News

The First Bitcoin ETFs Have Been Approved By US Regulators

The move takes cryptocurrencies a step further towards full Wall Street integration.

Fifteen years following the mining of the genesis block, the US Securities and Exchange Commission (SEC) has granted approval for Bitcoin exchange-traded funds (ETFs). The ruling marks a significant milestone in Bitcoin’s integration into the traditional financial system it once aimed to challenge. The decision paves the way for the availability of 11 spot Bitcoin ETFs to investors, including those offered by Grayscale, Fidelity, and BlackRock, among others.

Gary Gensler, the SEC chairman, clarified the approval by stating, “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto”.

For a decade, the SEC consistently rejected proposals for Bitcoin ETFs, which essentially function like bundles of assets, similar to mutual funds but tradable on exchanges. The commission regularly cited investment safety concerns, but now approval has been granted, new investors won’t need to set up individual wallets to trade Bitcoin, making it more accessible.

This development has generated considerable excitement among cryptocurrency enthusiasts, as ETF-issuing companies will be required to acquire corresponding amounts of Bitcoin to back their funds. Interestingly, the immediate impact on Bitcoin’s price was minimal, but in the long run, the introduction of a Bitcoin ETF is anticipated to facilitate the entry of traditional institutional investors into the cryptocurrency realm. This could include pension and insurance funds, leading to increased demand for Bitcoin.

Also Read: Non-Fungible Tokens: A Beginner’s Guide To Getting Started With NFTs

Until now, investors seeking exposure to cryptocurrency often invested in shares of crypto-centric companies such as Coinbase and MicroStrategy, the latter holding over $8 billion in Bitcoin as of January. The emergence of a Bitcoin ETF could potentially affect the valuation of these companies.

It’s important to mention that a false announcement briefly circulated on the SEC’s Twitter/X account on Tuesday, falsely claiming approval of Bitcoin ETFs, which caused some confusion.

