News

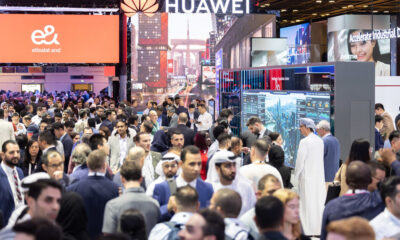

AI-Powered App Can Tell You How Your Cat Is Feeling

The app can reach an accuracy of up to 97% when provided a high-quality and full-face front image of the cat.

Are you sometimes unsure whether your cat is tired or plotting your assassination? You’re not alone because cats don’t show their emotions too well.

That’s why scientists came up with something called the Feline Grimace Scale, a method of assessing the occurrence or severity of pain experienced by cats according to objective scoring of facial expressions. Now, an Alberta-based animal health technology company called Sylvester.ai has paired the Feline Grimace Scale with an artificial intelligence algorithm to create an app that can tell you how your cat is feeling.

The app is called Tably, and you can download it directly from the App Store. To use it, you simply need to point your smartphone’s camera at your furry friend and wait for a short while for the app to analyze a variety of facial features, including eye-narrowing, muzzle tension, and how whiskers change, to determine how your cat is feeling.

According to Michelle Priest, Tably senior product manager, the app can reach an accuracy of up to 97 percent when provided a high-quality and full-face front image of the cat. That’s good enough not only for concerned cat owners but also for young veterinarians, who may not have the experience necessary to tell whether a cat is feeling pain.

Also Read: Microsoft Is Resurrecting Clippy With Its New 3D Emoji

The AI algorithm behind Tably was trained at the Wild Rose Cat Clinic of Calgary. “I love working with cats, have always grown up with cats,” said Dr. Liz Ruelle, DVM, DABVP Feline Specialist at the clinic. “For other colleagues, new grads, who maybe have not had quite so much experience, it can be very daunting to know — is your patient painful?”.

Tably is an excellent example of cutting-edge technology being used to positively impact the lives of those who don’t understand it themselves (although you never know with cats).

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.