News

Apple Likely To Release 8K VR Headset In 2022

Near the end of January, Bloomberg published a report claiming that Apple is working on what could be the most expensive 8K VR headset ever made. Now, a JP Morgan analysis, spotted by China Times, states that the headset could be available as early as Q1 2022, but it’s likely to cost around $3,000 USD.

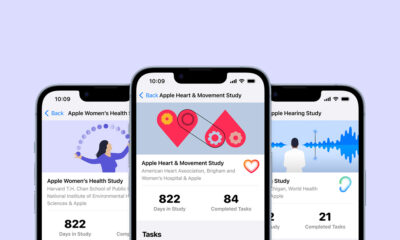

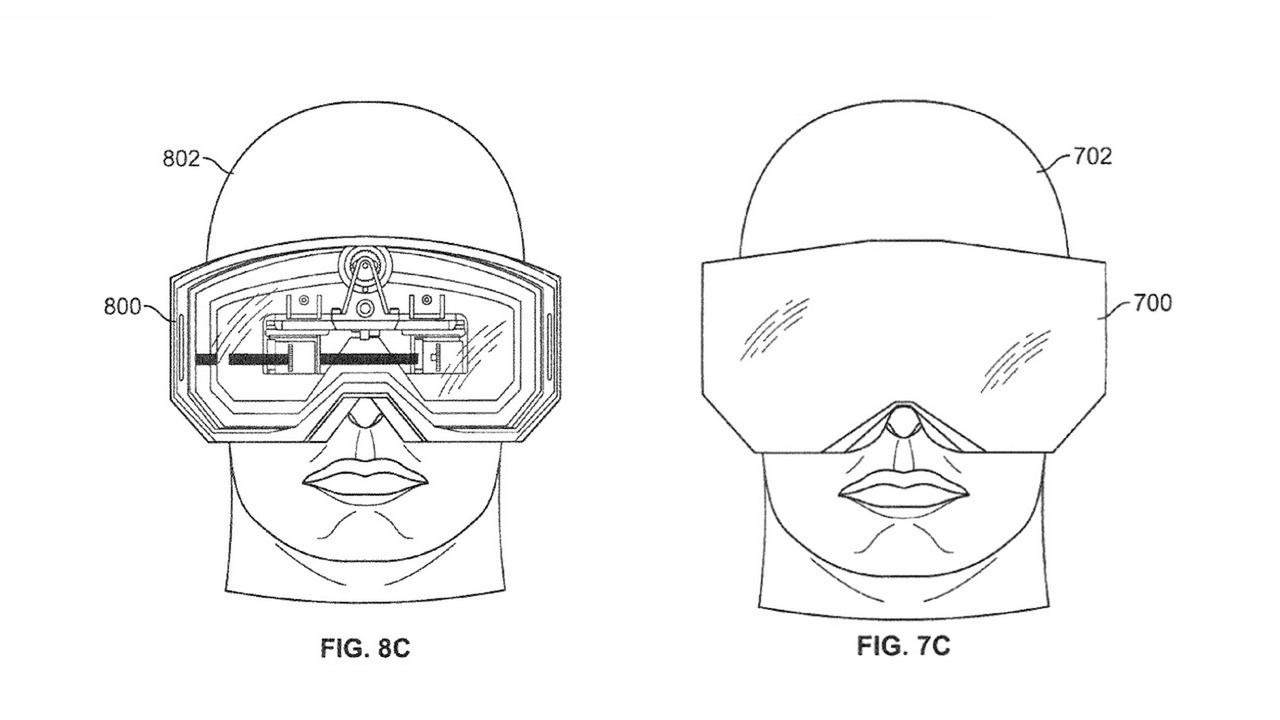

Why the steep price? Because Apple’s first VR headset will likely boast dual 8K displays with eye-tracking technology, offering far better resolution than other VR headsets that are commercially available at the moment. For example, the $300 USD Oculus Quest 2 has a singular fast-switch LCD panel with a 1832×1920 per eye resolution, while the $700 USD HTC Vive Cosmos displays text and graphics through a 2880 x 1700 combined pixel resolution.

In addition to an ultra-high-resolution display, the headset is also expected to feature the combination of an optical radar (LiDAR) and a Time-of-Flight (ToF) sensor for accurate location of the headset in space. All these and other components will be coordinated by a new version of the M1 chip, the first ARM-based system on a chip designed by Apple.

The chip will be manufactured by TSMC, one of the world’s biggest semiconductor foundries, and the final assembly of the headset will be handled Pegatron or Quanta Computer.

According to a drawing published by The Information, the headset could feature a HomePod-esque mesh fabric and swappable Apple Watch-style headbands. Depending on the specific materials Apple decides to use, the headset could be considerably lighter than its competitors, which would definitely help with long-term comfort.

Also Read: Google Launches Its Dunant Subsea Cable Between The US And Europe

Because of how expensive the headset will be, some experts predict that its target audience will be professional content creators—not regular users. Currently, producers of virtual reality content have to rely on third-party VR headsets and deal with the potential compatibility issues associated with them.

News

Checkout.com Set To Launch Card Issuing In The UAE

The payment service provider’s expansion is a first-of-its-kind investment and could reshape digital transactions across the region.

Checkout.com is laying the groundwork to become the first global payments platform to introduce card issuing in the United Arab Emirates — a move that could reshape how businesses in the region manage financial transactions.

The company plans to roll out its domestic card issuance offering in the UAE by 2026, subject to regulatory approval. The launch would give businesses the tools to issue both physical and virtual branded cards. This, in turn, opens up new ways to reward customers, streamline expense processes, and handle B2B payouts efficiently.

Checkout.com’s CEO and Founder, Guillaume Pousaz, revealed the plans during Thrive Abu Dhabi, the firm’s debut conference in the Emirates. Joined on stage by Remo Giovanni Abbondandolo, General Manager for MENA, Pousaz presented to an audience of over 150 partners and merchants at Saadiyat Island. Also in attendance was H.E. Omar Sultan Al Olama, the UAE’s Minister of State for Artificial Intelligence, Digital Economy, and Remote Work Applications.

Abbondandolo highlighted the strategic importance of the announcement: “As a global business, we focus on bringing products to markets that our customers want and need. Today’s announcement is proof of our commitment to the MENA region and its rising influence in the digital economy. The appetite for innovation here is real, and we’re proud to be building the infrastructure that powers it”.

One early adopter of Checkout.com’s UAE acquiring services is Headout, a travel experiences marketplace, which recently named the payment provider as its main partner in Europe. The company has already begun card issuing there and is keen to expand that offering into MENA once approval is granted.

The expansion of services in the UAE and beyond builds on Checkout.com’s track record in the region. It was the first global payments firm to secure a Retail Payment Services license from the UAE’s Central Bank and was instrumental in rolling out Mada and Apple Pay in both the UAE and Saudi Arabia.

Also Read: Protecting Your WhatsApp Account From Hackers: Kaspersky Expert Tips

The firm has also been rolling out new products: One of the latest is Flow Remember Me, currently in beta testing. It allows shoppers to store their card information once and access it across Checkout.com’s entire network, potentially cutting checkout times by up to 70%.

Earlier this year, Checkout.com also introduced Visa Direct’s Push-to-Card solution in the UAE, enabling both domestic and international payouts. Its collaboration with Mastercard has grown as well, making it easier for businesses to send funds directly to third-party cards securely and quickly.

With regional tech ambitions on the rise — spurred by initiatives like Saudi Arabia’s Vision 2030 and the UAE’s 2031 Agenda — Checkout.com sees its role as one of a key enabler. “Our mission is to help ambitious businesses navigate the complexity of payments, so they can move faster, go further, and make the most of every opportunity,” said Abbondandolo. “In MENA, performance is personal. It’s local. It’s built on trust. And when payments perform, businesses thrive”.