News

Facebook Scammers Pose As Support Staff On 3,200 Fake Profiles

A leading cybersecurity firm’s Dubai-based team uncovered a widespread scam targeting celebrities, businesses, sports teams, and individual accounts.

Global cybersecurity experts Group-IB today published new research into a worldwide phishing campaign carried out on Facebook by cybercriminals impersonating Meta (Facebook’s parent company) support staff.

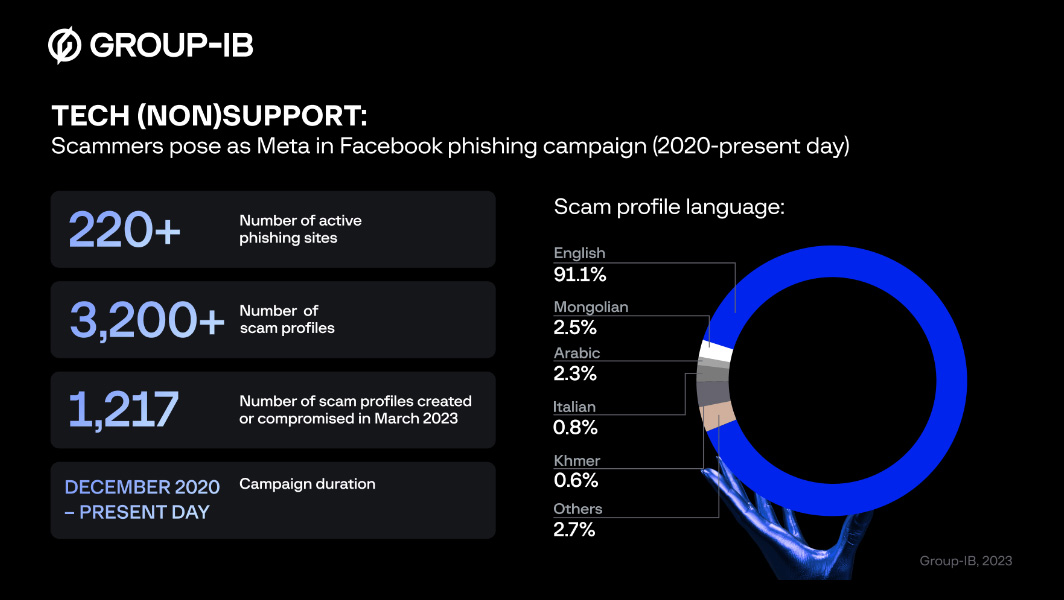

Between February and March 2023, Group-IB researchers based in Dubai identified over 3,200 Facebook profiles falsely claiming to be written by Meta support staff in over 20 languages. Upon discovering the scammers’ accounts, Group-IB’s Computer Emergency Response Team shared information with Facebook, which it must be noted had already deleted some of the offending profiles.

The cybercriminals’ goal was to hack the Facebook accounts of public figures and celebrities, businesses, sports teams, and individual accounts. As part of the elaborate scam, cookie data, and session hijacking were employed, though the criminals mostly used traditional phishing techniques to trick people into voluntarily entering email and password information.

Group-IB researchers began tracking this widespread scam in February 2023. As well as 3,200 fake Facebook profiles containing scam posts, the cybersecurity experts also discovered 220 websites intended to trick users into parting with their data.

The Details Of The Scam

This Facebook scammers used social engineering techniques to trick users into thinking their accounts were marked for suspension due to copyright violations. If victims attempted to verify their profile to prevent it from being blocked, they would be taken to a phishing website, where they were presented with a page that contained official-looking Meta or Facebook branding.

Also Read: Filmmaker Uses AI To Visualize Thousands Of Leaked Passwords

“Cybercriminals can use compromised accounts to launch further phishing attacks. Individuals can suffer legal and reputational damage [and] threat actors could also gain access to the victim’s financial services [and] hold compromised accounts for ransom, demanding payment from the victim for retrieval of the account,” says Sharef Hlal, Head of Group-IB’s Digital Risk Protection Analytics Team.

Group-IB recommends social network users ensure that their passwords are “strong and unique, and that they enable two-factor authentication (2FA) to provide an extra layer of security”. In addition, if you’re ever directed away from official social media platform pages, it’s a good idea to closely check the URL to ensure it’s legitimate.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant