News

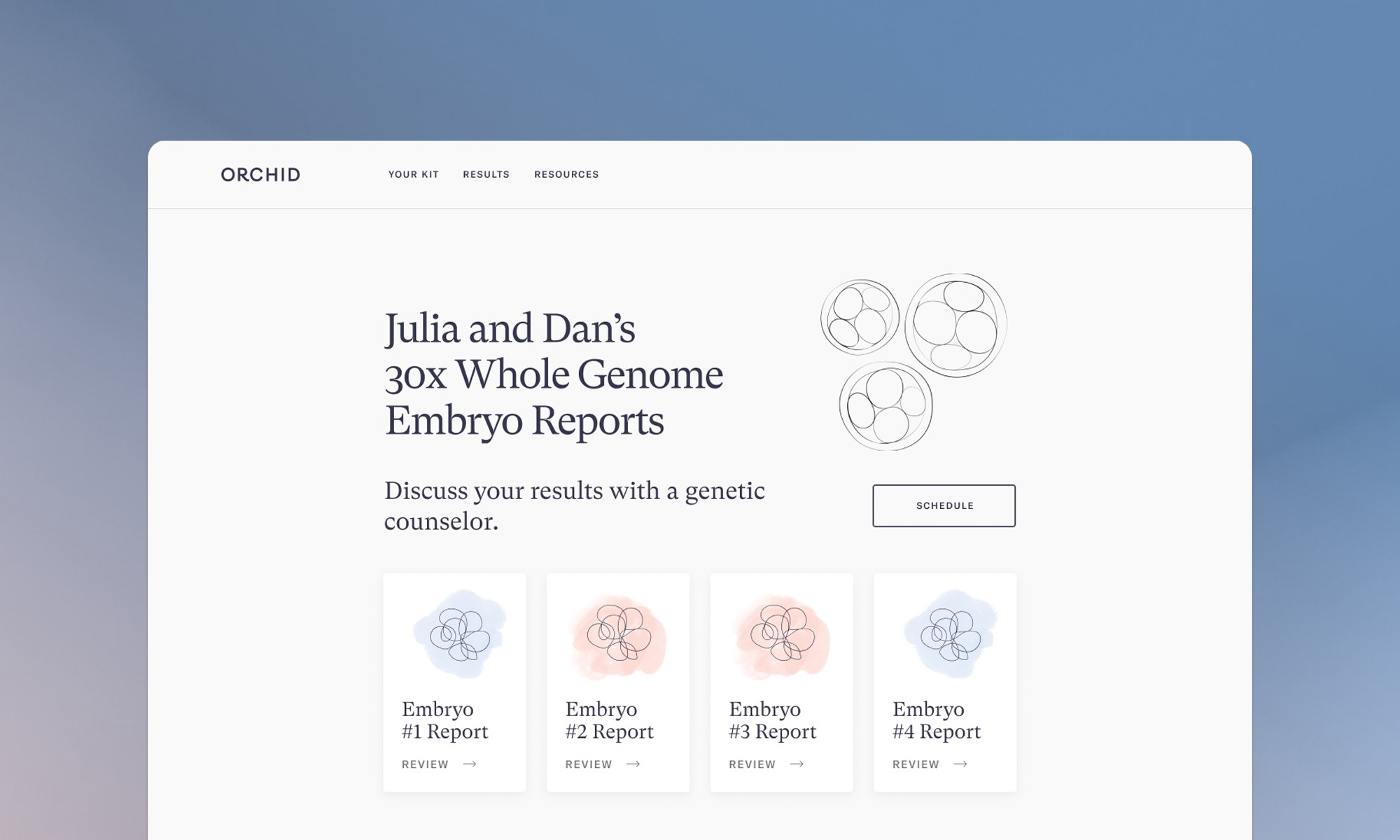

Orchid Plans To Find Out What’s Wrong With You Before You’re Born

According to CEO Noor Siddiqui, the company isn’t on a mission to make designer babies, but aims to beat genetic odds and relieve suffering.

Each day, around 400,000 babies are welcomed into the world. However, among those, a growing number will experience some kind of birth defect or inherited disease.

Noor Siddiqui, CEO of Orchid, hopes to “mitigate” unpleasant genetic surprises using genome sequencing technology to reveal a wealth of genetic information on which newborns will grow into healthy adults.

Until 2019, IVF specialists had access to under 1% of the human genome. The tests, called PGT-A and PGT-M, scanned a mere 1,000 data points in a genome comprising around 3 billion bases, offering a very limited dataset compared to the technology used by Orchid.

“Our chromosomes are like chapters in a book that make up the table of contents.” Explained Siddiqui. “[PGT-A and PGT-M tests] only examine the table of contents, whereas what Orchid is doing is like a spellcheck on the entire book.” Orchid’s genome sampling technology assesses “100 times the data, covering many more conditions.” In essence, an Orchid report covers three categories of common genetic issues: monogenic disorders, polygenic conditions, and de-novo mutations.

Also Read: Advancing MENA Health Through AI Vascular Age Analysis

Orchid’s technology raises many questions. Aside from the obvious ethical concerns, data privacy is the most obvious potential issue with the tests. Noor Siddiqui is keen to alleviate any concerns: “No data at Orchid is ever sold to any third parties. Parents are in complete control of their data. If they want to delete the data, we’re happy to delete it off of our servers. If they want to export the data, they can export the data. And if they want us to re-analyze the data, we can re-analyze the data”.

Compared to a lifetime of medical bills, gene therapy, and suffering, Orchid’s genome screening report has the potential to change the future lives of thousands of newborns worldwide.

News

PayPal & TerraPay Join Forces For Cross-Border MENA Payments

The collaboration will be especially helpful in regions where traditional banking infrastructure is limited or inconsistent.

PayPal has teamed up with TerraPay to improve cross-border payments across the Middle East and Africa. The move is designed to make it easier and faster for users to send and receive money internationally, especially in regions where traditional banking infrastructure can be limited or inconsistent.

The partnership connects PayPal’s digital payments ecosystem with TerraPay’s global money transfer network. The goal is to streamline real-time transfers between banks, mobile wallets, and financial institutions, significantly improving access for millions of users looking to move money securely and efficiently.

Through the partnership, users will be able to link their PayPal accounts to local banks and mobile wallets using TerraPay’s platform. This means faster transactions and fewer barriers for individuals and businesses across the region.

“The Middle East and Africa are at the forefront of the digital transformation, yet financial barriers still limit growth for many,” said Otto Williams, Senior Vice President, Regional Head and General Manager, Middle East and Africa at PayPal. “At PayPal, we’re committed to changing that […] Together, we’re helping unlock economic opportunity and build a more connected, inclusive financial future”.

For TerraPay, the deal is a chance to scale its reach while reinforcing its mission of frictionless digital transactions.

“Our mission at TerraPay is to create a world where digital transactions are effortless, secure, and accessible to all,” said Ani Sane, Co-Founder and Chief Business Officer at TerraPay. He added that the partnership is a major milestone for enhancing financial access in the Middle East and Africa, helping businesses grow and users move funds with fewer limitations.

Also Read: A Guide To Digital Payment Methods In The Middle East

The integration also aims to support financial inclusion in a region where access to global banking tools is still uneven. With interoperability at the core, TerraPay can bridge the gap between different financial systems — whether that’s a mobile wallet or a traditional bank — making it easier to send money, pay for services, or grow a business across borders.

As the demand for cross-border payment options continues to rise, both PayPal and TerraPay are doubling down on their commitment to provide reliable, secure, and forward-looking financial tools for the region.