News

Saudi-Based Mozn Uses AI To Detect Money Laundering & Fraud

The company combats a wide range of financial crimes using pattern recognition and advanced algorithms.

Saudi Arabia’s Mozn, an AI platform founded by Dr. Mohammed Alhussein, uses advanced artificial intelligence algorithms to detect and prevent financial crimes and increase compliance.

The company’s advanced platform is known as FOCAL. It can sift through masses of financial data using pattern recognition and other advanced techniques to spot fraud and money laundering in real time.

Dr. Alhussein developed the FOCAL platform by studying anti-money-laundering and anti-terrorism legislation and compliance and quickly realized that traditional (often manual) checks and safeguards were too slow to act.

Mozn’s AI technology uses name-matching algorithms uniquely optimized for the Arabic language and reconciles its findings against 1,300 international and regional sanctions. Meanwhile, the system’s anti-fraud functionality detects suspicious patterns by confirming payee identities against the records of destination accounts — a process that is said to reduce investigation times by up to 95%.

Also Read: A Guide To Digital Payment Methods In The Middle East

Although the platform was launched in Saudi Arabia, CEO Dr. Mohammed Alhussein recently announced plans to expand into the UAE, noting that the company’s long-term goal would be to develop operations further across the GCC. “The UAE has been making significant strides in enhancing its AML compliance and combating financial fraud, and Mozn entering UAE market will help accelerate these efforts,” Alhussein stated in a press release. “We are excited to begin this next chapter in Mozn’s growth journey as we enter the broader GCC market through our UAE office”.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

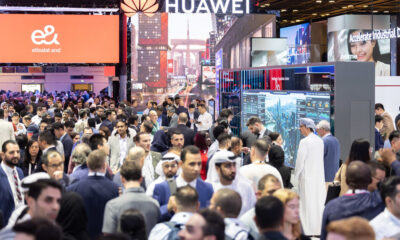

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.