News

Instagram’s Chronological Feed Is Now Available For All Users

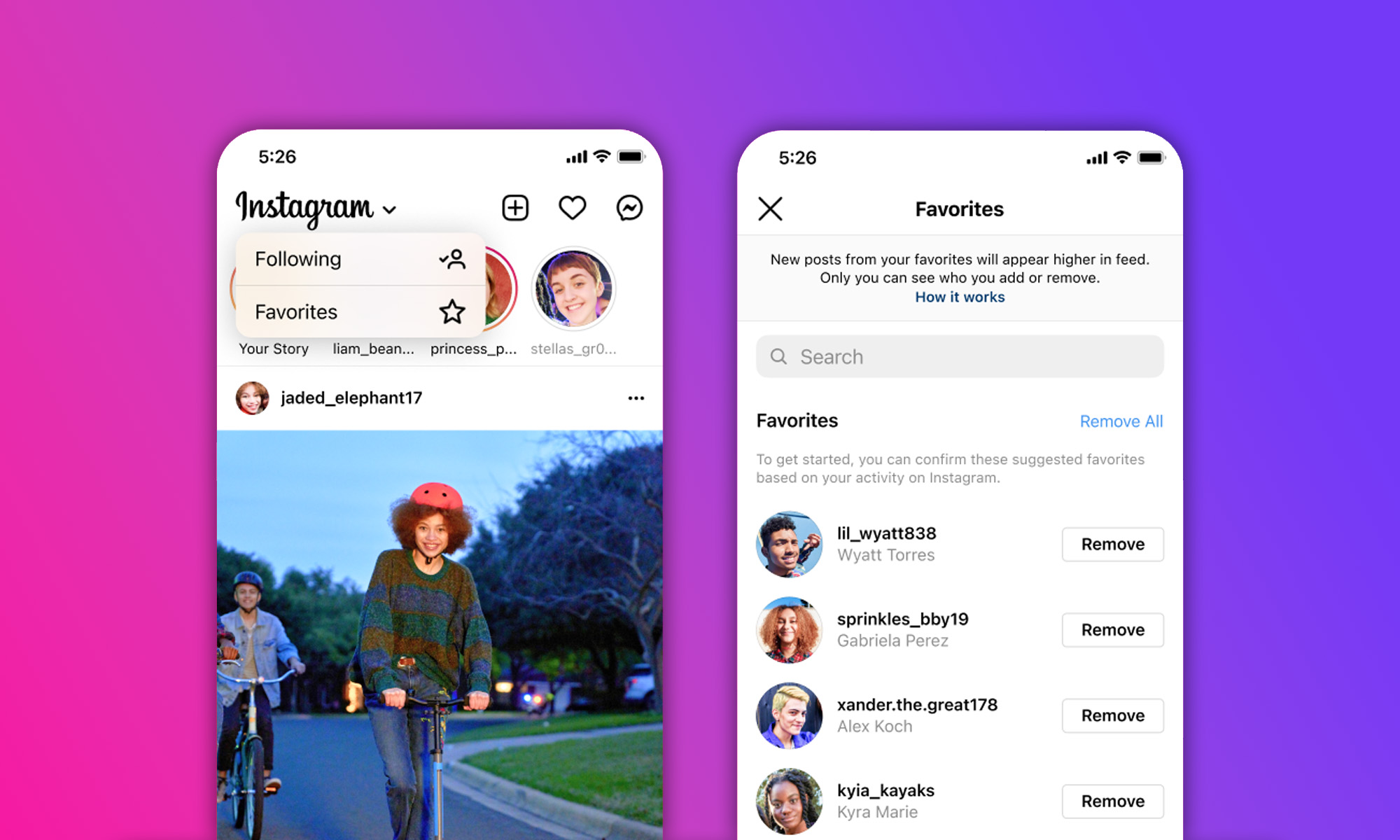

In addition to the chronological feed, there’s now also a new favorites feed option, which shows the latest posts from a list of chosen accounts.

In 2016, Instagram turned off the ability to display new posts in chronological order, claiming that users were missing many posts, even those posted by their close connections.

The algorithmic home feed took over, and it has been dictating what Instagram users see until now. After more than five years and many heated discussions about how the algorithmic home feed works, the ability to display new posts in chronological order is finally back.

“We want you to be able to shape Instagram into the best possible experience, and giving you ways to quickly see what you’re most interested in is an important step in that direction,” writes Adam Mosseri, Head of Instagram, in a blog post.

The decision to bring back the chronological feed comes after last year’s Senate hearing, during which Mosseri was asked if he believed users should be able to use the app without being manipulated by algorithms. The hearing prompted Instagram to say that it would give its users more freedom, and the social network has finally delivered on that promise.

Also Read: How To Find & Cancel Pending Instagram Requests

In addition to the chronological feed, there’s now also a new favorites feed option, which shows the latest posts from a list of chosen accounts.

To activate the chronological and favorites feeds:

- Launch the Instagram app on your smartphone.

- Tap the Instagram logo in the top left corner.

- Choose Following to see posts in chronological order or Favorites to see the latest posts from chosen accounts.

Unfortunately, the change doesn’t stick, which means that Instagram’s algorithmic feed will be back every time you reopen the Instagram app.

Another limitation is that it’s not possible to see Stories from the chronological and favorites feeds, making them feel somewhat inferior to the algorithmic feed, and that’s probably exactly how Instagram wants it to feel in order to steer its users toward the default experience.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.