News

Truecaller Reveals New Brand Identity & Feature Update

The refreshed “True Blue” logo follows an increased commitment to consumer privacy and safety, including new AI anti-fraud features.

Truecaller has been a market leader in call identification solutions for over 14 years, and boasts a staggering 356 million users worldwide.

Today, the company has announced details of a corporate rebranding, including a new app icon for the Google Play Store and Apple App Store. The update not only coincides with a range of updated Truecaller software but is also said to reflect the brand’s “renewed sense of purpose, energy, and enthusiasm”.

Commenting on the announcement, Alan Mamedi, Truecaller co-founder and CEO, said, “We are excited to unveil our new brand identity and logo. It signifies our continued commitment to our users and our focus to constantly evolve and improve every day”.

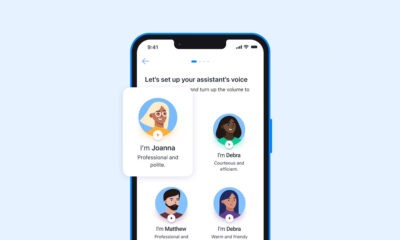

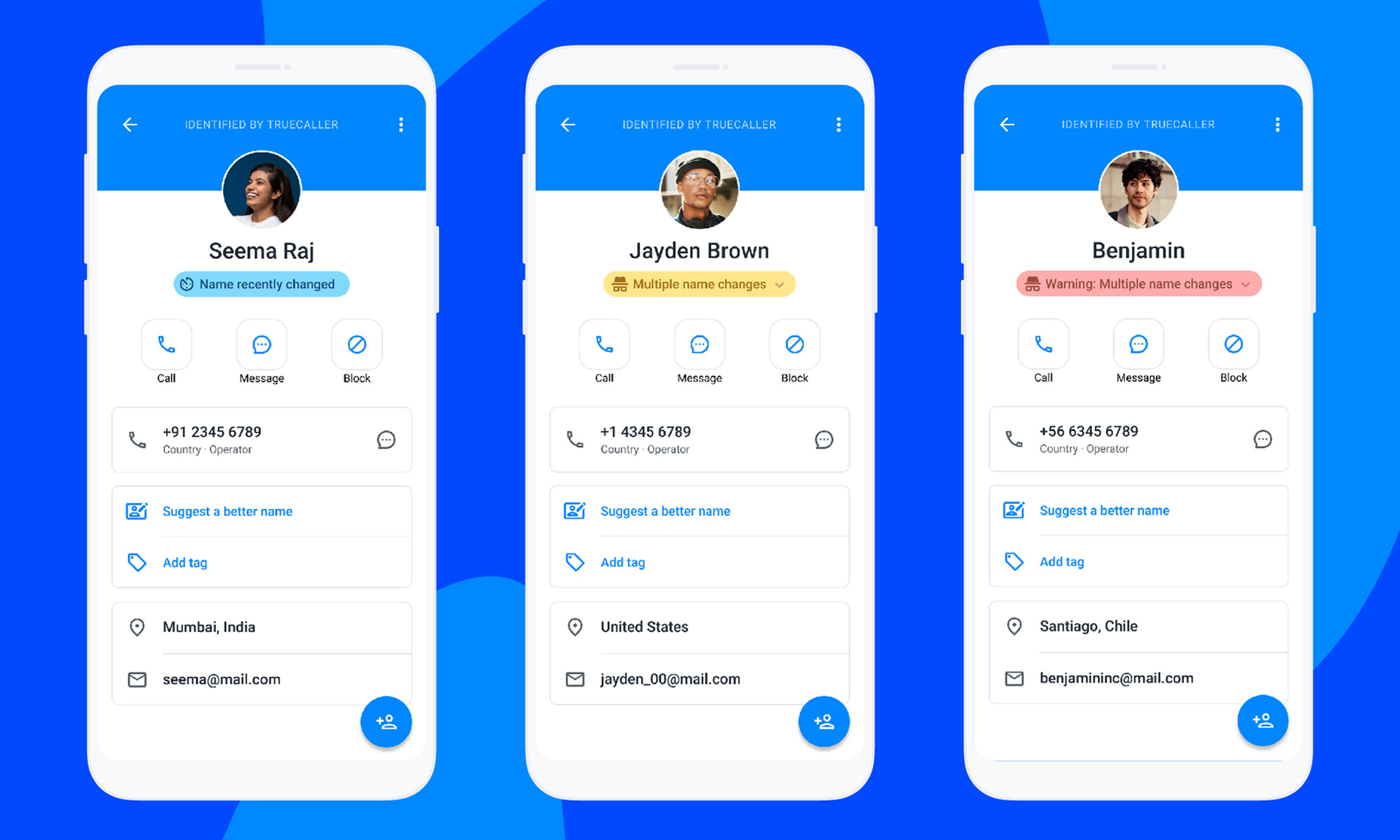

As part of the brand refresh, Truecaller users also gain access to a powerful new feature of the company’s AI Identity Engine called Search Context. The software will instantly notify users if the name for the number has been recently changed or is being changed frequently. The app also displays these contextual messages in three color categories: blue for neutral changes, yellow for potentially suspicious activity, and red for highly suspicious or known fraudulent activity. Messages will be shown to Truecaller users on all search results in Android, iOS, and via Truecaller web.

Also Read: Ovasave Empowers Women To Tackle Difficult Fertility Choices

The new brand identity was created by leading consultants Interbrand and will roll out worldwide over the coming weeks. To see the changes, users need to update to version 13.34 or later on Android and version 12.58 or newer on iOS.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.