News

Twitter Verification Badge Is Now Available To The Public

Twitter has relaunched its public verification program, allowing anyone who meets its qualification criteria to get their account verified.

Twitter’s account ownership verification program (aka Twitter verification program) launched in 2009 to reduce the risk of impersonation, but getting the strongly desired blue checkmark has been impossible for most users of the platform — until now.

After publishing a draft of its new verification policy last year, Twitter is now finally relaunching its public verification program, allowing anyone who meets its qualification criteria to get their account verified.

“We’re excited to share that starting today, we’ll begin rolling out our new verification application process and reviewing public applications for verification on Twitter,” writes Twitter in the official announcement. “Today’s application rollout marks the next milestone in our plans to give more transparency, credibility, and clarity to verification on Twitter.”

According to Twitter’s updated verification criteria, the following six categories of accounts can now quality for verification:

- Government

- Companies, brands, and organizations

- News organizations and journalists

- Entertainment

- Sports and gaming

- Activists, organizers, and other influential individuals

Additional account categories are planned to be introduced later this year, and they should extend the verification criteria to encompass scientists, academics, and religious leaders.

Also Read: Twitter Is Testing Two New Useful Features

In addition to belonging to the right category, Twitter also wants users to behave well before verifying them. Everyone who has misbehaved on the platform during the last 12 months and has been suspended for seven days or 12 hours for breaking the rules will be automatically rejected.

