News

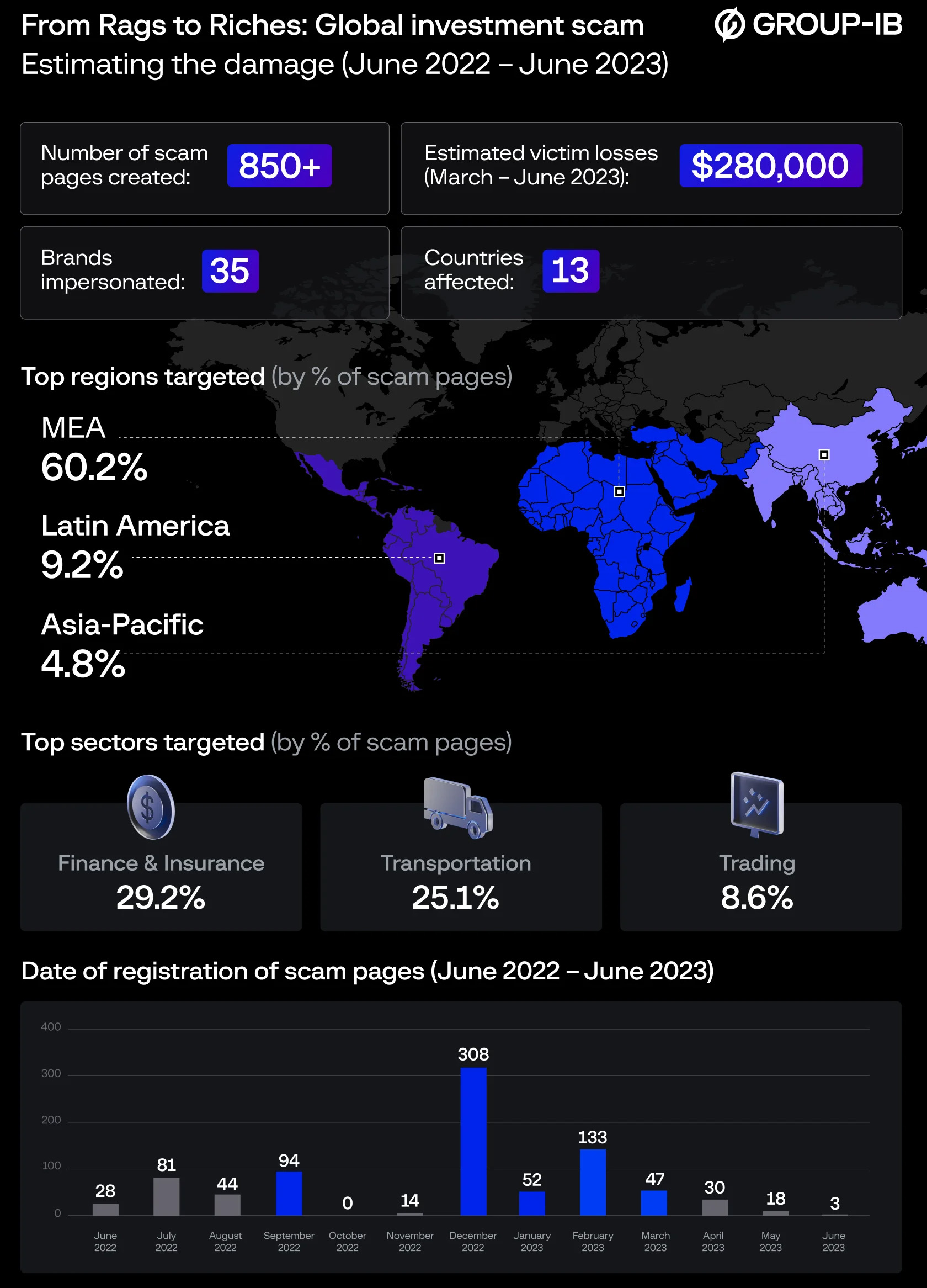

884 Scam Pages Unearthed In $280K Global Investment Scam

Links to the pages were shown in Facebook ads purchased by fraudsters, who lured users into making fake investments in market-leading companies.

Group-IB, a global cybersecurity firm working alongside the UAE Cybersecurity Council, has published new research outlining an international fake investment scam that significantly impacted social media users in the Middle East.

Experts from Group-IB’s Digital Risk Protection team discovered 884 scam pages with traffic coming from Facebook advertisements purchased by the fraudsters. The social media campaign offered users the opportunity to invest in one of 35 market-leading firms, including legitimate financial, insurance, transportation, oil, gas, and construction companies.

Group-IB researchers found English, Arabic, and Spanish Facebook ads. In Arabic-language advertisements, scammers enticed individuals with bold claims that they could “earn millions” by investing “a mere $200” amount.

If a user clicked on an ad, they were redirected to a scam page containing legitimate branding from a prominent company, along with a request for their name, email address, and phone number.

After filling out the form, users would receive daily emails claiming to be from a trading portal. Users would be urged to deposit funds into the fake trading account to begin buying stocks. The scammers would even resort to phone calls if a user didn’t respond. The elaborate con also requested bank details, ID, and passport copies.

Also Read: The Largest Data Breaches In The Middle East

“Retail investing is becoming increasingly popular among individuals who are looking for ways to diversify their income. This particular scam is notable as the cybercriminals leverage multiple communication channels, such as email and direct phone calls, as part of their social engineering efforts. We urge individuals to never share personal information or money with third parties unless you are certain of their legitimacy,” said Sharef Hlal, Head of Group-IB’s MEA Digital Risk Protection Analytics Team.

In total, 60% of the scam pages targeted users from the Middle East and Africa (MEA) region. Based on Group-IB’s research, the criminal campaign is thought to have caused $280,000 in financial damages between March and June 2023.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.