News

Snapdragon 8 Gen 3 Brings AI To More Android Phones

Users can expect greater efficiency with improved gaming and camera performance.

At its annual Snapdragon Summit yesterday, Qualcomm unveiled its latest mobile chipset. The Snapdragon 8 Gen 3 boasts a wealth of upgrades, but the introduction of on-device generative AI is probably the most noteworthy, being similar to the technology used by Google on its Tensor G3.

Qualcomm claims the new chipset’s AI Engine to be the world’s fastest Stable Diffusion system, able to generate images in less than a second.

Compared with the previous model, Qualcomm says the Snapdragon 8 Gen 3’s CPU offers 30% better performance while being 20% more efficient. In terms of graphics processing, users will benefit from a 25% performance boost while enjoying 25% greater efficiency.

When it comes to camera and editing technology, the new Snapdragon 8 Gen 3 will support the ability to remove people and objects from photos, just like Google’s “Magic Eraser” tool. Voice-activated editing will also be available using Qualcomm’s Cognitive ISP.

Elsewhere, gaming upgrades include support for Unreal Engine 5.2 plus hardware-accelerated ray-tracing, which the company says is a mobile chipset first that will deliver “lifelike, multi-source lighting” in games.

Also Read: Tribit FlyBuds C1 Earbuds Review: The Ultimate Bang For Your Buck

Outside of AI smarts and upgraded gaming ability, the new Snapdragon chipset also uses the X75 Modem-RF System to deliver improved 5G speeds, better coverage, and location accuracy. Wi-Fi 7 connectivity will also be supported.

Android users won’t have to wait long to try the Snapdragon 8 Gen 3. Qualcomm says new devices featuring the chipset should appear over the coming weeks. Among the manufacturers that will use it are ASUS, Sony, OnePlus, Oppo, Vivo, Xiaomi, Honor, and ZTE.

News

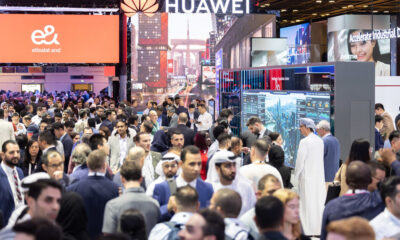

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.