News

Instagram Reels Has Arrived To The Middle East

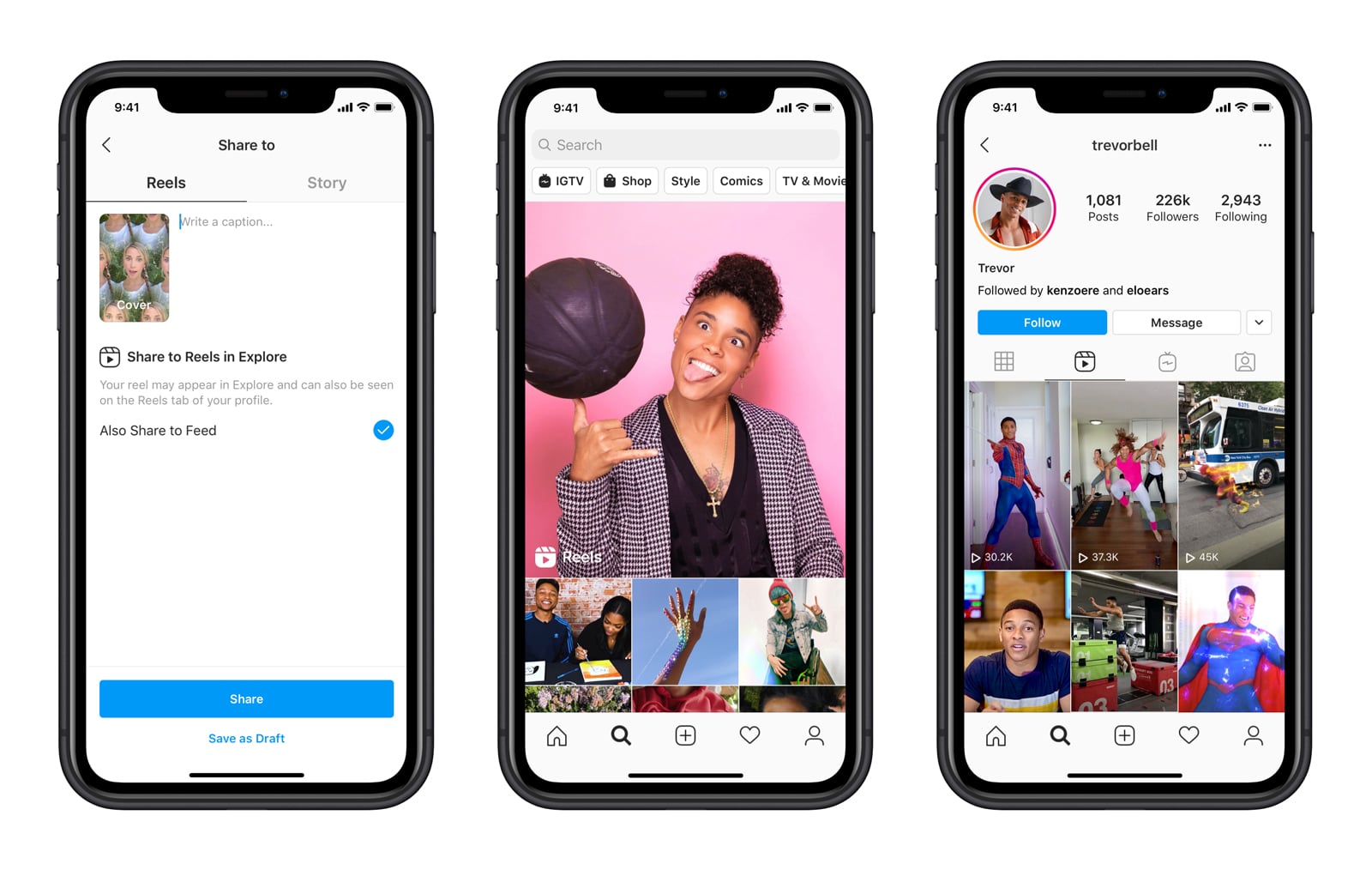

Instagram’s long awaited short-form video-sharing feature, Instagram Reels, has finally started rolling out in the Middle East. During Instagram’s previous “House of Instagram” event, the company announced that Reels would be a brand-new way for content creators and businesses in the MENA region to create and discover short and entertaining videos. The announcement of Reels comes just days after Instagram released Instagram Music in the Middle East.

Reels allows users to take and edit multi-clip videos up to 30 seconds long, with the ability to add effects and other new tools dedicated to this feature. Once taken, users can share Reels with their followers (for private accounts) and potentially with the entire Instagram community (your account will need to be set to public).

If you have the latest version of Instagram installed on your smartphone, you should see the Reels icon in the bottom center of the app’s homepage.

“Self-expression and versatility are part of the creative DNA of the region’s Gen Z and millennial population. As one of the primary platforms for this group of creators, we have always sought to adapt our features to what they need. With Reels, they now have more leverage when it comes to creating and sharing short-form content. Reels provides our community with greater freedom and flexibility to innovate, experiment and elevate their content, and we cannot wait to discover a new generation of talent via the feature.” said Samer Jamal, strategic partner manager at Instagram MENA.

Also Read: How To Find & Cancel Pending Instagram Requests

Instagram isn’t the only company to explore this type of short-form content. Last September, YouTube announced a similar feature called “Shorts” which gives creators the ability to capture short and catchy videos straight from their smartphone.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.