News

X Previews Long-Awaited “Shadowban” Alerts

Accounts sharing “sensitive content” will be labeled and restricted from searches and recommendations.

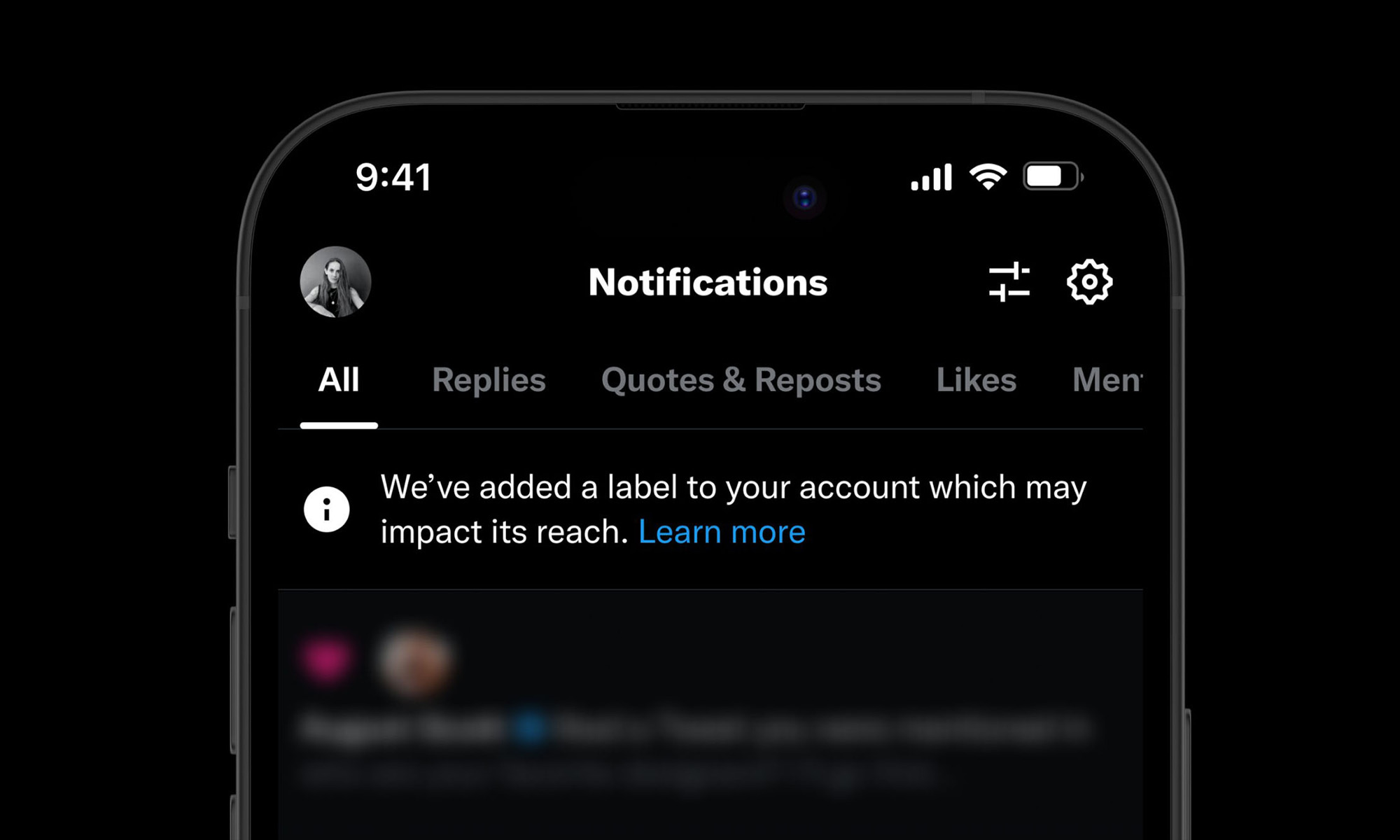

X, formerly Twitter, is moving a stage closer to adding a long-promised feature that notifies users when their account becomes “shadowbanned.” Andrea Conway, one of the developers at X, previewed the upcoming feature first promised by controversial CEO Elon Musk last year.

“We may cover your posts with a warning so people who don’t want to see sensitive content can avoid it. The reach of your account and its content may also be restricted, such as being excluded from the For You and Following timelines, recommended notifications, trends, and search results,” said Conway.

starting transparency somewhere pic.twitter.com/QUNKga1t4I

— Andrea Conway (@ehikian) September 26, 2023

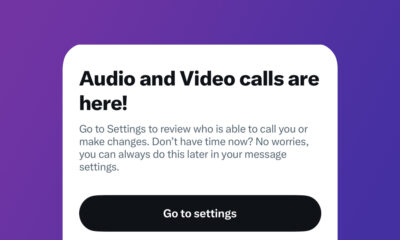

Conway displayed two mock-ups of the update: a notifications tab alert plus an informational page explaining why X may limit the visibility of certain accounts. “We have found that your account potentially contains sensitive media — such as graphic, violent, nudity, sexual behavior, hateful symbols, or other sensitive content,” it explains.

Underneath the message sits an appeal button, which users can click to request X review its initial decision. Conway also explained that users would be able to view their account status outside of the notifications tab but didn’t mention how that might work.

Also Read: The Largest Data Breaches In The Middle East

The feature tackles what has long been a controversial issue for Twitter (now X). For years, the company has limited the reach of accounts breaking its rules, sometimes without the account holders themselves being aware of the throttling.

The forthcoming update should add transparency to X’s decisions but is likely to also create further controversies and even conspiracy theories. Meanwhile, Conway said the company “should have more to share on this soon”.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant