News

Top 5 Features Coming To WhatsApp In 2022

Who doesn’t love new WhatsApp features?

WhatsApp has around 2 billion monthly active users, and the instant messaging service is well-aware that its users will remain loyal only if it manages to keep up with competing apps, such as Telegram, Viber, and iMessage.

In 2022, WhatsApp users can look forward to many new and exciting features. Unfortunately, we can’t say with certainty that they’ll all be available by the end of the year, but we’ll certainly keep you informed.

#1 – Instagram Reels Integration

WhatsApp and Instagram are both owned by the same company, Meta, so it makes sense for the two apps to become more closely integrated. In particular, WhatsApp is supposed to get a new section where users will be able to watch Instagram Reels, short videos published on Instagram, directly within the app.

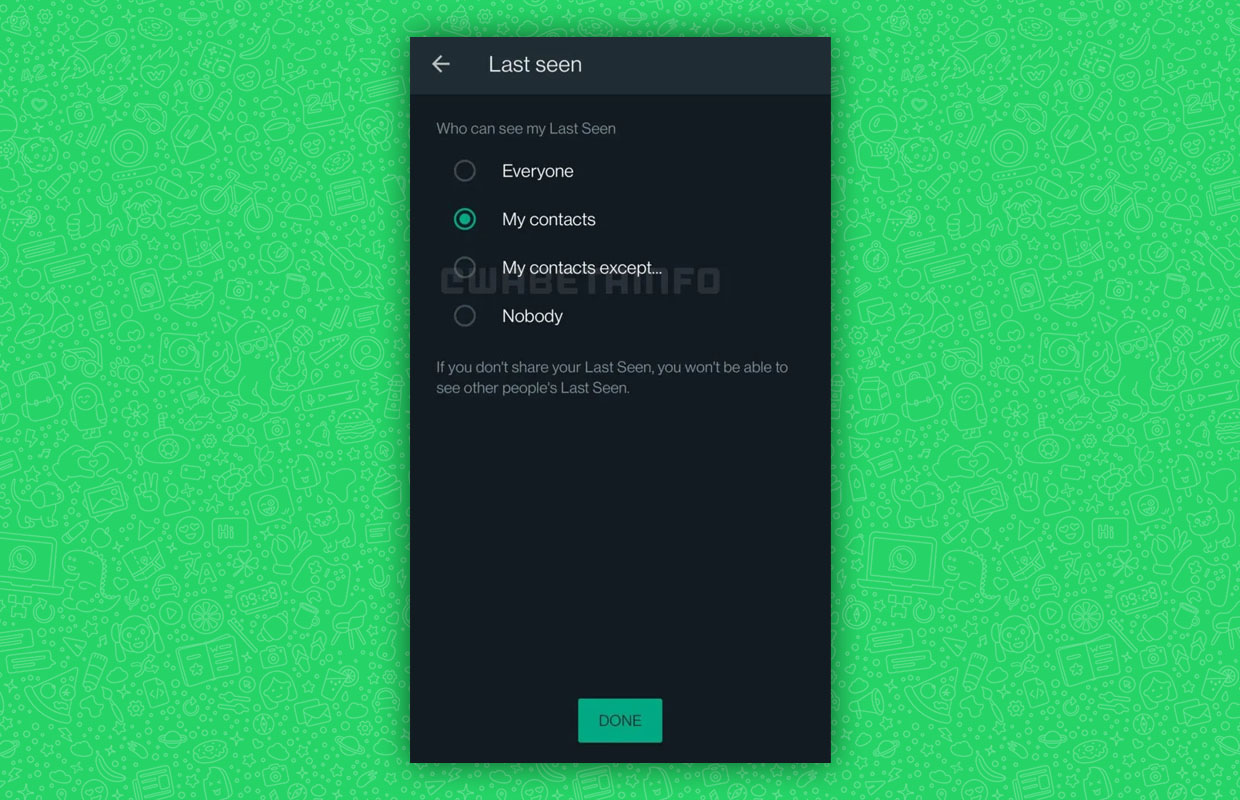

#2 – Last Seen Status Hiding

Right now, you can hide your last seen status on WhatsApp for nobody, your contacts, or everybody. Later this year, you should also be able to hide it only from specific contacts. This feature can go a long way in helping users better protect their privacy.

