News

Widespread Phishing Scam Discovered In Saudi Arabia

Group-IB, a global cybersecurity firm, has published research into a scheme where scammers impersonate one of the leading manpower agencies in Saudi Arabia.

Analysts from a leading cybersecurity firm, Group-IB, have uncovered a massive phishing scam operation meant to impersonate one of the Kingdom of Saudi Arabia’s top recruitment agencies.

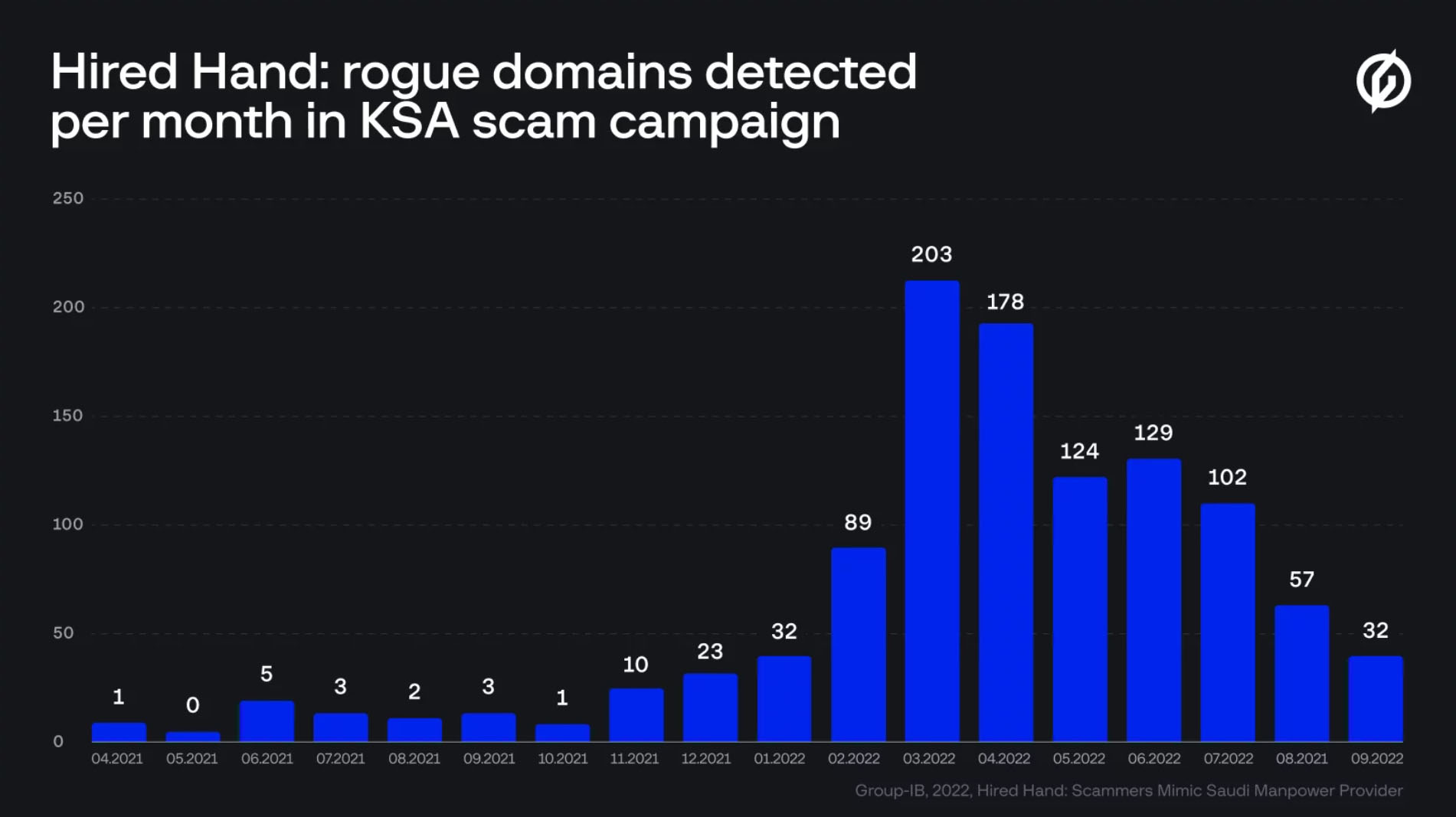

The cybersecurity team found at least 1,000 malicious domains during their research, with most containing a close match to a well-known Saudi agency that offers assistance in hiring employees for the construction and services sector, as well as domestic workers. Scams of this nature are growing at a rate of 10% per year, with more than $55 billion stolen during 2021 alone.

