News

Apple Close To Adding Diabetic Glucose-Tracking To Watches

The Cupertino company has been trialing the technology for a decade, and it now looks like diabetes sufferers will soon be able to monitor glucose using their Apple watch.

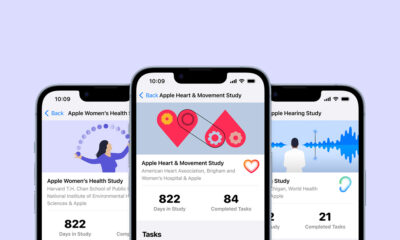

The Apple Watch has become a popular health and fitness monitoring tool in recent years, with features including a heart rate monitor, body temperature sensor, blood oxygen monitoring, and women’s health tracking. However, despite a growing feature set, the watch does have one notable omission: blood glucose monitoring.

According to data from the World Health Organization, around 422 million people worldwide have diabetes. Currently, the disease is monitored using a finger-prick test to measure glucose levels or by attaching patches to the skin.

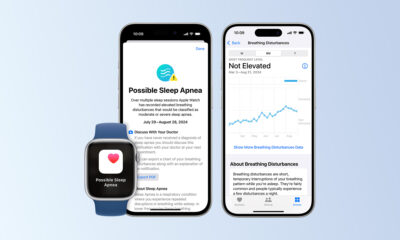

Apple is now reportedly close to adding a non-invasive glucose monitoring solution to its watches after testing various technologies for the best part of a decade. However, it could still be a few years before the device is ready for mass-market application.

If Apple’s monitoring sensors get the green light from medical professionals, its smartwatches could also be used to screen users for pre-diabetic indicators, as well as help long-term sufferers to manage their condition without the pain and inconvenience of skin-prick testing.

Also Read: Saudi Arabia To Transform Downtown Riyadh By 2030

Apple will use a chip-based solution called “silicon photonics” to measure glucose levels, combined with absorption spectroscopy, which measures reflected light to gauge insulin. Although the technology hasn’t yet been peer-reviewed by scientists, the Cupertino company is thought to be deep into the proof-of-concept stage of testing.

Once Apple’s technology has been evaluated by researchers, the company will have to work on reducing the size of the chips, as experts believe that early prototypes are still too large to fit into the compact frame of a smartwatch.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.