News

Spotify Is Now Available In 80+ Additional Countries

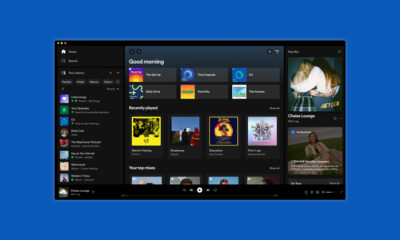

Spotify, the world’s largest audio streaming platform, has recently become available in more than 80 additional countries across Asia, Africa, and the Caribbean.

Thanks to the expansion, Spotify will now be able to potentially attract as much as 1 billion new listeners, who can enjoy its growing catalog of songs and podcasts in 36 extra languages. “These moves represent Spotify’s broadest market expansion to date,” stated the Swedish company.

Currently, Spotify users from all newly supported countries have full access to the streaming platform’s global music catalog, but its podcast catalog is not yet available in certain locations. To make its services more attractive to local audiences, Spotify is determined to work with local creators and partners to expands its music offering by including regional artists.

Spotify has been with us since 2008. The service now enjoys 345 million monthly active users (155 million of which are premium paying subscribers). “For the first time ever, we have the technology to connect the world through audio,” said Chief Executive Officer Daniel Ek at an investor event known as #StreamOn.

During the event, Ek talked about Spotify’s desire to become a full-fledged audio streaming platform offering all kinds of audio content. The service is already home to around 2 million podcasts, and its audiobook library is growing at a similarly impressive pace. Spotify has also announced dozens of new original series, such as sports shows and celebrity talk shows.

Also Read: Apple Likely To Release 8K VR Headset In 2022

In addition to the market expansion, the company has also announced Spotify HiFi which will be available later this year. Spotify HiFi changes the way people listen to music as it delivers all tracks in CD-quality, lossless format, giving users much more depth and clarity.

Newly supported countries:

Angola, Antigua and Barbuda, Armenia, Azerbaijan, Bahamas, Bangladesh, Barbados, Belize, Benin, Bhutan, Botswana, Brunei Darussalam, Burkina Faso, Burundi, Cabo Verde, Cambodia, Cameroon, Chad, Comoros, Côte d’Ivoire, Curaçao, Djibouti, Dominica, Equatorial Guinea, Eswatini, Fiji, Gabon, Gambia, Georgia, Ghana, Grenada, Guinea, Guinea-Bissau, Guyana, Haiti, Jamaica, Kenya, Kiribati, Kyrgyzstan, Lao People’s Democratic Republic, Lesotho, Liberia, Macau, Madagascar, Malawi, Maldives, Mali, Marshall Islands, Mauritania, Mauritius, Micronesia, Mongolia, Mozambique, Namibia, Nauru, Nepal, Niger, Nigeria, Pakistan, Palau, Papua New Guinea, Rwanda, Samoa, San Marino, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Solomon Islands, Sri Lanka, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Suriname, Tanzania, Timor-Leste, Togo, Tonga, Trinidad and Tobago, Tuvalu, Uganda, Uzbekistan, Vanuatu, Zambia, and Zimbabwe.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.