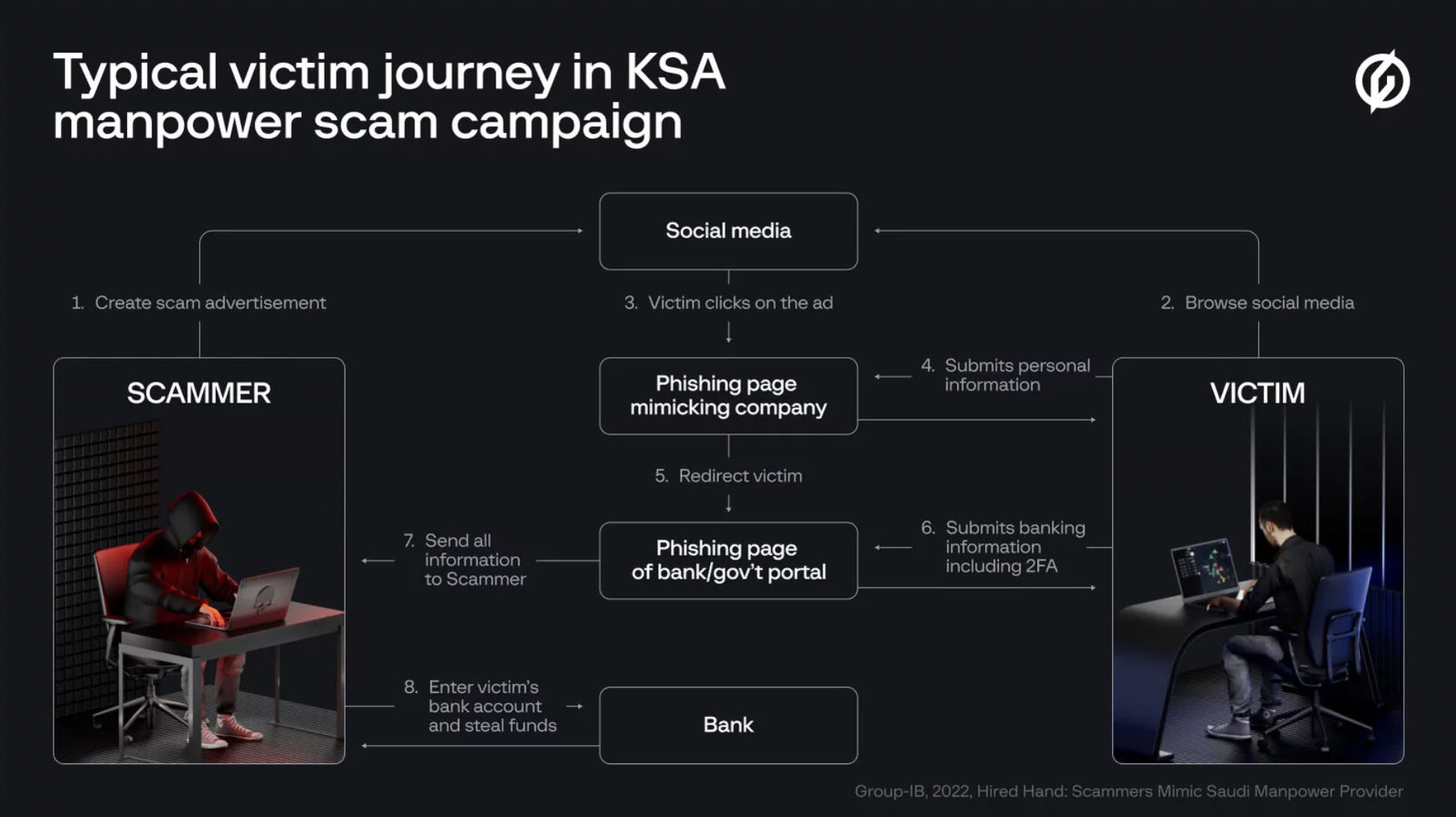

The fake domains and their associated URLs were meant to fool people into thinking they’re the real deal. In addition, each domain featured convincing web pages designed to mimic the official agency website. Scammers were using these web pages to convince people to enter their data, hoping to harvest banking details, as well as both login information and two-factor authentication (2FA) codes.

To drive traffic to these fraudulent websites, the criminals used multiple layers of social engineering, first using ads on Facebook, Twitter, and Google that encouraged SMS or WhatsApp conversations, and then sending unwitting users to the fake sites to enter their details.

Once a user had landed on a fake domain, they were persuaded to part with a small processing fee of 50 or 100 SAR (approximately $13 or $27), which enabled the scammers to harvest banking data to empty accounts and make off with user’s hard-earned cash.

Also Read: Is Your Phone Hacked? How To Find Out & Protect Yourself

“Scammers are becoming increasingly resourceful and collaborative, and spoof domain brokers are actively assisting cybercriminals. We encourage companies and organizations to monitor for signs of brand abuse, and we also urge internet users to remain vigilant so that they do not become victims of scams such as this,” says Mark Alpatskiy, CERT-GIB Senior Analyst.

Falling victim to a phishing scam can be costly, and Internet users are urged to show caution and always check URLs to verify they are legitimate before entering any personal data, as well as ensuring they are in communication with online chat services or call centers of the official company in question.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.