News

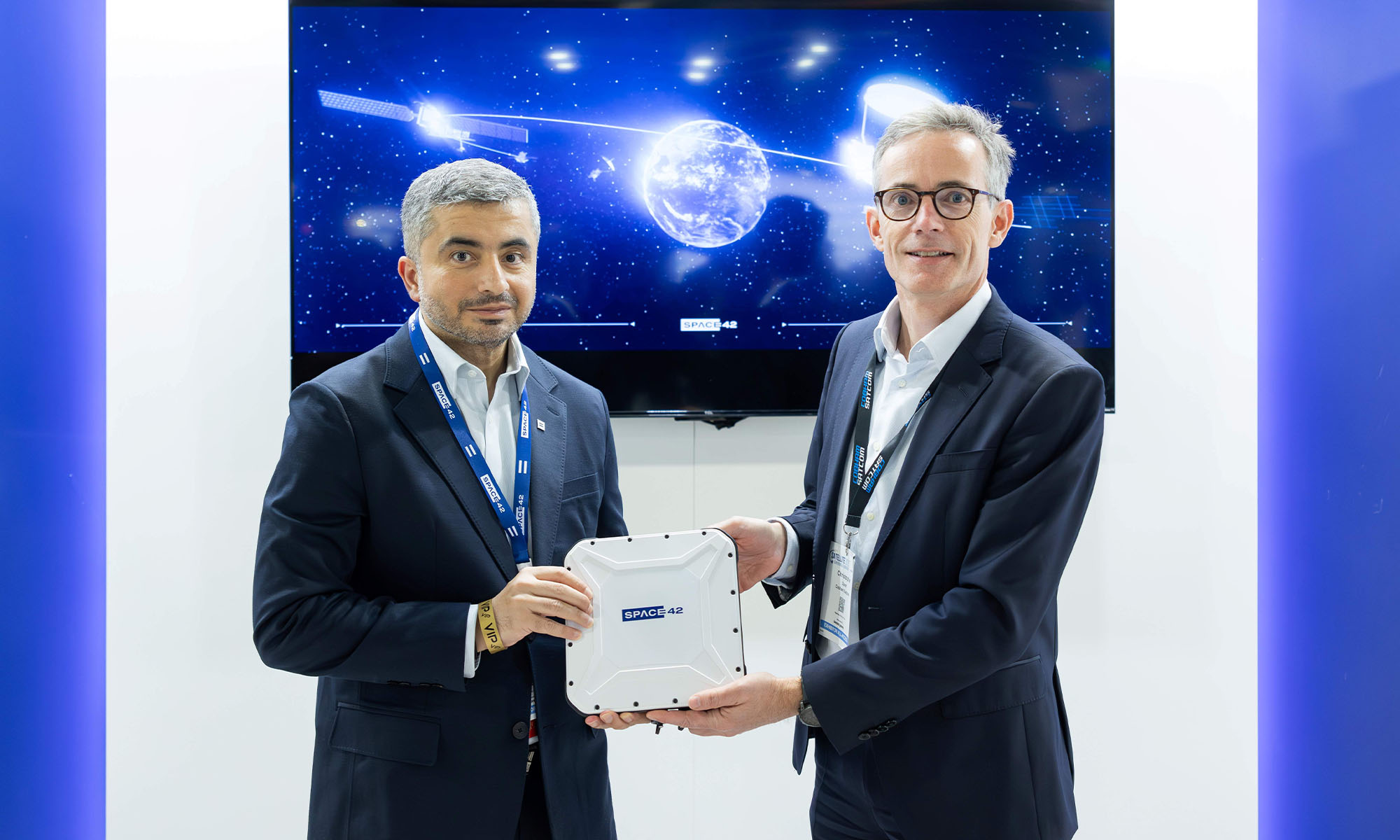

Space42 & Cobham Satcom Launch New Satellite Broadband Terminal

IP NEO has been engineered to provide uninterrupted, high-speed connectivity for sectors that rely on secure communication.

UAE-based SpaceTech firm Space42, has teamed with Cobham Satcom, a global player in satellite communications, to introduce IP NEO — a next-generation satellite broadband terminal built for reliability and security.

Developed through a collaboration between Cobham Satcom and Space42’s satellite solutions division, Thuraya, IP NEO is engineered to provide uninterrupted, high-speed connectivity for sectors that rely on secure communication. Its design, optimized for compactness and durability, ensures seamless data transmission across Thuraya’s network, making it a valuable asset for government agencies, NGOs, corporations, and even individuals operating in remote areas where traditional technologies may fall short.

As the exclusive provider of Thuraya 4 terminals for Space42, Cobham Satcom has also played a crucial role in building the ground infrastructure for the upcoming Thuraya 4 satellite network. This strategic integration reinforces Cobham Satcom’s standing as a leading global provider of L-band connectivity solutions.

Ali Al Hashemi, CEO of Yahsat Space Services at Space42, emphasized the terminal’s strengths, stating: “IP NEO demonstrates our commitment to delivering secure, resilient, and future-ready satellite communication solutions. Built on robust L-band technology, the platform ensures reliable connectivity, even in the most challenging environments. Its compatibility with Thuraya 4 further strengthens its capabilities, enabling high-throughput speeds that meet the evolving demands of mission-critical operations”.

Designed to support critical applications such as internet access, video conferencing, surveillance, and VPN connectivity, IP NEO is built to withstand tough conditions, featuring water and dust resistance — ideal for use in extreme environments.

Also Read: Pure Electric Expands To UAE, Boosting Micro-Mobility Sector

Christophe Duret, CEO of Cobham Satcom, highlighted the impact of this innovation: “Along with Space42’s state-of-the-art Thuraya 4 satellite’s advanced capabilities, our new terminals for government and commercial end-users will provide the fastest standard L-band connectivity ever achieved, unlocking new opportunities for secure and resilient high-speed connectivity for demanding land and ocean environments”.

Part of Space42’s next-generation product lineup, IP NEO is designed for long-term adaptability and is fully compatible with the Thuraya 4 satellite. Once operational, Thuraya 4 will enable IP NEO to deliver speeds of up to 1024 kbps, along with simultaneous voice and data communication along with remote terminal access.

The official launch of IP NEO is set to take place at the 2025 SatShow (March 11-13, 2025), at the Walter E. Washington Convention Center in Washington, D.C.