News

Zoho Launches Zoho Payroll Solution For UAE Businesses

The cloud-based software allows UAE companies to process wages in a single click while staying fully compliant with local labor laws.

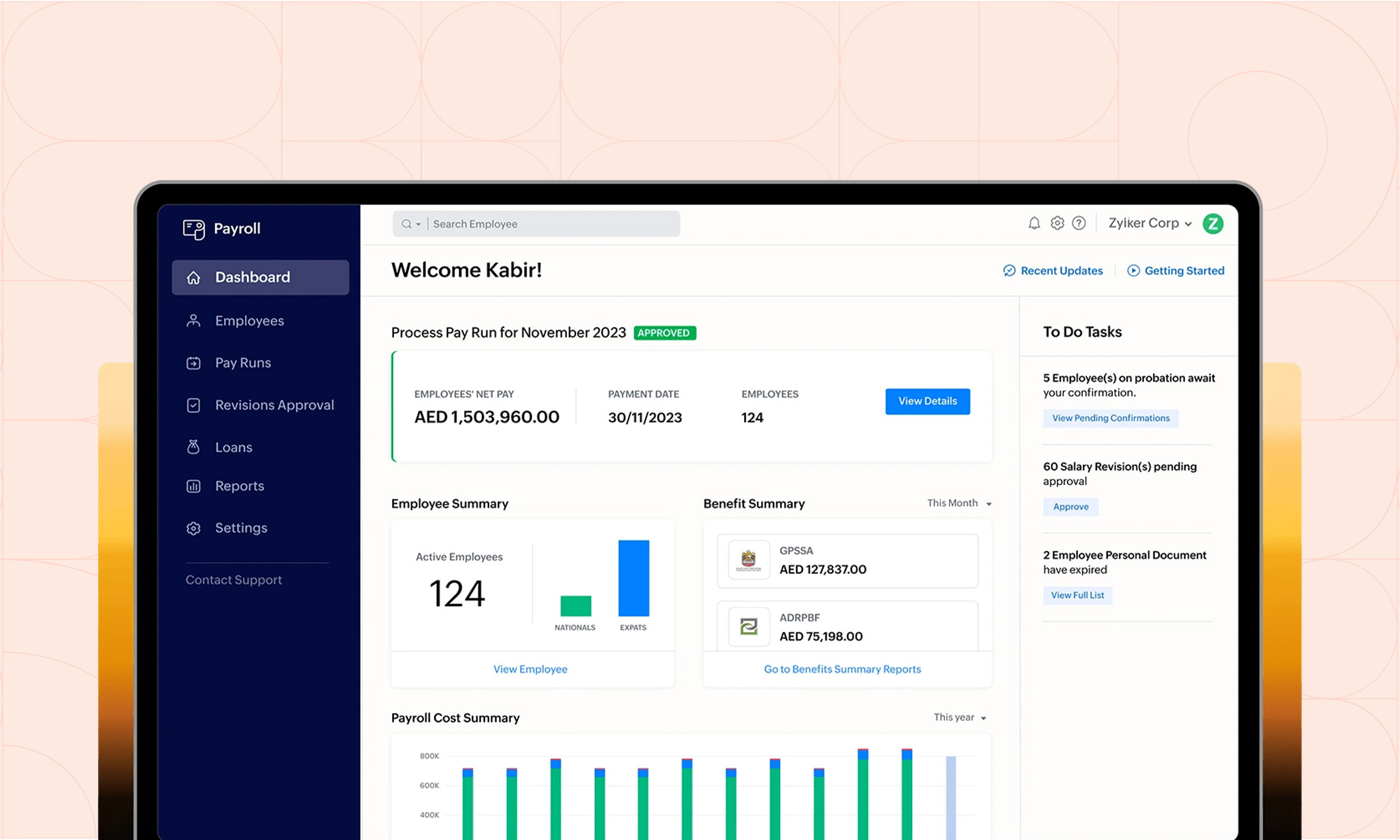

Zoho, a leading software provider with over 55 productivity and business apps, has launched its payroll management software — Zoho Payroll — for UAE-based companies. The solution allows businesses to streamline payroll management, automate monthly tasks, and ensure compliance.

“Businesses often face key challenges in payroll management like pulling in employee records from multiple sources while staying compliant with the local labor laws. Payroll is a modern alternative for UAE businesses, providing built-in compliance, automating monthly payroll tasks, and seamlessly connecting with the relevant data sources,” said Prashant Ganti, Head of Product Management, Zoho Finance and Operations Suite.

Zoho Payroll allows simple employee onboarding and offboarding, benefits handling, single-click payroll processing, and real-time reports. The app automatically ensures gratuity and pension scheme compliance and provides advanced customizations for salary components, email notifications, reminders, and alerts.

The platform also features a self-service portal that can be accessed through a dedicated iOS and Android app. Employees can view salary information, download payslips, track borrowed loans, and communicate with payroll teams.

Also Read: How (And Why) To Start A Tech Business In Dubai

Zoho Payroll comes pre-integrated with Zoho Books, allowing for automated accounting entries, plus Zoho Expense for employee expense reimbursements, and Zoho People for employee data and annual leave tracking. The software also integrates with the recently launched Zoho Practice, a practice management software solution for accountants, where client’s pending pay runs, unapproved revisions, and payments can be viewed.

Pricing & Availability

Zoho’s new payroll software is available now, with prices starting at AED7 per employee per month, billed annually.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.