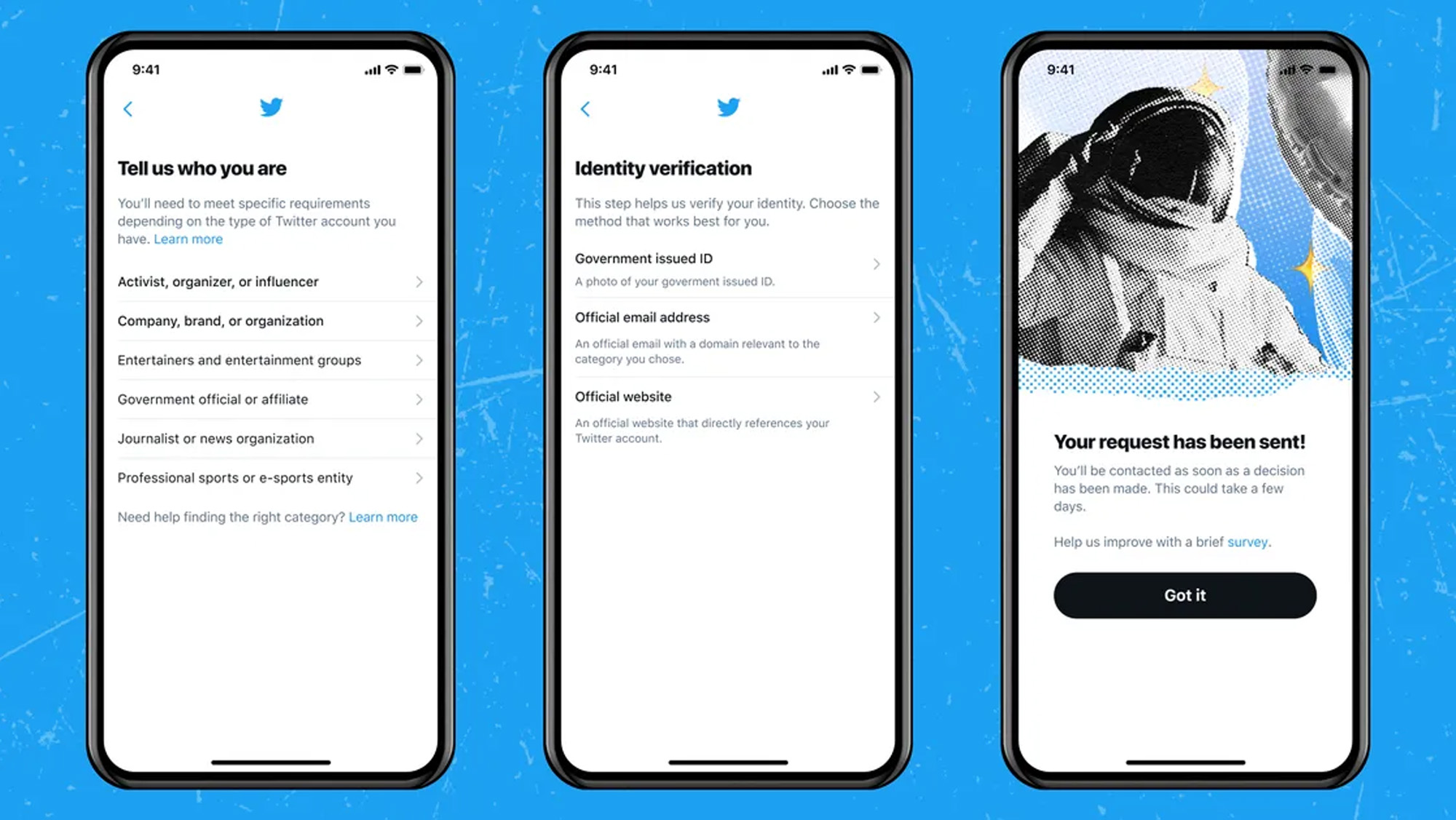

How To Apply For Twitter Verification?

To apply for the blue Twitter checkmark, you need to:

- Log in to your Twitter account.

- Go to the Account Settings tab.

- Choose Identity verification.

- Provide your official email address, website, or government ID.

- Wait up to several weeks for your account to be verified.

That’s right, Twitter said that the verification process could take up to several weeks, depending on the current demand. However, it should typically take only a few days. Users who end up rejected can reapply 30 days after receiving the decision.

News

Checkout.com Set To Launch Card Issuing In The UAE

The payment service provider’s expansion is a first-of-its-kind investment and could reshape digital transactions across the region.

Checkout.com is laying the groundwork to become the first global payments platform to introduce card issuing in the United Arab Emirates — a move that could reshape how businesses in the region manage financial transactions.

The company plans to roll out its domestic card issuance offering in the UAE by 2026, subject to regulatory approval. The launch would give businesses the tools to issue both physical and virtual branded cards. This, in turn, opens up new ways to reward customers, streamline expense processes, and handle B2B payouts efficiently.

Checkout.com’s CEO and Founder, Guillaume Pousaz, revealed the plans during Thrive Abu Dhabi, the firm’s debut conference in the Emirates. Joined on stage by Remo Giovanni Abbondandolo, General Manager for MENA, Pousaz presented to an audience of over 150 partners and merchants at Saadiyat Island. Also in attendance was H.E. Omar Sultan Al Olama, the UAE’s Minister of State for Artificial Intelligence, Digital Economy, and Remote Work Applications.

Abbondandolo highlighted the strategic importance of the announcement: “As a global business, we focus on bringing products to markets that our customers want and need. Today’s announcement is proof of our commitment to the MENA region and its rising influence in the digital economy. The appetite for innovation here is real, and we’re proud to be building the infrastructure that powers it”.

One early adopter of Checkout.com’s UAE acquiring services is Headout, a travel experiences marketplace, which recently named the payment provider as its main partner in Europe. The company has already begun card issuing there and is keen to expand that offering into MENA once approval is granted.

The expansion of services in the UAE and beyond builds on Checkout.com’s track record in the region. It was the first global payments firm to secure a Retail Payment Services license from the UAE’s Central Bank and was instrumental in rolling out Mada and Apple Pay in both the UAE and Saudi Arabia.

Also Read: Protecting Your WhatsApp Account From Hackers: Kaspersky Expert Tips

The firm has also been rolling out new products: One of the latest is Flow Remember Me, currently in beta testing. It allows shoppers to store their card information once and access it across Checkout.com’s entire network, potentially cutting checkout times by up to 70%.

Earlier this year, Checkout.com also introduced Visa Direct’s Push-to-Card solution in the UAE, enabling both domestic and international payouts. Its collaboration with Mastercard has grown as well, making it easier for businesses to send funds directly to third-party cards securely and quickly.

With regional tech ambitions on the rise — spurred by initiatives like Saudi Arabia’s Vision 2030 and the UAE’s 2031 Agenda — Checkout.com sees its role as one of a key enabler. “Our mission is to help ambitious businesses navigate the complexity of payments, so they can move faster, go further, and make the most of every opportunity,” said Abbondandolo. “In MENA, performance is personal. It’s local. It’s built on trust. And when payments perform, businesses thrive”.