News

MIT’s “PhotoGuard” Protects Images From Unauthorized AI Edits

The technology invisibly alters select pixels to throw off algorithmic AI models.

As AI continues to develop rapidly, chatbots are gaining the power to create and manipulate images, with Shutterstock and Adobe currently leading the way. Despite the obvious power of AI algorithms, the technology has a few pitfalls, one of which is the unauthorized manipulation of copyrighted artwork and images.

MIT CSAIL thinks it has the answer to this growing problem in the form of PhotoGuard, a new technique that alters select pixels in an image to disrupt AI’s ability to understand what the image is.

The altered pixels are known as “perturbations” and are invisible to the human eye but easily seen by AI bots as they scan the color and position of every pixel in an image. Any edits AI tries to make to a protected image will also apply to the fake pixels, resulting in an unrealistic or broken final image, thanks to PhotoGuard.

Also Read: PicSo Review: A Popular AI-Based Text-To-Image App

“The encoder attack makes the model think that the input image is some other image,” explained MIT student and lead author of the paper, Hadi Salman. “Whereas the diffusion attack forces the diffusion model to make edits towards some target image”. The technique sounds complex but could potentially stop malicious actors from reverse engineering protected images by adding minor edits to circumvent copyright.

“A collaborative approach involving model developers, social media platforms, and policymakers presents a robust defense against unauthorized image manipulation. Working on this pressing issue is of paramount importance today,” Salman said in a recent press release. “And while I am glad to contribute towards this solution, much work is needed to make this protection practical. Companies that develop these models need to invest in engineering robust immunizations against the possible threats posed by these AI tools”.

News

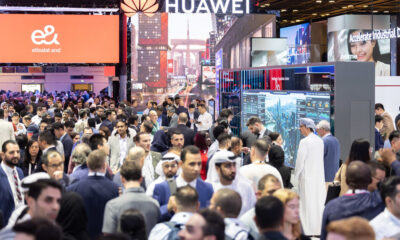

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.