News

Dubai To Issue Licenses To Support AI And Web3 Businesses

The licenses will be 90% subsidized and support the emirate’s push to transform itself into a digital society.

Dubai will issue commercial licenses to help artificial intelligence and Web3 startups to set up businesses as the UAE aims to attract more investment and further digitize its economy.

The licenses will be issued by the AI and Web 3.0 Campus through the Dubai International Financial Center and will be 90% subsidized, the DIFC said on Monday.

The activities will include AI research and consultancies, IT infrastructure, technology research and development, and public networking services.

“We are confident that by granting these licenses, we will attract more global talent and investment to the region and create a culture of collaboration and innovation. This is a notable milestone for the Dubai AI and Web3 Campus and will strengthen Dubai’s position as the business destination of choice for technology-focused companies,” explained Mohammad Alblooshi, chief executive of the DIFC Innovation Hub.

Launched in June, the campus aims to form the largest cluster of AI and Web3 companies in the MENA region. DIFC aims to attract over 500 companies by 2028, bring $300 million in funds, and create more than 3,000 jobs over the next five years.

Also Read: USB-C Will Be Mandatory From 2025 For All Saudi Smart Devices

AI has rapidly gained traction as the digital economy grows and countries continue to encourage its adoption. The technology is already in widespread use for online shopping, search engines, smart homes, data analysis, speech and face recognition systems, and more.

For businesses, AI could add between $2.6 trillion and $4.4 trillion annually, according to a recent study from McKinsey. Web3, meanwhile, encompasses blockchain and general decentralization and is projected to contribute $15 billion to GCC economies annually by 2030.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

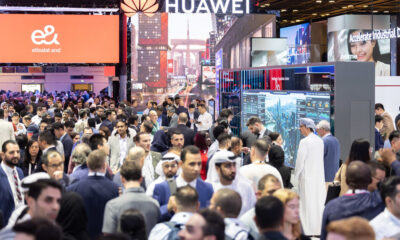

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.