News

Cybersecurity Firm Uncovers 2,400+ Fake Arabic Job Pages

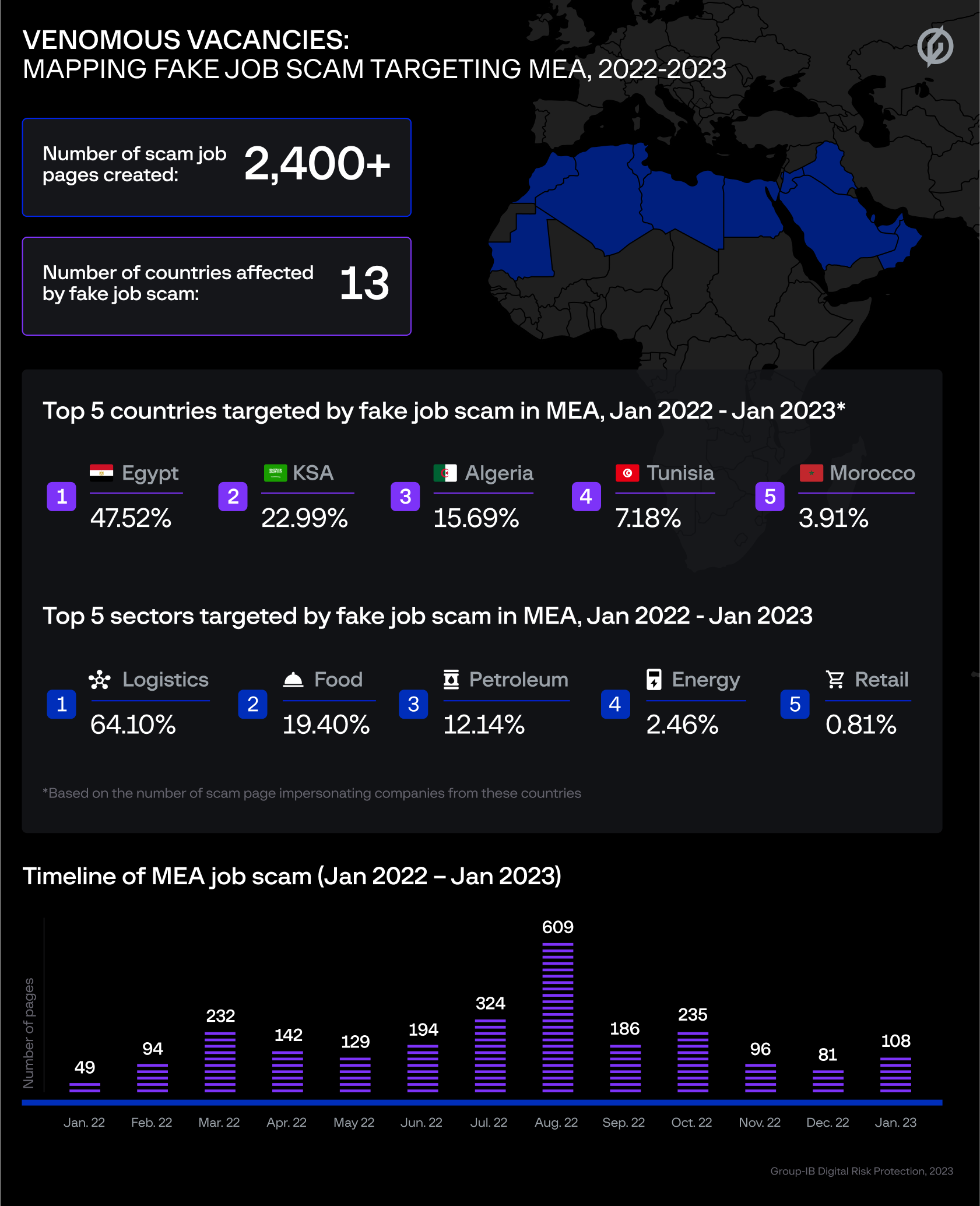

The scam targeted internet users across 13 Middle East and North African countries.

Global cybersecurity leader Group-IB has revealed new research from its center in Dubai detailing a widespread fake job scam campaign targeting Arabic speakers in the MENA region.

Digital Risk Protection experts used AI and text analyzing tools to uncover over 2,400 fake job pages impersonating companies from 13 countries. The posts were created on social media platforms throughout the entirety of 2022.

On the job pages, fraudsters spoofed more than 40 of the MENA region’s largest companies. They published vacancies in Arabic offering salaries too good to be true, including “4,500 euros (USD $4,800) for drivers and painters”. Once interested victims interacted with links on the pages, they were taken to fake phishing sites where they were asked to enter login credentials and passwords.

Which Countries Were Targeted?

Arabic-speaking individuals were the exclusive targets of this particular scamming campaign, with Egyptian companies most frequently spoofed by the criminals.

According to Group-IB, “48% of all the fake profiles created on Facebook spoofed companies from Egypt. Organizations from Saudi Arabia (23% of all scam pages), Algeria (16%), Tunisia (7%), and Morocco (4%) were also frequently mimicked as well as offering individuals jobs at the 2022 FIFA World Cup in Qatar”.

What Industries Were Selected?

The scammers responsible for the fake job pages made adverts across multiple industries, though logistics firms were a popular target (64%). Group-IB noted that “scammers targeting MENA users are particularly fond of impersonating logistics enterprises due to the high potential ROI. The food and beverage (20% of scam pages) and petroleum (12%) industries were also heavily impersonated by the scammers, with one particular company being impersonated on more than 1,000 fake pages”.

Also Read: Is Your Phone Hacked? How To Find Out & Protect Yourself

Staying Safe Online

Group-IB warned internet users to stay vigilant and always confirm URLs when following links that supposedly lead to a company’s website — a particularly important habit on social media sites. Users should enable two-factor authentication (2FA) for all online accounts supporting the security feature and ensure they never use the same password across multiple accounts.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.