News

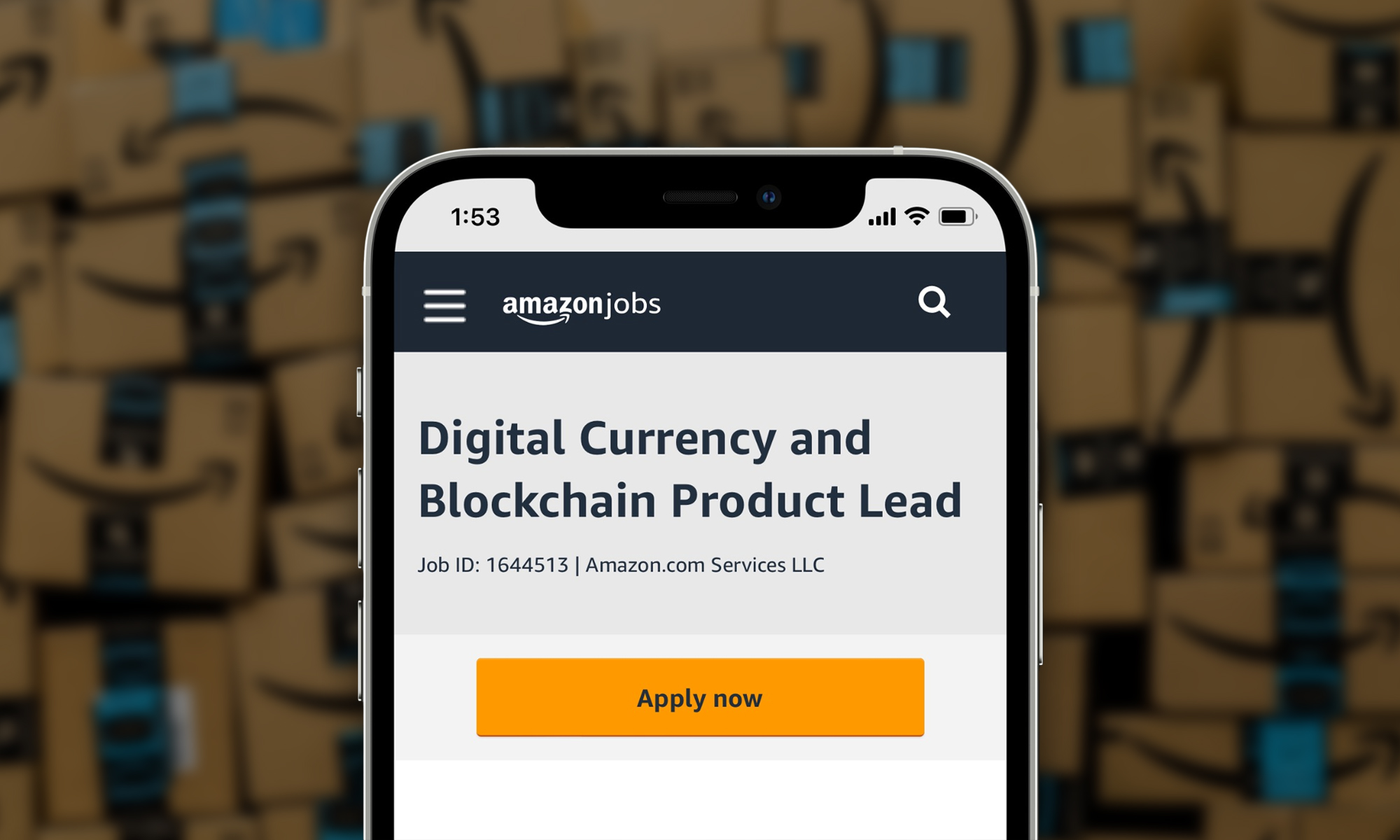

Amazon Is Looking For A Digital Currency & Blockchain Expert

Amazon’s ideal candidate is someone who has at least 10 years of experience in product management and understands blockchain and related technologies.

When the value of Bitcoin, and most other cryptocurrencies along with it, suddenly jumps up from just under $30,000 to nearly $40,000, you know that either Elon Musk has tweeted again or that some potentially groundbreaking cryptocurrency news is making the headlines. This time around, it’s the latter. Insider recently noticed that Amazon’s payments acceptance and experience team has posted a job listing for a Digital Currency and Blockchain Product Lead, and journalists and cryptocurrency advocates alike have immediately started speculating if Amazon is planning to start accepting cryptocurrency payments.

“The Payments Acceptance & Experience team is seeking an experienced product leader to develop Amazon’s Digital Currency and Blockchain strategy and product roadmap,” the job listing states. “You will leverage your domain expertise in Blockchain, Distributed Ledger, Central Bank Digital Currencies and Cryptocurrency to develop the case for the capabilities which should be developed, drive the overall vision and product strategy, and gain leadership buy-in and investment for new capabilities.”

According to Amazon’s qualifications requirements, the ideal candidate is someone who has at least 10 years of experience in product or program management, product marketing, business development, or technology and understands blockchain and related technologies.

Since the job listing was first noticed, Amazon has officially confirmed its validity. In May, a similar job listing was published by Apple.

Also Read: Instagram Fights Cybercrime With New Security Checkup Feature

Currently, Amazon doesn’t accept cryptocurrency payments, but the company’s Amazon Web Services (AWS) division does offer a managed blockchain service, allowing anyone to easily create and manage scalable blockchain networks.

Microsoft is the biggest competitor that already accepts cryptocurrency payments that Amazon currently has, and there are many other large companies across a variety of different industries doing the same. If Amazon decides to join their ranks, it would be the black swan event so many people in the cryptocurrency industry are currently waiting for.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant