News

Twitter Admits Data Breach Compromised Anonymous Accounts

Twitter has released an official statement admitting that it was unable to confirm the number of profiles exposed, but expects the figure to top 5.4 million.

Twitter has released a statement acknowledging that in December 2020, a coding error resulted in a data breach of user information. A hacker exploited the flaw before it was discovered and subsequently patched in January 2022.

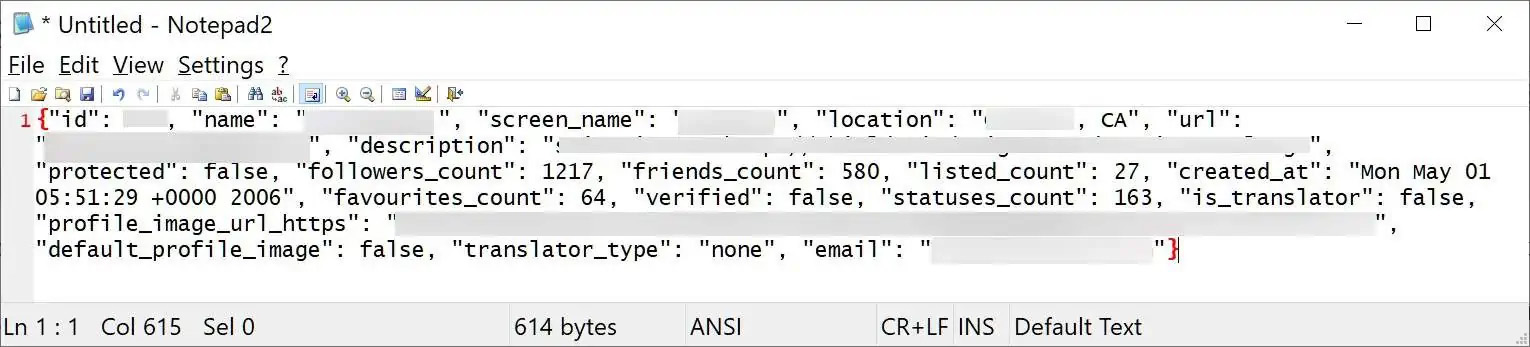

The vulnerability allowed malicious actors to submit an email address or phone number to verify if it was associated with an existing Twitter account. Hackers could then access the associated account ID, linking the information together.

A researcher uncovered the coding flaw through Twitter’s Bug Bounty program. The social media giant claimed that the vulnerability hadn’t been exploited before engineers were made aware of the issue. However, a hacker who contacted the website Bleeping Computer disputed the official narrative, claiming to have gained access to over 5.4 million user accounts via the flawed code and offering to sell the data for $30,000.

After reviewing the compiled database, Twitter responded with an official statement:

“Because we can’t verify every account that may have been affected, we’re releasing this alert because we’re particularly concerned about people using pseudonymous accounts who may be targeted by the state or other actors. If you use a pseudonymous Twitter account, we realize the hazards that an occurrence like this might bring and we profoundly regret that this happened.”

Also Read: Report Highlights $7.45 Million In Damages From Data Breaches Across The Middle East

Owners of accounts that have been compromised due to the data breach will be notified by direct message from Twitter, with the company advising those who wish to remain anonymous online not to associate a publicly available email or phone number with their account.

Because two or more individuals have already purchased and gained access to the leaked data, users should be wary of targeted phishing scams trying to gain access to login credentials. Although no passwords were revealed during the initial breach, Twitter advises all users to adopt two-factor authentication for an extra layer of security.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.