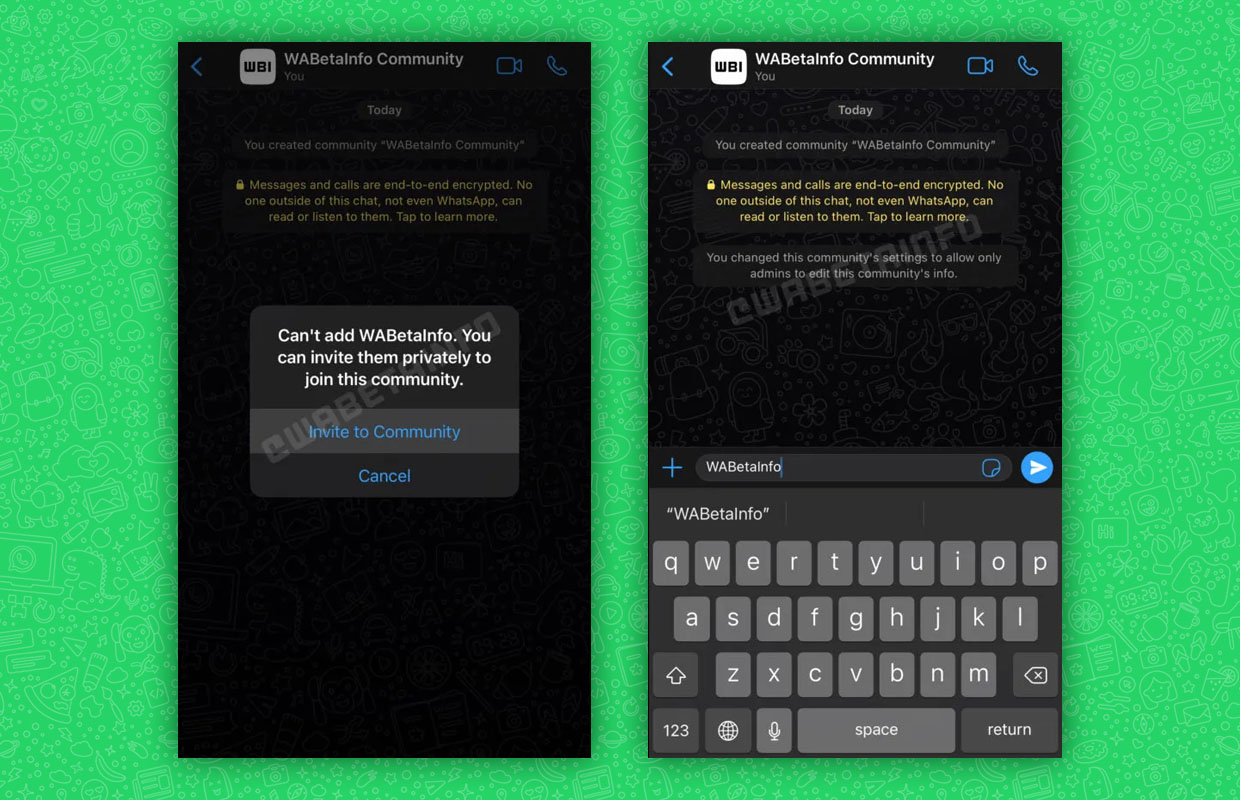

#3 – WhatsApp Community

In the near future, WhatsApp users will have one fewer reason to use Discord because the upcoming Community feature will make it possible for admins to create a community channel with up to 10 groups. Admins will then be able to send messages to all groups at once.

Also Read: How To Backup WhatsApp Chats On Android And iOS

#4 – Message Reactions

Facebook, Instagram, Viber, and Telegram users are all enjoying the option to respond to a message with a reaction emoji, and WhatsApp users should soon be able to do the same. Exactly how many reactions will be supported hasn’t been confirmed yet, but some people estimate that it will be six.

#5 – Custom Sticker Packs

Stickers are fun, and users love sharing them with others. An upcoming update is expected to introduce the ability to create custom sticker packs using photos and images downloaded from the internet. This feature is guaranteed to unleash a torrent of creativity across the entire user base.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.