News

Futuristic Electric Self-Driving Trucks Are Coming To The UAE

Startup Einride is about to begin its expansion into the Middle East.

Einride, a Swedish startup and pioneer in electric autonomous freight transport, is expanding into the Middle East. The move follows a collaboration agreement with the government of the United Arab Emirates to accelerate the transition to sustainable logistics and shipping.

Founded in 2016, Einride has a grand vision to decarbonize the freight industry by developing an entire ecosystem of electric and autonomous vehicles, charging stations, and connectivity networks.

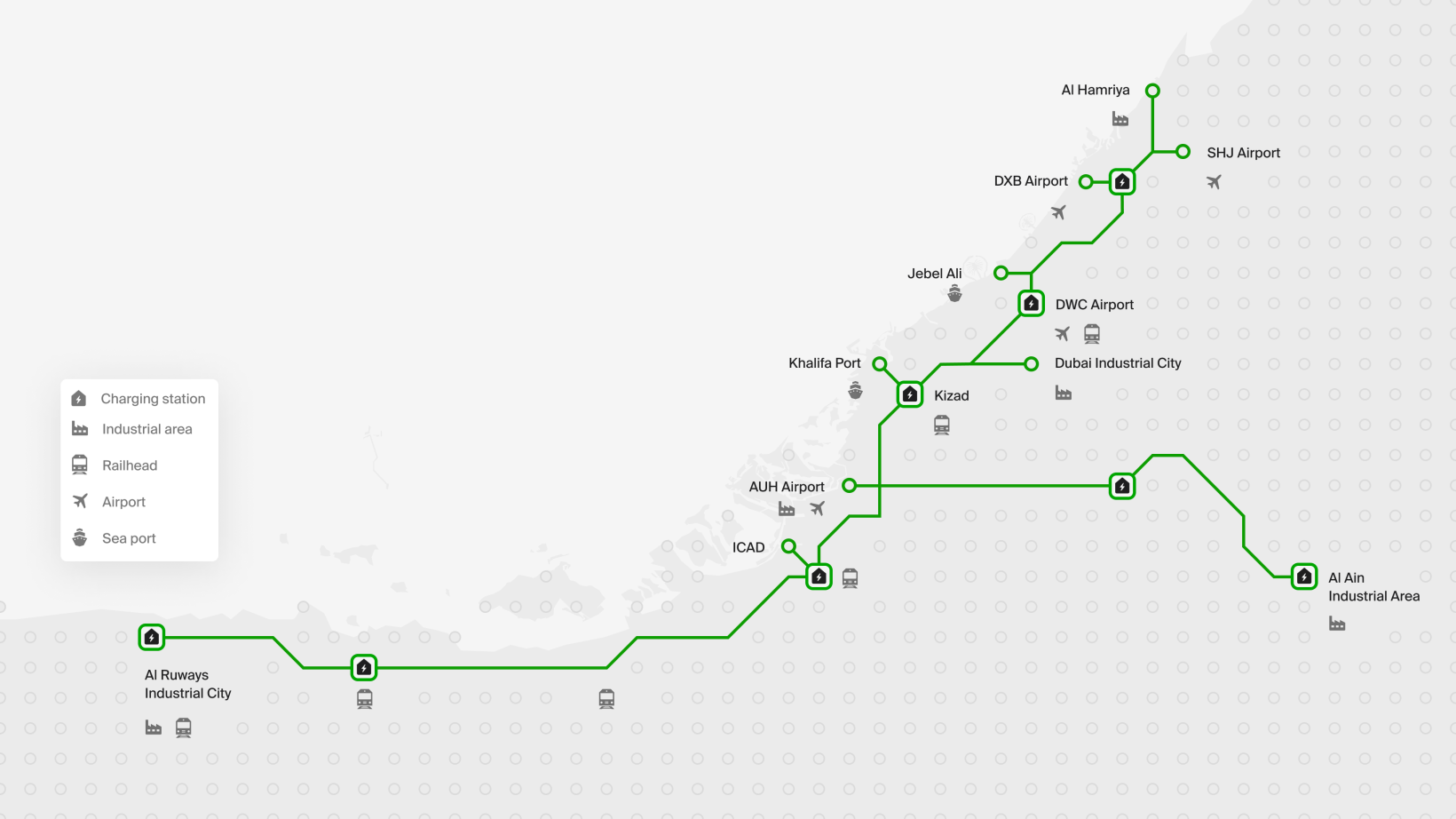

The Scandinavian firm is already operating in Europe and the United States and will soon add over 550 km of its autonomous logistics ecosystem to Abu Dhabi, Dubai, and Sharjah. The project, known as Falcon Rise Grid, will encompass 2,000 electric trucks, of which 200 will be fully autonomous. Einride will develop the project over the next five years, which will include the installation of 500 charging points and other network hardware.

“This collaboration gets to the core of what Einride provides — the transformation to effective and sustainable shipping that is fully electric,” announced Einride founder and CEO, Robert Falck. The startup, which has already partnered with the likes of Coca-Cola and Oatly, says its clients have reduced emissions by up to 95% while staying competitive.

Also Read: Dubai Hospital Delivery Drone Completes Successful First Trial

The UAE’s Falcon Rise Grid project follows a series of expansions for Einride over the past year, including Germany, Benelux, and the UK. In 2019 the company became the first to deploy an autonomous electric vehicle on a public road in Sweden, and in 2022, received approval to do the same in the United States.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.