News

A Line-Up Of Over 100 Shows Comes To Snapchat This Ramadan

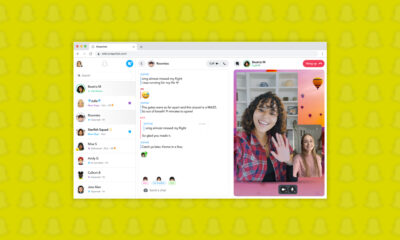

Snapchatters can watch a wide range of content, including entertainment, drama, and comedy.

As people across the Middle East celebrate the beginning of Ramadan this week, Snapchat has announced a new line-up of over 100 Ramadan shows to be added to the Discover platform, bringing drama, comedy, and more for the holy month. Snapchatters can also browse Spotlight to discover fresh creators and content from across the MENA region and beyond.

Snapchat partners on the Discover line-up include the Saudi Broadcasting Authority, Augustus Media, MBC Group, Rotana Media Group, Dubai Media Inc, 7awi Group, Alfan Group, and more. Snap Inc. has revealed that shows will include “Netflorex, THAT, and Marahel, as well as MBC’s highly anticipated show Tash Returns, Studio 23, and prank show Ramez Never End”.

Snapchat’s Discover and Spotlight will also feature creator content from Saudi legacy Creator Bader Saleh, Ahmad Alzahabi’s cooking show “The Golden Balance”, and Muslim Girl, a US-based award-winning creator empowering Muslim women worldwide.

Also Read: ChatGPT Is Accelerating The AI Revolution In The Middle East

“This Ramadan, we are partnering with some of the region’s most trusted media partners and fan-favorite creators to showcase engaging content on Discover and Spotlight. Snapchatters spent 31 percent more time watching Ramadan content than the year prior. We are excited to help our community discover new creators and content in a personalized way, allowing them to watch and share their favorite content that captures the spirit of the holy month,” says Hussein Freijeh, General Manager at Snap Inc. in MENA.

To view Snapchat’s Discover shows, simply swipe right on the app, search for the show you want to watch, and then subscribe!

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.