How The Scam Worked

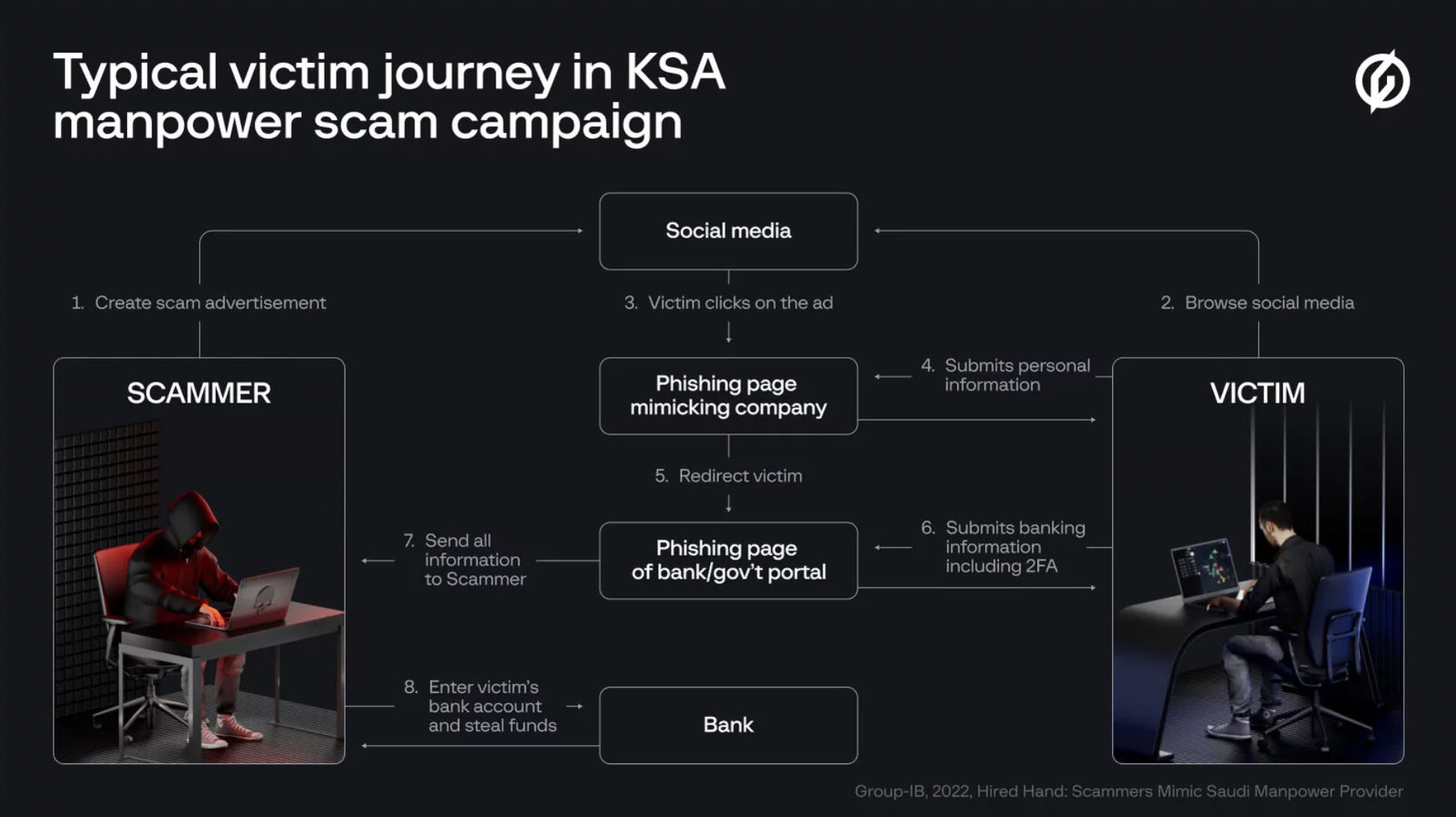

The fake domains and their associated URLs were meant to fool people into thinking they’re the real deal. In addition, each domain featured convincing web pages designed to mimic the official agency website. Scammers were using these web pages to convince people to enter their data, hoping to harvest banking details, as well as both login information and two-factor authentication (2FA) codes.

To drive traffic to these fraudulent websites, the criminals used multiple layers of social engineering, first using ads on Facebook, Twitter, and Google that encouraged SMS or WhatsApp conversations, and then sending unwitting users to the fake sites to enter their details.

Once a user had landed on a fake domain, they were persuaded to part with a small processing fee of 50 or 100 SAR (approximately $13 or $27), which enabled the scammers to harvest banking data to empty accounts and make off with user’s hard-earned cash.

Also Read: Is Your Phone Hacked? How To Find Out & Protect Yourself

“Scammers are becoming increasingly resourceful and collaborative, and spoof domain brokers are actively assisting cybercriminals. We encourage companies and organizations to monitor for signs of brand abuse, and we also urge internet users to remain vigilant so that they do not become victims of scams such as this,” says Mark Alpatskiy, CERT-GIB Senior Analyst.

Falling victim to a phishing scam can be costly, and Internet users are urged to show caution and always check URLs to verify they are legitimate before entering any personal data, as well as ensuring they are in communication with online chat services or call centers of the official company in question.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.