News

Dubai Introduces Its Metaverse Strategy

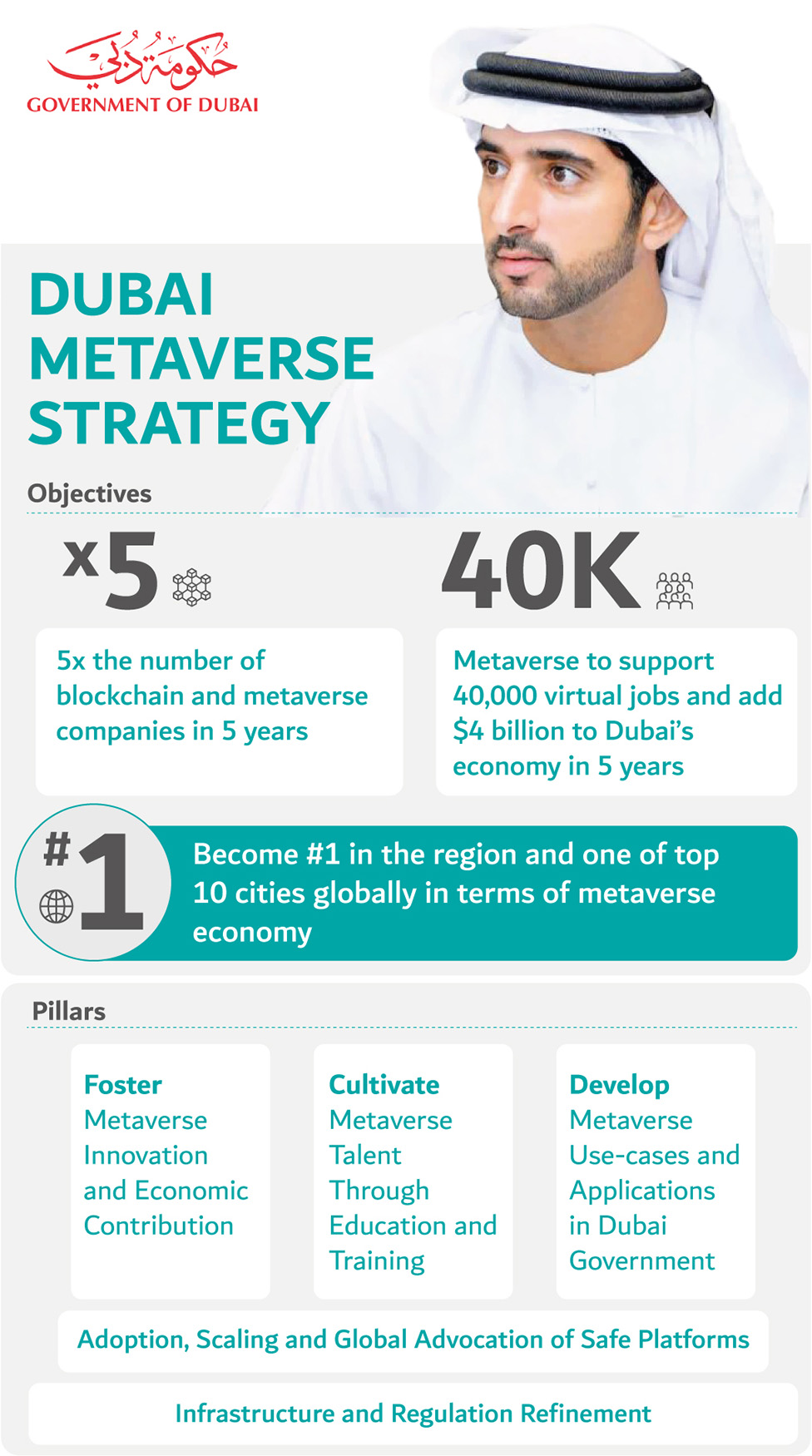

The aim of the initiative is to make Dubai the leader in the region and one of the top 10 cities globally in terms of metaverse economy.

Dubai Crown Prince Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum seems to share Meta’s vision for the next generation of the internet because he has recently launched the Dubai Metaverse Strategy.

The aim of the initiative is to make Dubai the leader in the region and one of the top 10 cities globally in terms of metaverse economy by supporting 40,000 virtual jobs and 5x the number of blockchain and metaverse companies. By achieving these ambitious goals, Dubai could add $4 billion to its economy within the next 5 years.

“His Highness added that adopting new technologies will be a stepping stone in Dubai’s vision to use future technologies to create new work models in vital sectors and increase the metaverse’s impact on regional and global economies,” states an announcement published by the UAE official news agency WAM.

The Dubai Metaverse Strategy consists of three pillars. The first pillar is intended to foster metaverse innovation and economic contribution. The purpose of the second pillar is to cultivate metaverse talent through education and training. Finally, the third pillar is all about developing metaverse use-cases and applications at the government level.

The three pillars are supported by the adoption, scaling, and global advocation of safe platforms, in addition to infrastructure and regulation refinement.

Also Read: UAE To Punish Crypto Scammers With Fines & Jail Time

While certainly one of the most bullish proponents of the metaverse, Dubai isn’t the first city to introduce a cohesive strategy. Just last month, Chinese city Shanghai released a policy paper that outlines its strategy to cultivate a metaverse industry worth more than 350 billion yuan ($52 billion) by the end of 2025.

Globally, the metaverse market is projected to be worth around $1,607.12 billion by the end of the decade, according to Precedence Research. Do you think Dubai will see a return on this massive investment?

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.