News

Zoom Launches Intelligent Director Feature For Zoom Rooms

The AI-powered solution enhances connections and optimizes conference room experiences using multiple cameras.

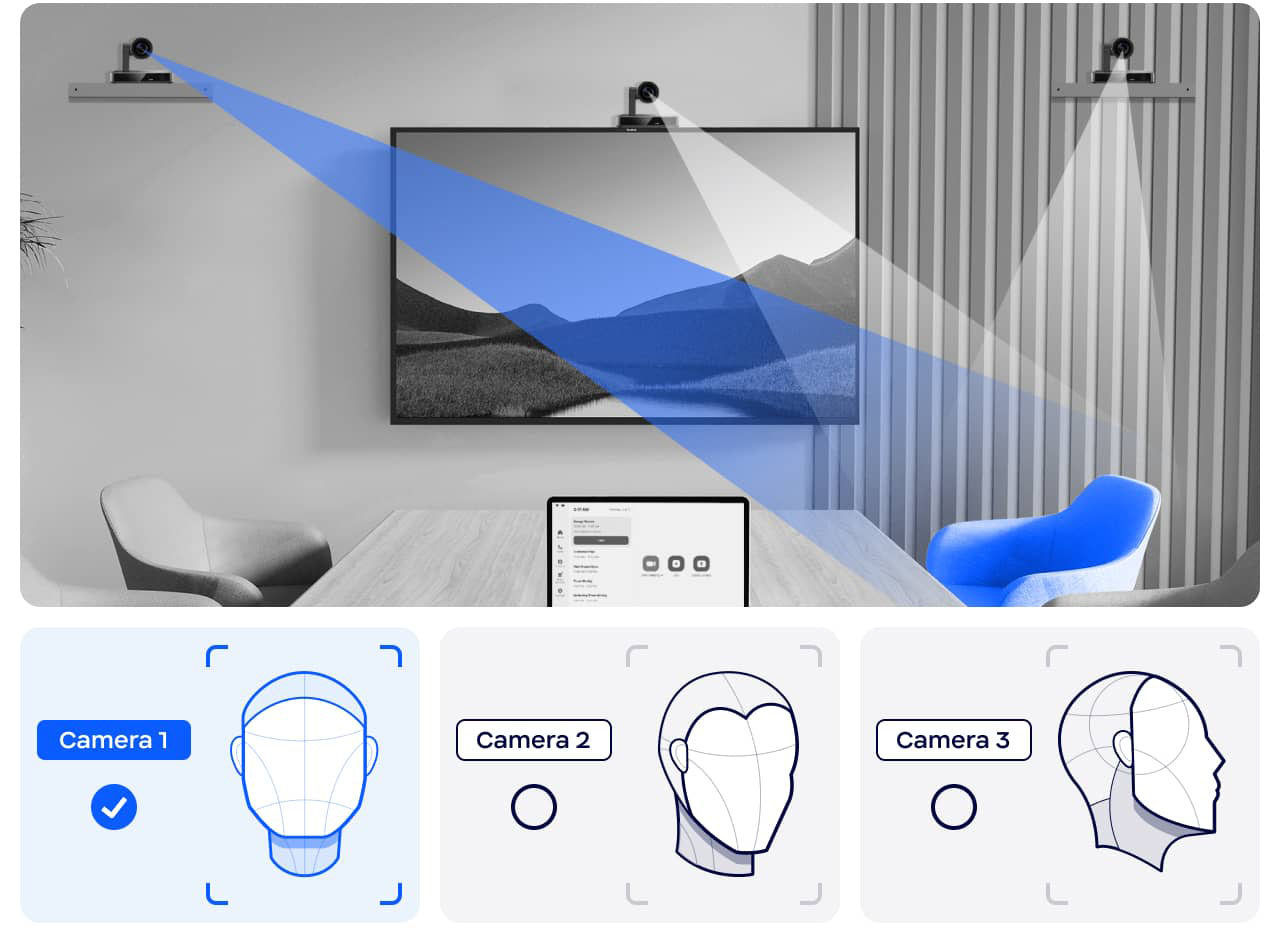

Popular video meeting app Zoom has just announced a new feature, Intelligent Director, for improved hybrid meetings within Zoom Rooms. The technology uses multiple cameras combined with AI algorithms to display the best image and angle of meeting participants.

“As more people return to the office, it’s no longer enough to deliver the best remote worker experience; every business needs a solution to deliver the best hybrid meeting experience,” explained Smita Hashim, chief product officer at Zoom. “Even with some employees in the office, oftentimes other team members are dispersed, so meeting equity and inclusion become more important than ever. Intelligent Director is the solution that can bring employees together, regardless of location, so they can truly connect face-to-face”.

Intelligent Director will allow greater clarity for remote participants, even in large conference rooms, and help to avoid the “bowling alley effect” by sending streams to the gallery view of the Zoom Meeting. The AI-enhanced tech can frame up to 16 participants and is an evolution of the company’s existing Smart Gallery feature.

For larger meeting spaces, participants can often be hidden when only using a single camera, so Intelligent Director’s multi-camera configuration was designed to enable meeting equity for everyone in a conference, even if they move or turn their heads.

Also Read: Checkout.com Uses AI To Boost eCommerce Acceptance Rates

Intelligent Director has been made possible through support from Zoom’s hardware partner ecosystem, which includes industry heavyweights including Apple, Dell, HP, Intel, and Logitech.

Whether or not remote working has a future after the pandemic, video conferencing continues to prove a vital communication tool for keeping employees and teams connected, and continuous feature enhancements are a way for Zoom to maintain its position as a market leader.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant