News

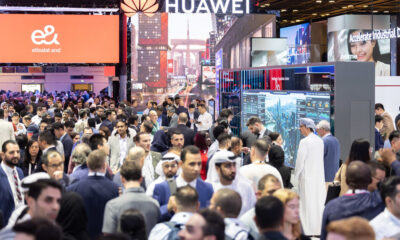

Microsoft Enhances AI Capabilities In Windows 11 Update

The update isn’t a game changer, but is useful for Copilot fans.

After introducing Copilot Pro at the beginning of the year, Microsoft has added a series of enhancements to bolster its AI assistant’s functionality in Windows 11. A notable new addition is the integration of plugins, a feature previously exclusive to the web version of Copilot.

Users can now seamlessly connect Copilot with various services like OpenTable and Instacart, allowing them to book restaurant reservations and do grocery shopping directly within the chat interface. Additional plugins from Kayak, Klarna, and Shopify are slated for release in the coming month, underscoring Microsoft’s aim to optimize usability within the Copilot environment.

In addition, Microsoft is streamlining access to system settings by enabling users to perform tasks like toggling battery saver mode, and managing hardware profiles directly from inside of the AI chat interface. Copilot can also execute commands to activate accessibility features such as Live Captions, Narrator, and Screen Magnifier, as well as display available Wi-Fi networks. This enhanced integration should improve the user experience by eliminating the need to navigate through the Settings app.

Furthermore, Microsoft is enhancing AI capabilities in select Windows 11 apps such as Photos and Clipchamp. Photos now features a Generative Erase function for removing unwanted elements from images, while Clipchamp is set to introduce a Silence Removal AI tool for editing videos.

Also Read: Getting Started With Google Gemini: A Beginner’s Guide

These Copilot and AI enhancements will be gradually rolled out to users with Windows 11 versions 22H2 and 23H2. To access these updates, Microsoft advises users to enable the “Get the latest updates as soon as they’re available” option. Most features are expected to be accessible with the optional March 2024 non-security preview update.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.