News

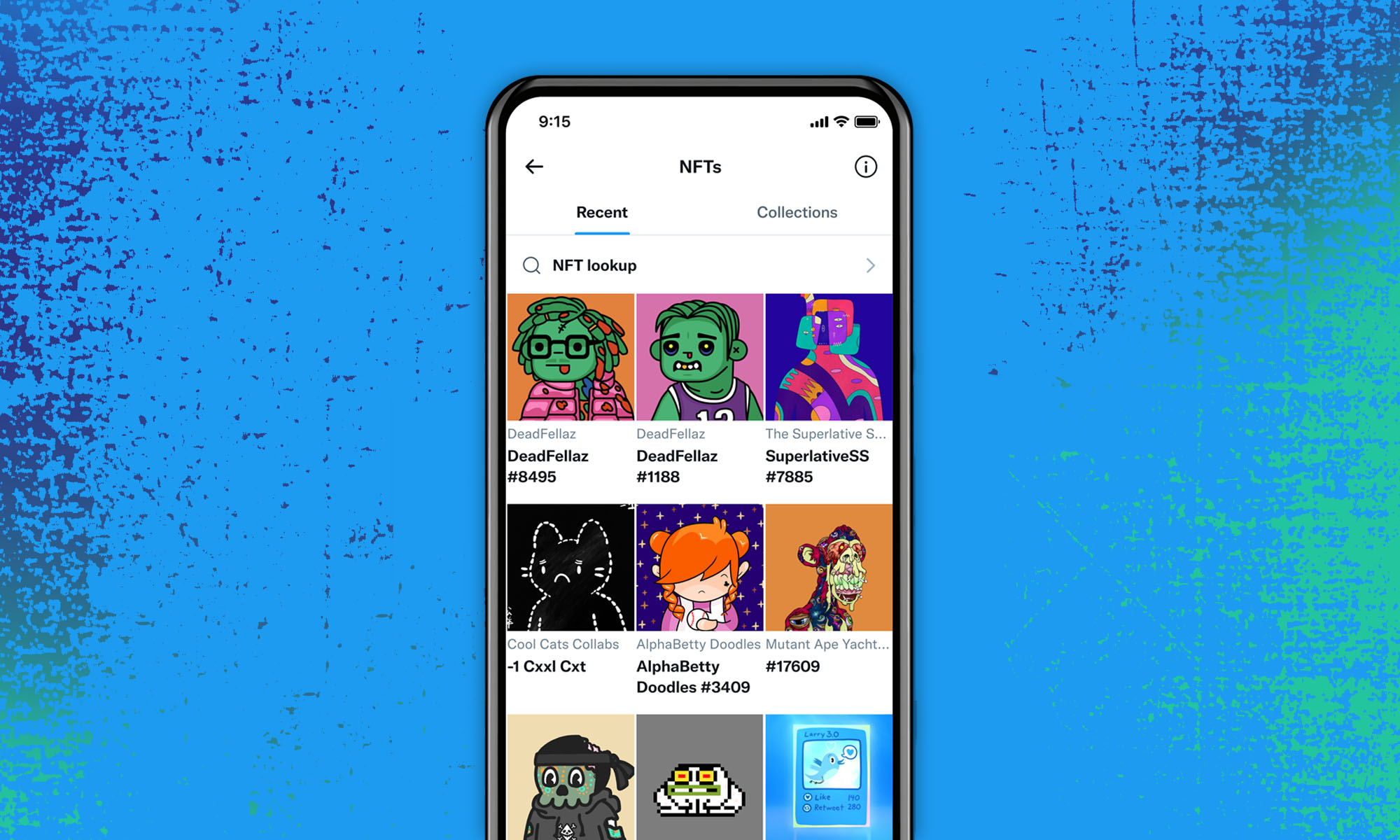

Twitter Now Lets Users Set NFTs As Profile Pictures

The new feature is currently only available in the United States, Canada, Australia, and New Zealand through Twitter’s iOS app.

Non-fungible tokens, or NFTs for short, are redefining the art industry and making some of their creators obscenely rich. Since the early days, NFT fans have been discussing the latest twist on blockchain technology on Twitter, often using their most cherished NFTs as profile pictures.

But since NFTs are technically just receipts to patronage that don’t prevent anyone from right-clicking on them and making as many copies as they want, distinguishing their rightful owners from impostors hasn’t been easy — until now.

All Twitter Blue paid subscribers in the United States, Canada, Australia, and New Zealand can now use the Twitter for iOS app (no other versions are supported at the moment) to connect to their crypto wallet and use their NFTs as profile pictures. Here’s how:

- Launch the Twitter for iOS app.

- Open your profile.

- You should see a notification about using an NFT as your profile picture. Tap the Choose NFT option.

- Connect Twitter to the cryptocurrency wallet that contains the NFT you want to use.

- Choose your desired NFT and tap Done.

Even though it’s currently possible to set NFTs as profile pictures only on iOS, the results are visible to users across all versions of Twitter. To visually stand out from regular profile pictures, Twitter displays NFTs in an hexagonal outline instead of the regular circular outline.

Also Read: A Beginner’s Guide To Getting Started With NFTs

The NFT feature is powered by OpenSea, an online marketplace for NFTs. Since the feature depends on a third party, it could stop working if something happened to OpenSea. The profile pictures themselves are most likely cached on Twitter’s servers, however, so they probably would still be visible.

Twitter’s embrace of NFTs, which are closely tied to the cryptocurrency Ethereum, comes shortly after the departure of the company’s former CEO, Jack Dorsey, who is known for rejecting other cryptocurrencies besides Bitcoin.

News

HiFuture Wraps Up Successful GITEX GLOBAL 2024 Appearance

The electronics company wowed audiences at the world’s largest tech event with a range of wearable and smart audio devices.

This year’s GITEX GLOBAL 2024 in Dubai saw a huge number of startups, electronics firms, and innovators from around the globe gather for the tech sector’s largest event of its kind. One company making waves at this year’s expo was Chinese tech group HiFuture, which showcased a range of products with a focus on wearable technology and smart audio.

At the HiFuture booth, the company captivated attendees with cutting-edge smartwatches like the ACTIVE and AURORA, along with a range of powerful wireless speakers, earbuds, and even smart rings. Visitors were eager to check out the sleek new designs on offer and even had the chance to test out some of the products themselves.

Among the highlights were smartwatches combining dual-core processors with customizable options. The devices blended style and technology, offering health monitoring capabilities, personalized watch faces, and advanced AI-driven functionalities, giving attendees a taste of the future of wearable technology.

On the audio front, HiFuture’s wireless speakers left a lasting impression, offering rich, immersive sound in compact, portable designs. These speakers cater to both intimate gatherings and larger celebrations, offering versatility for users. Meanwhile, the company also showed off its Syntra AI technology, which it claims “revolutionizes health and fitness tracking by combining advanced optical sensors with intelligent algorithms for precise, real-time insights”.

Also Read: How (And Why) To Start A Tech Business In Dubai

The presence of HiFuture’s leadership team at GITEX 2024 underscored the importance of this event for the company, with CEO Levin Liu leading a team of executives, all keen to engage with attendees and offer insights into HiFuture’s vision, product development process, and future direction.

Overall, it seems that GITEX GLOBAL 2024 has been a rewarding experience for HiFuture. The enthusiasm and curiosity of attendees shown to the company’s diverse range of products was obvious, with the HiFuture team leaving on a high note and clearly excited and motivated by the event.