News

Spotify Is Now Available In 80+ Additional Countries

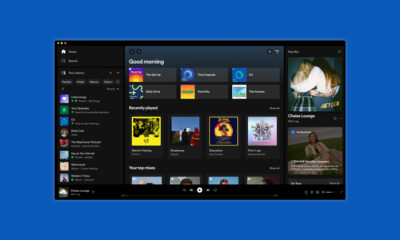

Spotify, the world’s largest audio streaming platform, has recently become available in more than 80 additional countries across Asia, Africa, and the Caribbean.

Thanks to the expansion, Spotify will now be able to potentially attract as much as 1 billion new listeners, who can enjoy its growing catalog of songs and podcasts in 36 extra languages. “These moves represent Spotify’s broadest market expansion to date,” stated the Swedish company.

Currently, Spotify users from all newly supported countries have full access to the streaming platform’s global music catalog, but its podcast catalog is not yet available in certain locations. To make its services more attractive to local audiences, Spotify is determined to work with local creators and partners to expands its music offering by including regional artists.

Spotify has been with us since 2008. The service now enjoys 345 million monthly active users (155 million of which are premium paying subscribers). “For the first time ever, we have the technology to connect the world through audio,” said Chief Executive Officer Daniel Ek at an investor event known as #StreamOn.

During the event, Ek talked about Spotify’s desire to become a full-fledged audio streaming platform offering all kinds of audio content. The service is already home to around 2 million podcasts, and its audiobook library is growing at a similarly impressive pace. Spotify has also announced dozens of new original series, such as sports shows and celebrity talk shows.

Also Read: Apple Likely To Release 8K VR Headset In 2022

In addition to the market expansion, the company has also announced Spotify HiFi which will be available later this year. Spotify HiFi changes the way people listen to music as it delivers all tracks in CD-quality, lossless format, giving users much more depth and clarity.

Newly supported countries:

Angola, Antigua and Barbuda, Armenia, Azerbaijan, Bahamas, Bangladesh, Barbados, Belize, Benin, Bhutan, Botswana, Brunei Darussalam, Burkina Faso, Burundi, Cabo Verde, Cambodia, Cameroon, Chad, Comoros, Côte d’Ivoire, Curaçao, Djibouti, Dominica, Equatorial Guinea, Eswatini, Fiji, Gabon, Gambia, Georgia, Ghana, Grenada, Guinea, Guinea-Bissau, Guyana, Haiti, Jamaica, Kenya, Kiribati, Kyrgyzstan, Lao People’s Democratic Republic, Lesotho, Liberia, Macau, Madagascar, Malawi, Maldives, Mali, Marshall Islands, Mauritania, Mauritius, Micronesia, Mongolia, Mozambique, Namibia, Nauru, Nepal, Niger, Nigeria, Pakistan, Palau, Papua New Guinea, Rwanda, Samoa, San Marino, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Solomon Islands, Sri Lanka, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Suriname, Tanzania, Timor-Leste, Togo, Tonga, Trinidad and Tobago, Tuvalu, Uganda, Uzbekistan, Vanuatu, Zambia, and Zimbabwe.

News

Checkout.com Set To Launch Card Issuing In The UAE

The payment service provider’s expansion is a first-of-its-kind investment and could reshape digital transactions across the region.

Checkout.com is laying the groundwork to become the first global payments platform to introduce card issuing in the United Arab Emirates — a move that could reshape how businesses in the region manage financial transactions.

The company plans to roll out its domestic card issuance offering in the UAE by 2026, subject to regulatory approval. The launch would give businesses the tools to issue both physical and virtual branded cards. This, in turn, opens up new ways to reward customers, streamline expense processes, and handle B2B payouts efficiently.

Checkout.com’s CEO and Founder, Guillaume Pousaz, revealed the plans during Thrive Abu Dhabi, the firm’s debut conference in the Emirates. Joined on stage by Remo Giovanni Abbondandolo, General Manager for MENA, Pousaz presented to an audience of over 150 partners and merchants at Saadiyat Island. Also in attendance was H.E. Omar Sultan Al Olama, the UAE’s Minister of State for Artificial Intelligence, Digital Economy, and Remote Work Applications.

Abbondandolo highlighted the strategic importance of the announcement: “As a global business, we focus on bringing products to markets that our customers want and need. Today’s announcement is proof of our commitment to the MENA region and its rising influence in the digital economy. The appetite for innovation here is real, and we’re proud to be building the infrastructure that powers it”.

One early adopter of Checkout.com’s UAE acquiring services is Headout, a travel experiences marketplace, which recently named the payment provider as its main partner in Europe. The company has already begun card issuing there and is keen to expand that offering into MENA once approval is granted.

The expansion of services in the UAE and beyond builds on Checkout.com’s track record in the region. It was the first global payments firm to secure a Retail Payment Services license from the UAE’s Central Bank and was instrumental in rolling out Mada and Apple Pay in both the UAE and Saudi Arabia.

Also Read: Protecting Your WhatsApp Account From Hackers: Kaspersky Expert Tips

The firm has also been rolling out new products: One of the latest is Flow Remember Me, currently in beta testing. It allows shoppers to store their card information once and access it across Checkout.com’s entire network, potentially cutting checkout times by up to 70%.

Earlier this year, Checkout.com also introduced Visa Direct’s Push-to-Card solution in the UAE, enabling both domestic and international payouts. Its collaboration with Mastercard has grown as well, making it easier for businesses to send funds directly to third-party cards securely and quickly.

With regional tech ambitions on the rise — spurred by initiatives like Saudi Arabia’s Vision 2030 and the UAE’s 2031 Agenda — Checkout.com sees its role as one of a key enabler. “Our mission is to help ambitious businesses navigate the complexity of payments, so they can move faster, go further, and make the most of every opportunity,” said Abbondandolo. “In MENA, performance is personal. It’s local. It’s built on trust. And when payments perform, businesses thrive”.