News

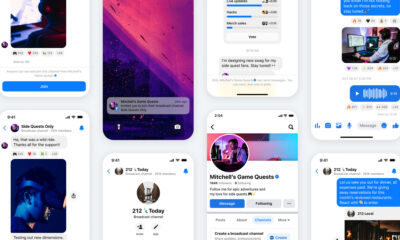

Facebook & Instagram Are Testing Twitter-Style Blue Checks

The $12 per month “Meta Verified” upgrade will give users a blue badge along with increased visibility, impersonation protection, priority support, and more.

Mark Zuckerberg’s Meta is testing a paid verification service for Facebook and Instagram known as “Meta Verified“. The upgrade will cost $11.99 per month on the web and $14.99 on mobile, granting users a verified badge and other perks like increased visibility and prioritized customer support. The feature will first roll out to Australian and New Zealand residents this week and arrive in more countries “soon”.

To enjoy the benefits of Meta Verification, users must be at least 18 years of age, meet minimum activity requirements, and submit an official government ID matching the name and photo listed on Facebook and/or Instagram. Meta confirms that it won’t make changes to accounts that have been verified using the company’s previous system, including notability and authenticity.

Also Read: Hub71 To Invest $2 Billion In New Web3 Startup Ecosystem

As well as verification, users who subscribe to the service will unlock exclusive stickers for Stories and Reels and receive 100 free stars per month — the digital currency used to tip creators on Facebook. Meta cautions that businesses can’t apply for a Meta Verified badge just yet, and profile names, usernames, birthdays, and profile photos won’t be able to be altered without going through the verification process from scratch.

It’s hard to ignore the similarity between Meta’s new checkmark service and Twitter Blue, launched by Elon Musk recently. However, Meta seems to be taking account authenticity far more seriously, which hopefully won’t cause the deluge of fake verified accounts we saw on Twitter towards the end of 2022.

News

Mamo Completes $3.4M Funding Round To Enhance Fintech Services

The startup will use the influx of cash to expand into Saudi Arabia and across the wider GCC while improving its product offering.

UAE-based fintech Mamo has announced the completion of a $3.4 million funding round that will help the startup extend its market presence and improve its product offering. Investors included 4DX Ventures, the Dubai Future District Fund and Cyfr Capital.

Mamo’s platform offers “payment collection, corporate cards and expense management” to help small and medium-sized businesses consolidate and streamline their operations. With the latest influx of capital, Mamo will further develop its comprehensive suite of services and begin testing its product lines in Saudi Arabia, further extending its footprint across the GCC.

Imad Gharazeddine, co-founder and CEO of Mamo, stated: “We’ve been in the market for a while now and are incredibly proud of what our team has achieved. The holistic and expansive nature of our product offering has helped us continue to grow sustainably. This additional funding will allow us to reach our medium-term goals even faster. The support from new and existing investors is a testament to our strong expertise and the ability to deliver on our customer promise”.

Daniel Marlo, General Partner of lead investor 4DX Ventures, added: “We have immense trust in Imad’s vision, leadership and Mamo’s innovative approach to provide a user-friendly and comprehensive financial solution for SMEs that makes financial management more accessible and efficient. We are proud to partner with them and support their mission”.

Also Read: A Guide To Digital Payment Methods In The Middle East

Amer Fatayer, Managing Director of Dubai Future District Fund’s investment team, also commented: “Mamo’s localized product lines serve as an infrastructure for SME payments and spend management in UAE, a segment that is underserved by the country’s current banking infrastructure. The team has taken a product-first approach to consolidating SMEs’ financial journeys and building a fintech solution deeply embedded in a business’s core operations”.

To date, Mamo has raised around $13 million in investment funding and now boasts a team of 30 people. The company’s intuitive financial services platform has allowed over 1,000 businesses to consolidate their financial operations and significantly reduce payment fees.

-

News4 weeks ago

News4 weeks agoAmazon Prime Day 2024: Get Ready For 6 Days Of Amazing Deals

-

News4 weeks ago

News4 weeks agoSamsung Unpacked 2024: What To Expect From The July 10 Event

-

News3 weeks ago

News3 weeks agoCoursera Report Shows Surge In UAE Interest In AI Upskilling

-

News4 weeks ago

News4 weeks agoMeet Dubai’s Groundbreaking Smart Robot Delivery Assistant