News

Twitter Admits Data Breach Compromised Anonymous Accounts

Twitter has released an official statement admitting that it was unable to confirm the number of profiles exposed, but expects the figure to top 5.4 million.

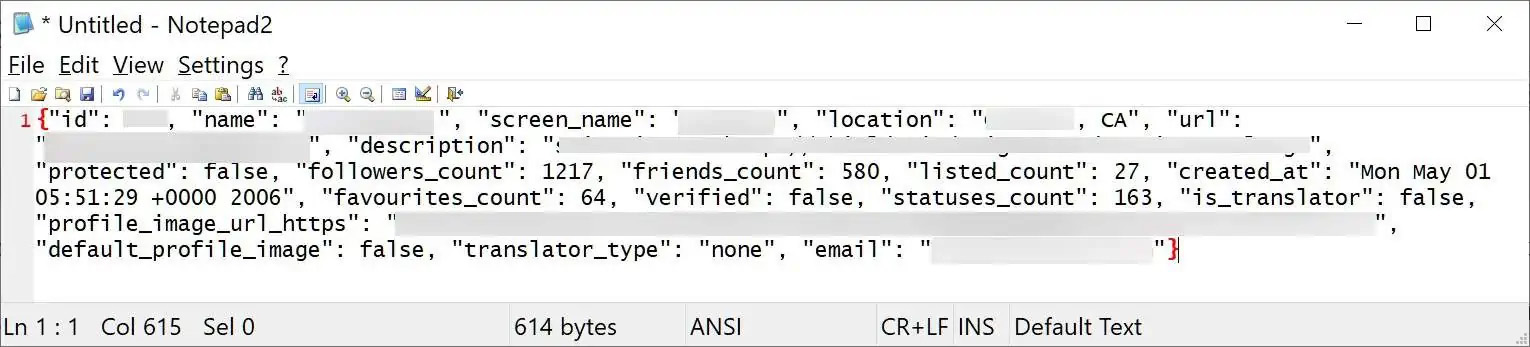

Twitter has released a statement acknowledging that in December 2020, a coding error resulted in a data breach of user information. A hacker exploited the flaw before it was discovered and subsequently patched in January 2022.

The vulnerability allowed malicious actors to submit an email address or phone number to verify if it was associated with an existing Twitter account. Hackers could then access the associated account ID, linking the information together.

A researcher uncovered the coding flaw through Twitter’s Bug Bounty program. The social media giant claimed that the vulnerability hadn’t been exploited before engineers were made aware of the issue. However, a hacker who contacted the website Bleeping Computer disputed the official narrative, claiming to have gained access to over 5.4 million user accounts via the flawed code and offering to sell the data for $30,000.

After reviewing the compiled database, Twitter responded with an official statement:

“Because we can’t verify every account that may have been affected, we’re releasing this alert because we’re particularly concerned about people using pseudonymous accounts who may be targeted by the state or other actors. If you use a pseudonymous Twitter account, we realize the hazards that an occurrence like this might bring and we profoundly regret that this happened.”

Also Read: Report Highlights $7.45 Million In Damages From Data Breaches Across The Middle East

Owners of accounts that have been compromised due to the data breach will be notified by direct message from Twitter, with the company advising those who wish to remain anonymous online not to associate a publicly available email or phone number with their account.

Because two or more individuals have already purchased and gained access to the leaked data, users should be wary of targeted phishing scams trying to gain access to login credentials. Although no passwords were revealed during the initial breach, Twitter advises all users to adopt two-factor authentication for an extra layer of security.

News

Alienware Just Announced Six New Gaming Monitors

The new models include three QD-OLED and three budget-friendly QHD options, expanding the company’s lineup for all gamers.

Alienware has just updated its gaming monitor lineup with six new additions, including the highly anticipated Alienware 27 4K QD-OLED Monitor. The latest wave of releases is set to reach more gamers than ever, offering high-end QD-OLED displays alongside more budget-friendly options.

The latest displays clearly show that the company is doubling down on QD-OLED with three new models sporting the technology. A redesigned Alienware 34 Ultra-Wide QD-OLED Monitor is also making a return, further refining what is already a fan-favorite display.

A Unified Design: The AW30 Aesthetic

All six monitors feature Alienware’s new AW30 design language, first introduced at CES. The AW30 aesthetic brings a futuristic, minimalist look that unites the entire lineup under a cohesive visual identity.

Pushing QD-OLED Even Further

The refreshed Alienware 34 Ultra-Wide QD-OLED Monitor (AW3425DW) builds on its predecessor’s success with a 240Hz refresh rate (up from 175Hz) and HDMI 2.1 FRL support. It also gains G-SYNC Compatible certification alongside AMD FreeSync Premium Pro and VESA AdaptiveSync, ensuring ultra-smooth performance. With a WQHD (3440×1440) resolution and an 1800R curve, this display enhances immersion for both gaming and cinematic experiences.

For those who crave speed, the Alienware 27 280Hz QD-OLED Monitor (AW2725D) pairs a high refresh rate with QHD resolution, balancing sharp visuals with ultra-smooth gameplay. Meanwhile, the Alienware 27 4K QD-OLED Monitor (AW2725Q) delivers stunning clarity with an industry-leading pixel density of 166 PPI, making it the sharpest OLED or QD-OLED monitor available.

Also Read: Infinite Reality Acquires Napster In $207 Million Deal

Worried about OLED burn-in? Alienware’s entire QD-OLED lineup comes with a three-year limited warranty covering burn-in concerns, offering peace of mind for gamers investing in these high-end displays.

Bringing QHD To A Wider Audience

Alongside QD-OLED, Alienware is also releasing three new QHD gaming monitors aimed at more price-conscious gamers. The Alienware 34 Gaming Monitor (AW3425DWM), Alienware 32 Gaming Monitor (AW3225DM), and Alienware 27 Gaming Monitor (AW2725DM) provide a range of sizes and formats to suit different preferences:

- The Alienware 34 Gaming Monitor (AW3425DWM): An ultrawide (WQHD) option for a panoramic, immersive experience.

- The Alienware 32 Gaming Monitor (AW3225DM): A standard 16:9 panel for a traditional but expansive desktop setup.

- The Alienware 27 Gaming Monitor (AW2725DM): A 27” display offering the same performance in a more compact form factor.

All three gaming monitors feature a fast 180 Hz refresh rate, a 1ms gray-to-gray response time, and support for NVIDIA G-SYNC, AMD FreeSync, and VESA AdaptiveSync to eliminate screen tearing. Additionally, with 95% DCI-P3 color coverage and VESA DisplayHDR400 certification, these displays deliver vibrant colors and high dynamic range for lifelike visuals.