News

Twitter Is Testing Two New Useful Features

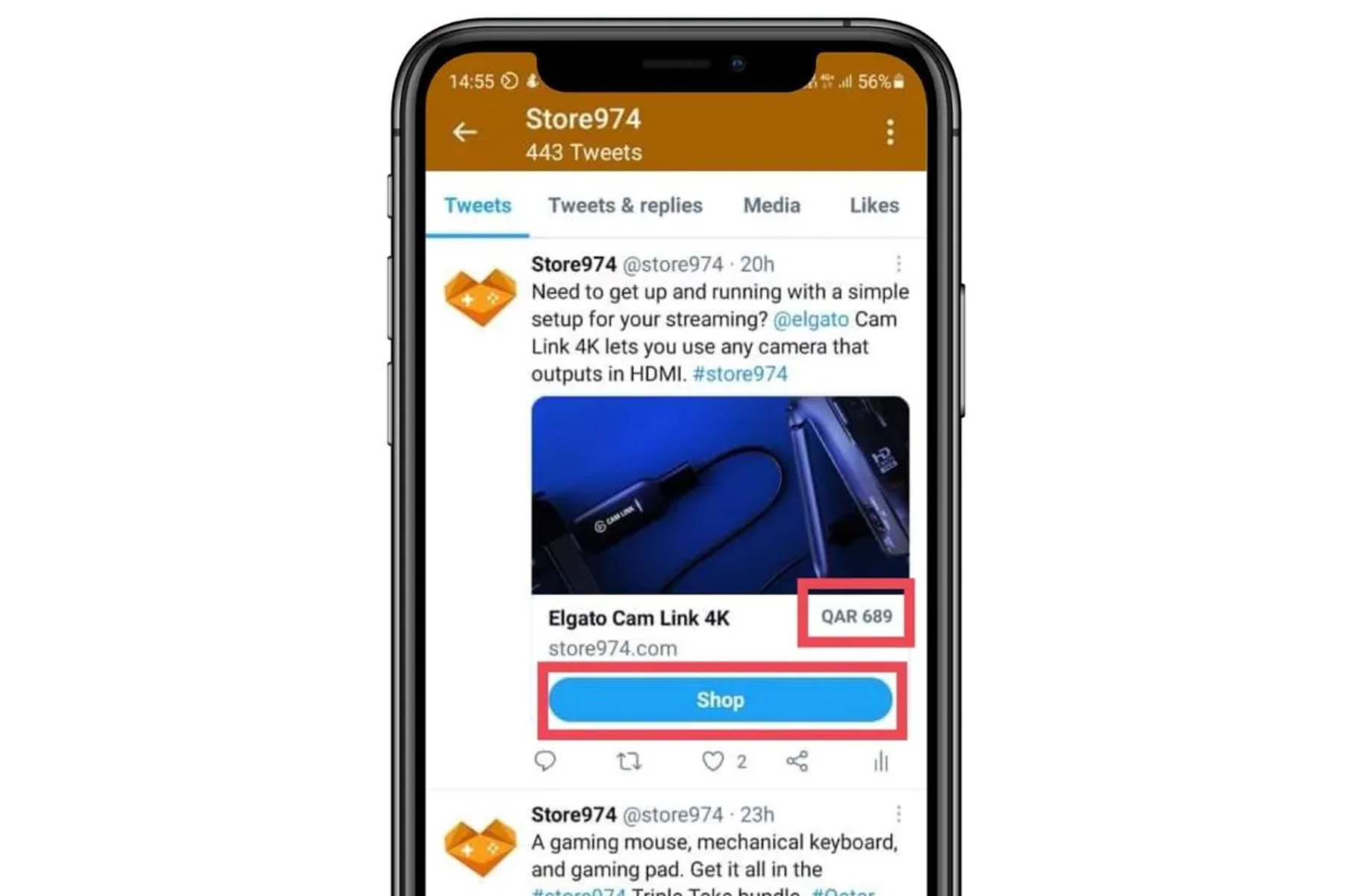

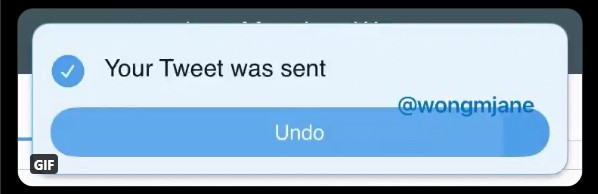

If you’re an observing Twitter user, there’s a chance that you’ve already noticed two new buttons. One of the two buttons is titled “Shop,” and it’s intended for tweets containing links to product pages on a shop’s website. The other button is titled “Undo,” and it lets you undo a recently sent tweet.

Shop Button

The Shop button was spotted by Qatar-based social media consultant Matt Navarra, who first noticed it on his Android device. Tweets with the Shop button can be seen as alternatives to ads because they both serve the same purpose. The biggest difference between them is that ads are not organic, and many Twitter users don’t see them at all because they use various ad-blockers.

The color of the Shop button matches Twitter’s established color scheme, but it’s likely that it will eventually be customizable. If the button takes off, then we could see other similar e-commerce buttons launch in the future, such as a subscription button.

Twitter has also recently announced that it’s aiming to become a creator platform, so that’s yet another use case for this new tweet format, with exclusive subscriber-only content being just one click away.

Undo Button

While arguably less exciting, the Undo button is something all Twitter users can appreciate. It appears for five to six seconds when a user hits send on a tweet, giving the user a chance to change their mind and make the tweet disappear before the whole world sees it.

Also Read: Instagram Lite Delivers All Essential Features In Just 2 MB

We expect the feature to result in fewer tweets with typos and embarrassing grammar errors, but we can also see it saving relationships and careers by making users rethink whether their tweet is really appropriate or not.

Unfortunately, there still hasn’t been any news about the prospect of an Edit button, which Twitter users have been requesting for years now. But because Twitter CEO Jack Dorsey previously said that Twitter would likely never implement it, it’s probably nowhere on the horizon.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.