News

WhatsApp Introduces Flows For Improved In-App Shopping

The company plans to build rich experiences for other business types, too.

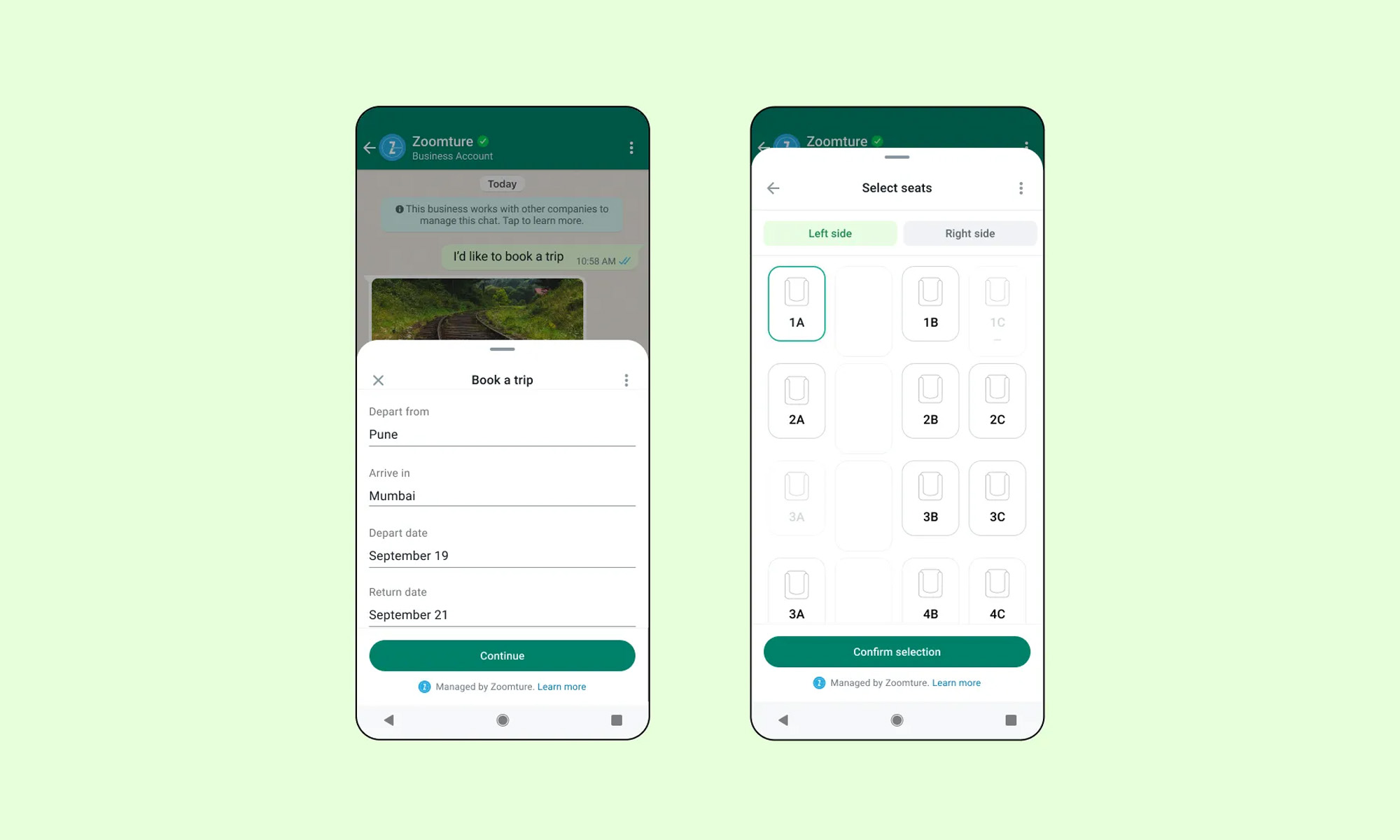

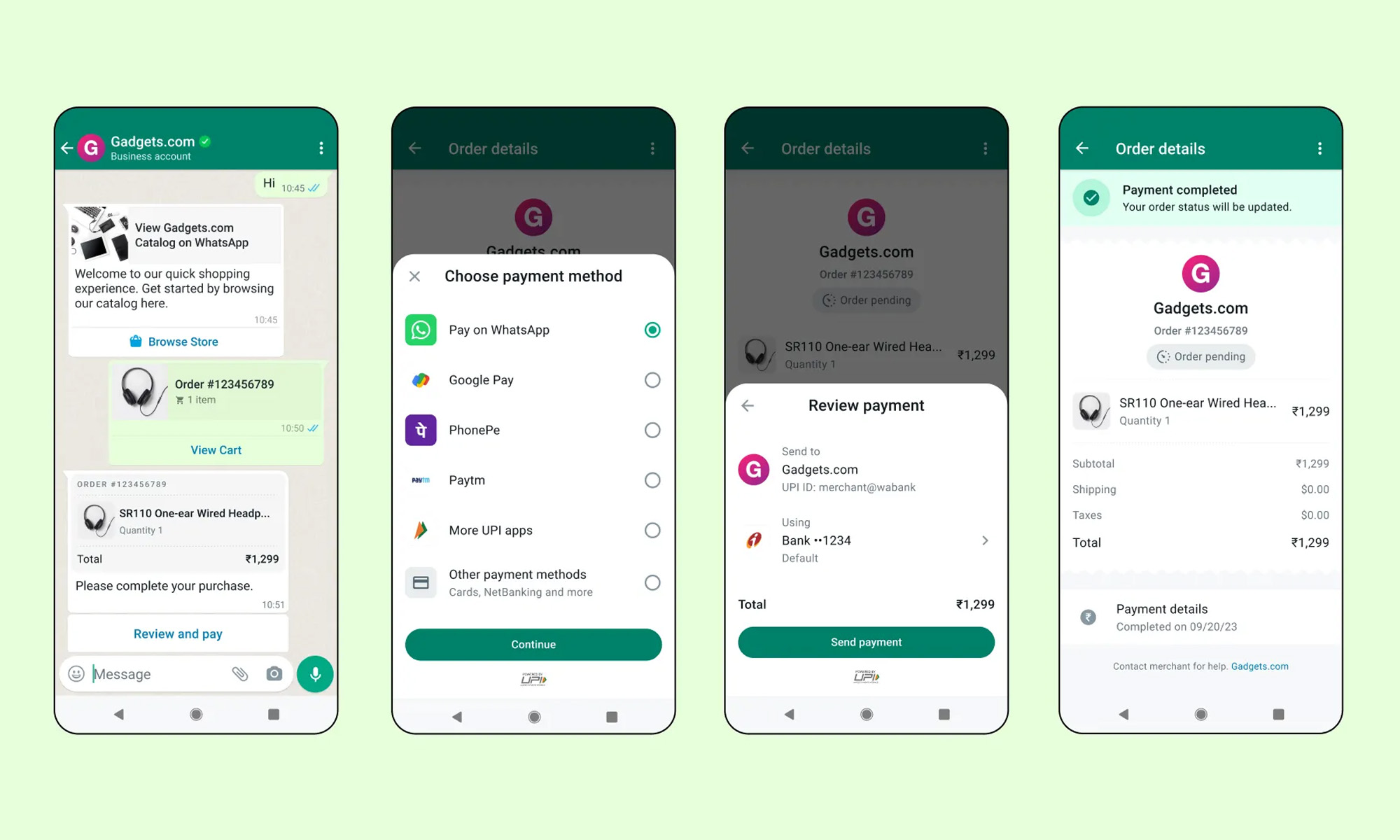

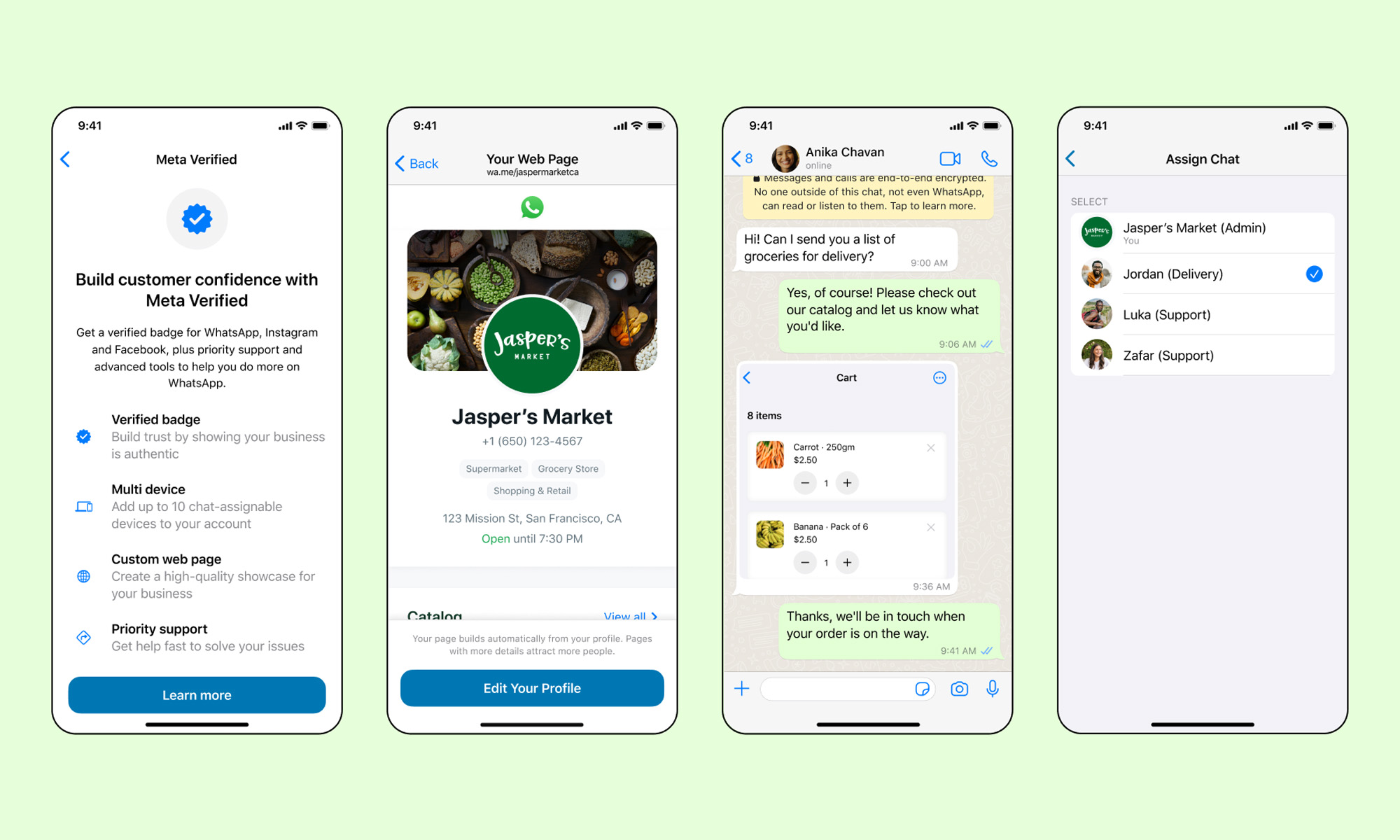

WhatsApp is improving shopping experiences for both e-commerce merchants and their customers through a new feature called Flows. The add-on lets WhatsApp users complete tasks such as booking a seat on a flight or making an appointment without leaving the messaging app.

When using Flows, merchants will benefit from tools such as text boxes, calendars and a seat picker. These features will allow e-commerce companies to build rich experiences while improving booking and payment workflows. The Flows support page gives multiple examples of how the new service can be used, including booking appointments, product customization, account logins, form filling, and signing up for events.

WhatsApp said it had been testing Flows with businesses including Brazilian bank Banco Pan, retailer MagaLu, tech giant Lenovo, Indian travel service redBus, and car-reselling platform Spinny.

“Shopping and e-commerce is one of the biggest verticals we want to focus on. The goal is to enable business messaging in a way that businesses and people can do a lot more right in the chat thread. We are trying to build rich experiences within the chat, and that’s where Flows comes in,” said Nikila Srinivasan, Meta’s VP of business messaging.

Flows will become available over the coming months, and Meta will not initially charge merchants separately for the service. Currently, only e-commerce businesses can utilize Flows’ features, though WhatsApp has plans to develop rich experiences for other business verticals as well.

Also Read: A Guide To Digital Payment Methods In The Middle East

Earlier this year, WhatsApp’s business app surpassed the 200 million monthly active users mark. The messaging company said it had also started testing a personalized messages feature for merchants, which was announced this June. The service lets businesses send custom notifications such as discounts or offers to select patrons.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.