News

Global Influencer & Creator Economy To Double Over Next 5 Years

According to Goldman Sachs, brand deals, platform payouts, and video advertising are expected to drive growth.

According to Goldman Sachs, the influencer and creator economy market could double over the next five years, driven by a significant increase in digital media consumption and the rise of new technology.

With over 50 million individual creators, the total value of this market segment could rise to $480 billion by 2027, up from a current total of $250 billion.

“New platforms such as TikTok have emerged, while legacy platforms like Facebook and YouTube have also introduced new formats for sharing short-form video, live streaming channels and other forms of user-generated content,” says Eric Sheridan, Senior Equity Research Analyst, Goldman Sachs.

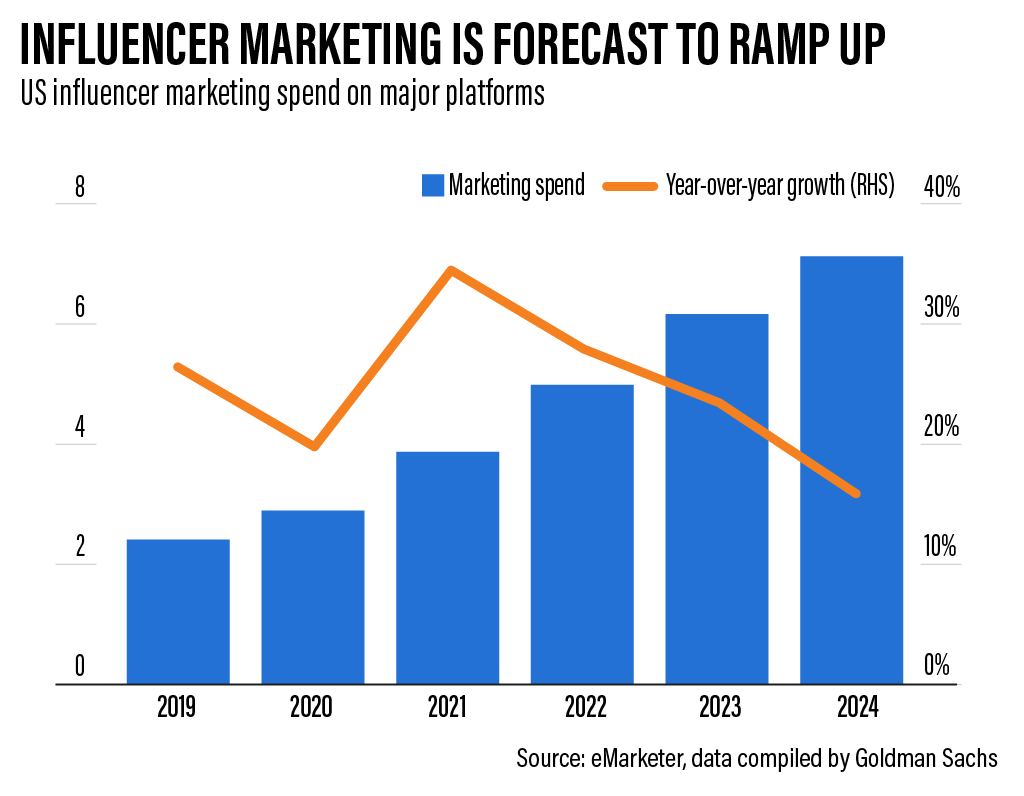

Goldman Sachs expects influencer marketing, payouts from social platforms, and short-form video advertising to boost the growth of the creator economy, with the number of global content creators estimated to rise by 10-20% annually over the next five years.

Also Read: How To Permanently Delete Your Instagram Account

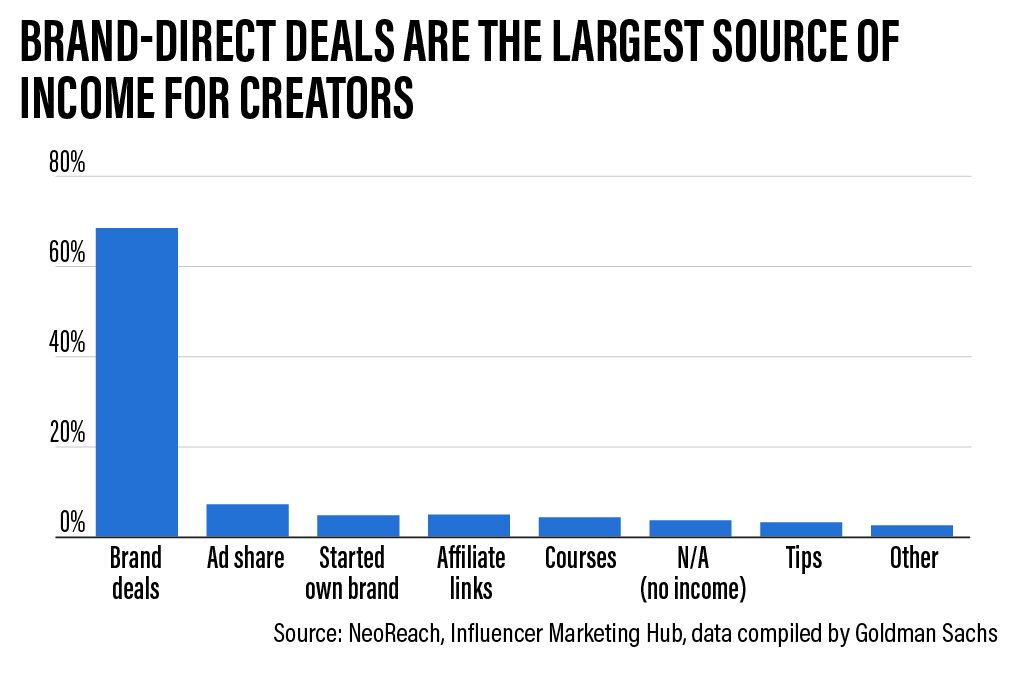

Social media creators and influencers earn a living by making endorsement deals with brands, through advertising revenue, and direct donations and subscriptions from followers. The Goldman Sachs report revealed that brand deals are now the primary source of creator revenue at about 70%, followed by ad sharing.

Digital platforms offering multiple ways to monetize creator content will continue attracting influential creators as competition intensifies due to economic uncertainty and rising interest rates, putting significant strains on funding and investment.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.