News

Beirut Airport Cybersecurity Incident: How It Unfolded

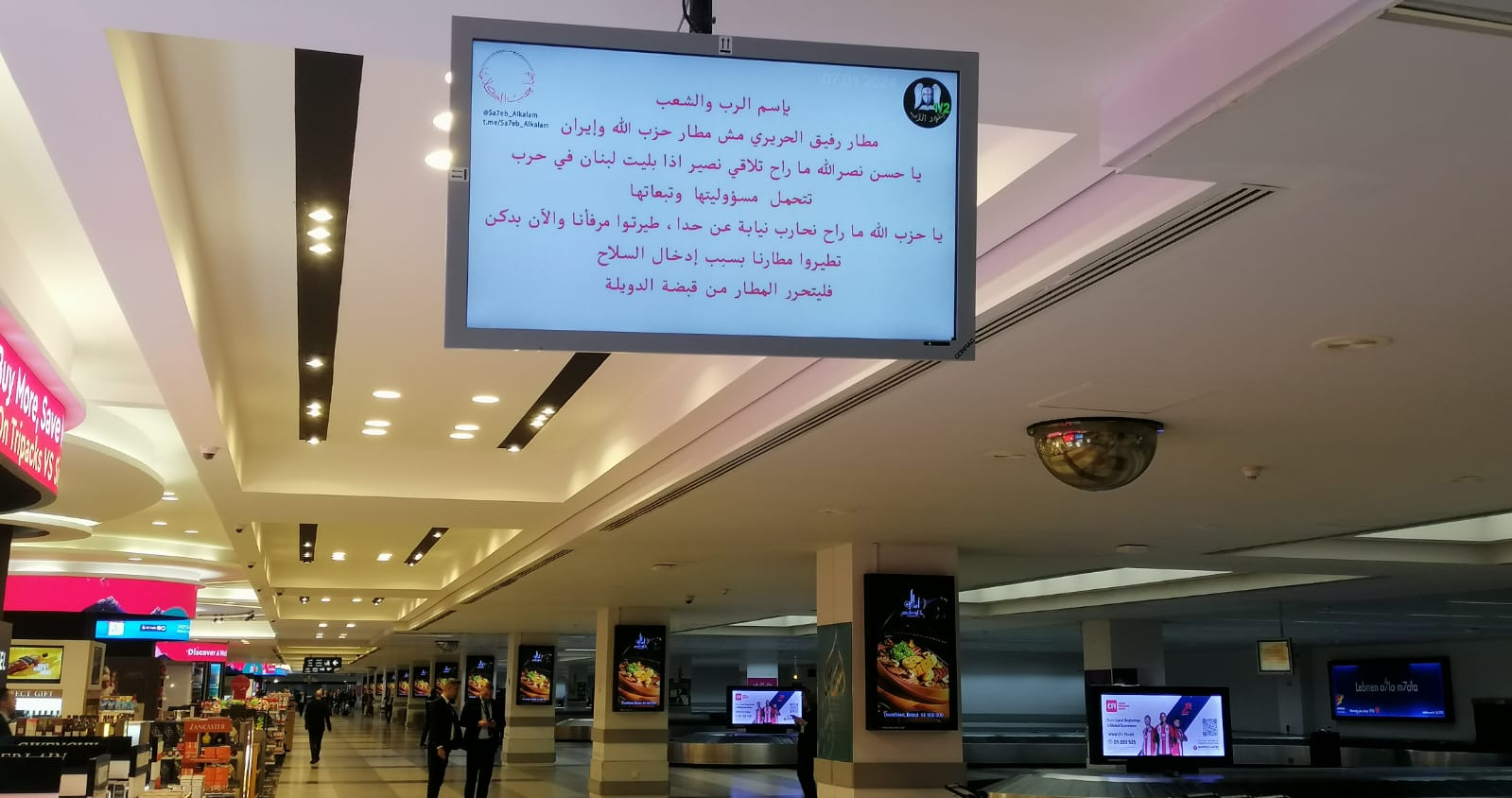

On Sunday January 7, Rafic Hariri International Airport’s screens began displaying political messages instead of flight information.

On Sunday evening, January 7, 2024, Beirut’s Rafic Hariri International Airport experienced a cyber attack that resulted in political messages appearing on its departure and arrival screens, disrupting normal flight information and temporarily halting luggage belt operations.

Lebanon’s Minister of Public Works and Transport, Ali Hamieh, addressed the public the following day, expressing a commitment to uncovering the perpetrators of the incident and reassuring the public that the airport remained fully operational.

Meanwhile, Fadi El-Hassan, Director General of Civil Aviation, reported that the issues with the airport’s screens had been resolved, and normal functionality had been restored across passenger terminals, including arrival and departure halls.

Despite these developments, official statements from Lebanese authorities regarding the incident were yet to be released, as investigations continued under the oversight of the Lebanese security services, as confirmed by Minister Ali Hamieh.

As of now, no information has surfaced regarding the compromise of airport data, such as flight details, passenger records, or other sensitive information. However, technical experts at SMEX, a nonprofit organization dedicated to advancing digital human rights across West Asia and North Africa, say that the severity of the cyberattack reveals clues on the motives behind it.

Also Read: The Largest Data Breaches In The Middle East

Members of SMEX’s technical team raised concerns about the cyber breach, stating, “If the perpetrators were able to manipulate screen content and disrupt the Baggage Handling System (BHS), it indicates the possible presence of malware within the compromised system”.

SMEX’s technical experts have also outlined several conceivable scenarios for the attack:

- The breach may have originated from the airport’s internal network, possibly involving the installation of malicious software by an individual with insider access to the airport’s systems.

- Another possibility is the compromise of an employee’s device through social engineering or a phishing attack, typically delivered via email or other deceptive means.

- An employee with privileged system access might have been coerced or manipulated through blackmail, bribery, or threats, facilitating unauthorized entry into the airport’s systems.

Lebanese authorities have yet to pinpoint the root cause of the airport cyberattack, leaving room for speculation about potential sources, which may include internal, external, or even governmental actors.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.