News

Apple Wallet Will Be Able To Store COVID-19 Vaccination Cards

The feature will be available in the next iOS update.

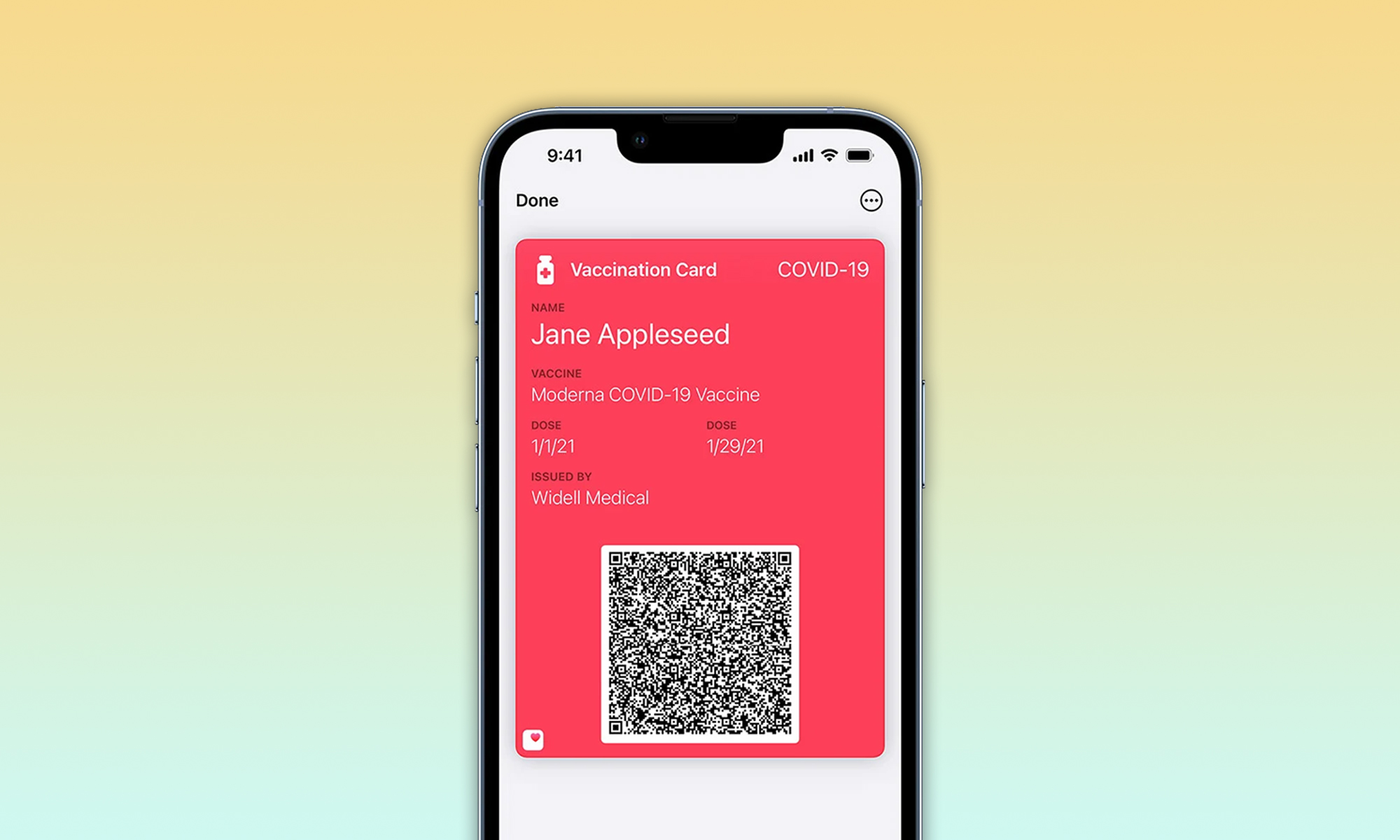

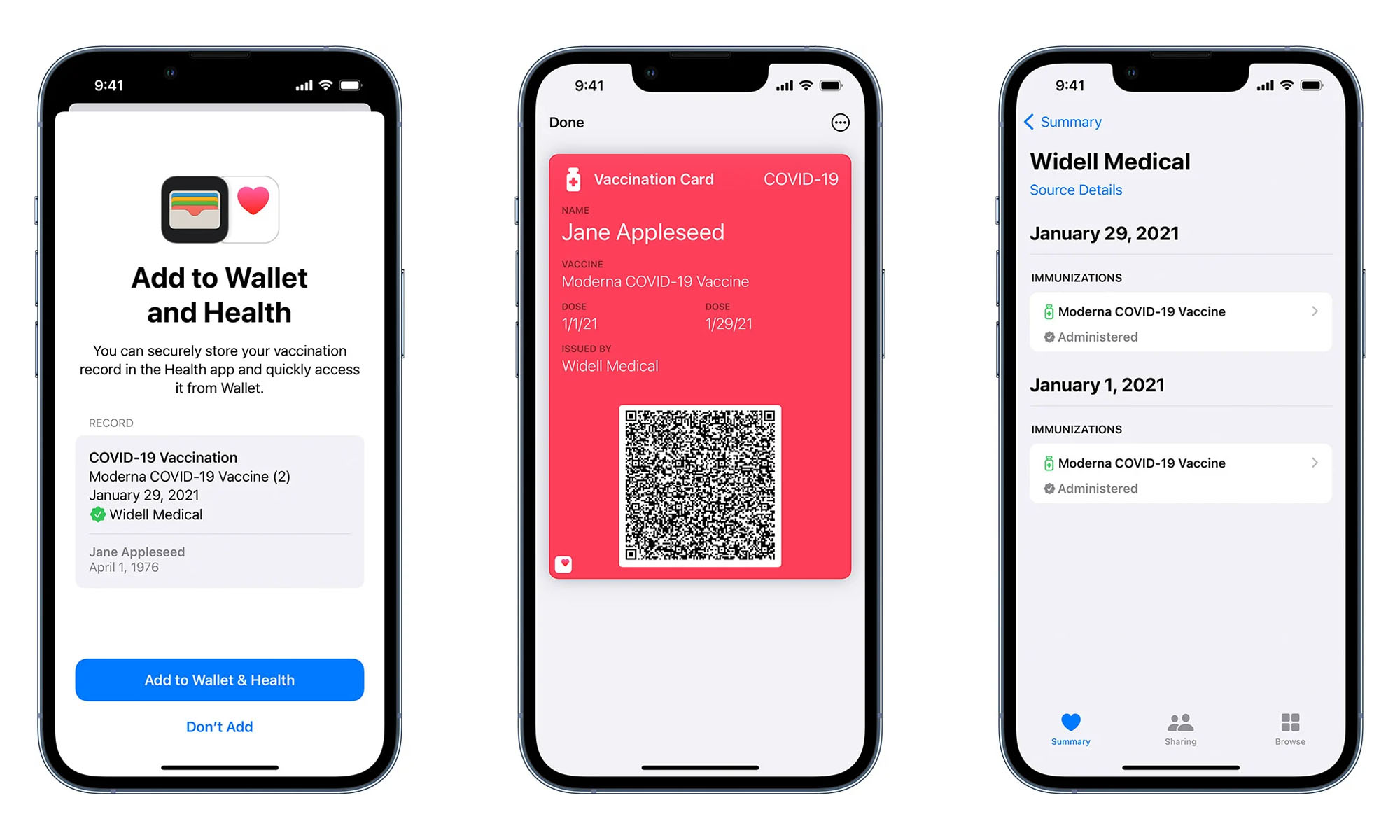

Since the recent public release of iOS 15, iPhone users have been able to store COVID-19 immunizations and test results in the Health app and share them with approved third-party apps. We now know that the upcoming iOS 15.1 update, whose beta version has just been released to developers, will add the ability to store COVID-19 vaccination cards in the Apple Wallet app to present to businesses, venues, and more.

The vaccination information will be stored using the SMART Health Card standard, whose goal is to make presenting this kind of information in a verifiable manner to another party as easy as possible.

Apple

“Organizations that issue SMART Health Cards will soon be able to use a new button to let users know that they can securely download and store their vaccination information in the Health app and quickly add and present it from Wallet,” states Apple on its developer website.

Because the standard is open, there’s nothing stopping any health organization from implementing it to produce a digital proof of vaccination whose verification is as easy as scanning a QR code.

Also Read: Samsung Pay Introduces Support For Digital COVID-19 Vaccination Cards

We don’t know when the iOS 15.1 update will be released, but our guess is that it won’t take too long considering that minor updates are usually spaced approximately one month apart.

The SMART Health Card standard is just one of many examples of how the disruption and challenges created by the COVID-19 pandemic have promoted innovation. We can now only hope that it won’t take too long before presenting vaccination information in any form will, once again, be reserved only for very rare occasions.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.