News

Twitter Will Soon Allow You To Edit Your Tweets

Did your last tweet contain an embarrassing typo? Twitter will soon allow you to fix it.

Here’s something that happens on Twitter every day: someone makes a tweet, the tweet becomes popular, the person who made the tweet is alerted to an embarrassing typo by receiving an endless stream of jokes as replies.

Unfortunately for the sender, it’s currently not possible to edit tweets that have already been published, so they can either delete it or live with it. This could change by the end of this year because Twitter has recently confirmed that it’s testing an edit button.

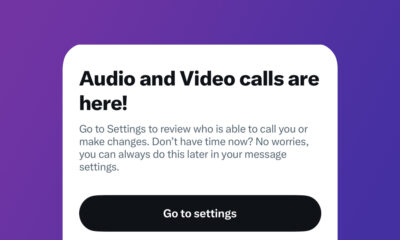

“Now that everyone is asking… Yes, we’ve been working on an edit feature since last year!” the social media network tweeted. “We’re kicking off testing within @TwitterBlue Labs in the coming months to learn what works, what doesn’t, and what’s possible.”

Back when Twitter was still led by Jack Dorsey, any requests for the introduction of an edit button were rejected because Dorsey feared that the feature could be used to change the meaning of a tweet after it gets shared online, and the last thing any social network wants is to deal with more disinformation and manipulation.

Also Read: Instagram’s Chronological Feed Is Now Available For All Users

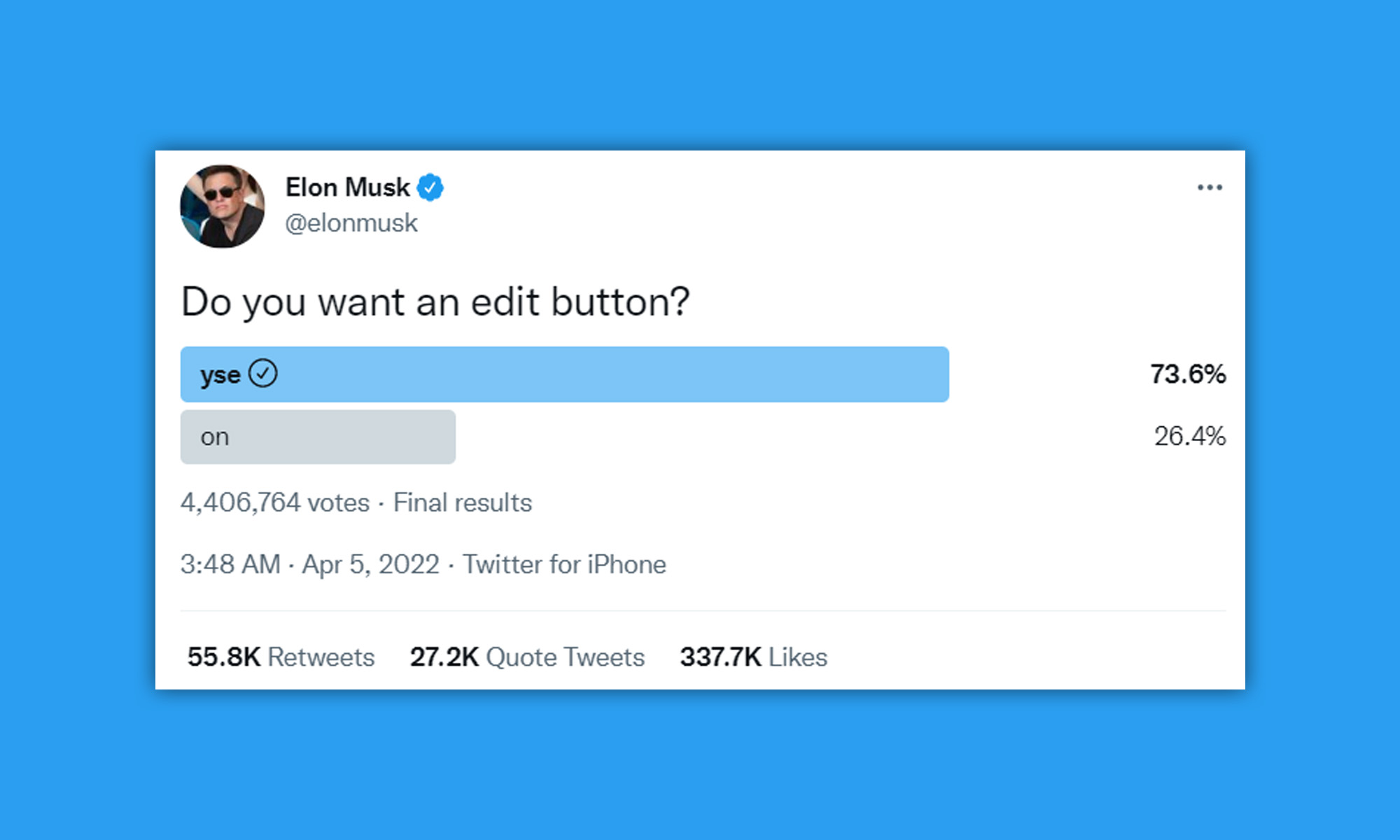

But Dorsey is no longer in charge of Twitter, and Parag Agrawal, who was announced as CEO on 29 November 2021, sees things differently. Elon Musk, who has recently purchased a 9.2 percent stake in Twitter, maybe does as well, especially considering that he has recently polled his followers on this very topic.

Twitter’s VP of consumer product, Jay Sullivan, recognizes that the ability to edit tweets has been the most requested Twitter feature for many years, but he stresses the importance of implementing it carefully.

“Without things like time limits, controls, and transparency about what has been edited, Edit could be misused to alter the record of the public conversation,” he said. “Protecting the integrity of that public conversation is our top priority when we approach this work.”

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News4 weeks ago

News4 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant